Retail sales grew a surprising 0.6% in June, demonstrating the strength of the consumer sector as the economic reopening continues. Sales through brick & mortar channels were up 0.9% from the month before, outpacing total sales and brightening the outlook for malls and shopping centers, and the retail REIT sector.

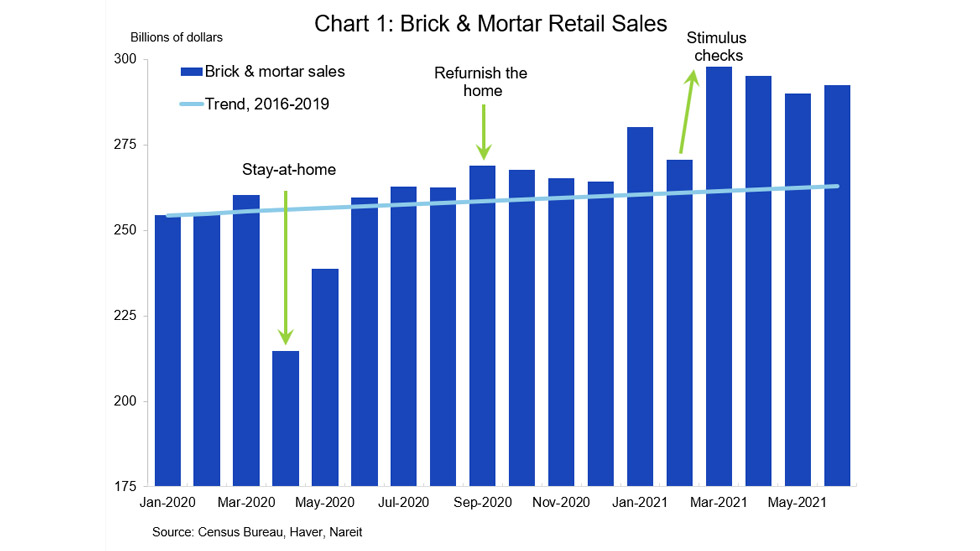

Brick & mortar sales have been on the front lines of many waves of the pandemic-induced recession and reopening recovery. Sales plunged in April 2020 due to stay-at-home orders and store closures (chart 1, first green arrow). In-store sales recovered quickly, however, and by June 2020 had already moved back above the pre-pandemic trend growth (shown in light blue in the chart).

The social distancing rules of the pandemic spurred an additional increase in spending last summer. Once it became clear that the pandemic would last much longer than initially expected, many consumers decided to refurnish their homes. Sales of deck furniture, home electronics, kitchen items, and other household purchases caused brick & mortar sales to run even higher above trend during the summer months of last year (second green arrow).

Federal stimulus checks brought about another round of increases in consumer spending, including a 10.1% jump in brick & mortar retail sales in March 2021 (the third green arrow). This was the second-largest monthly increase in brick & mortar sales in at least 30 years, behind the 11.1% increase in May 2020 as stores began to reopen.

Many observers had expected total retail sales, including in-store sales, to fade as households finished spending their stimulus checks. The most recent sales figures indicate that consumers have a lot more spending power from money they have saved up during the pandemic. The pent-up demand for purchases, strong financial positions of many households, and a return to more normal shopping environment in shopping centers and malls are likely to continue to support sales in the months ahead.

Investors have noted the improved outlook for retail REITs. The total stock market return for retail REITs was 34.0% year-to-date as of July 15, compared to 26.1% for the FTSE Nareit All Equity REITs Index, and 17.0% for the S&P 500. Within the retail sector, regional mall REITs are up 51.6% YTD, and shopping center REITs are up 44.6%.