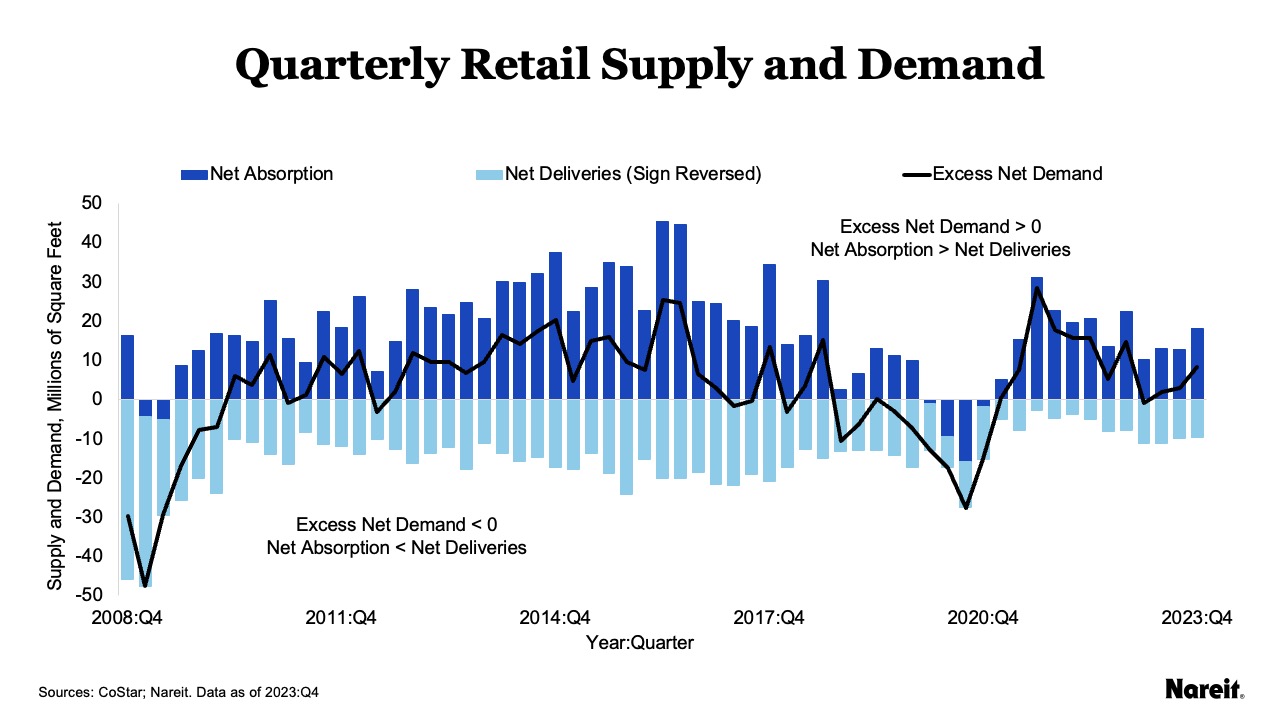

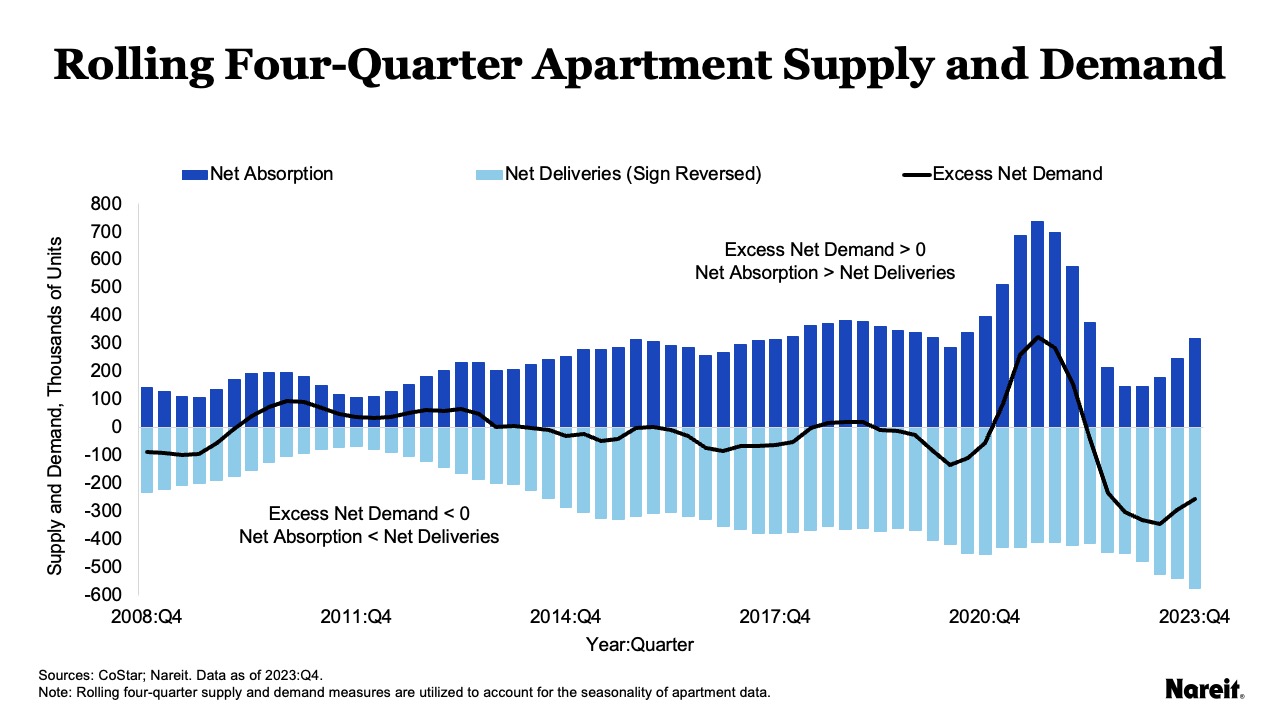

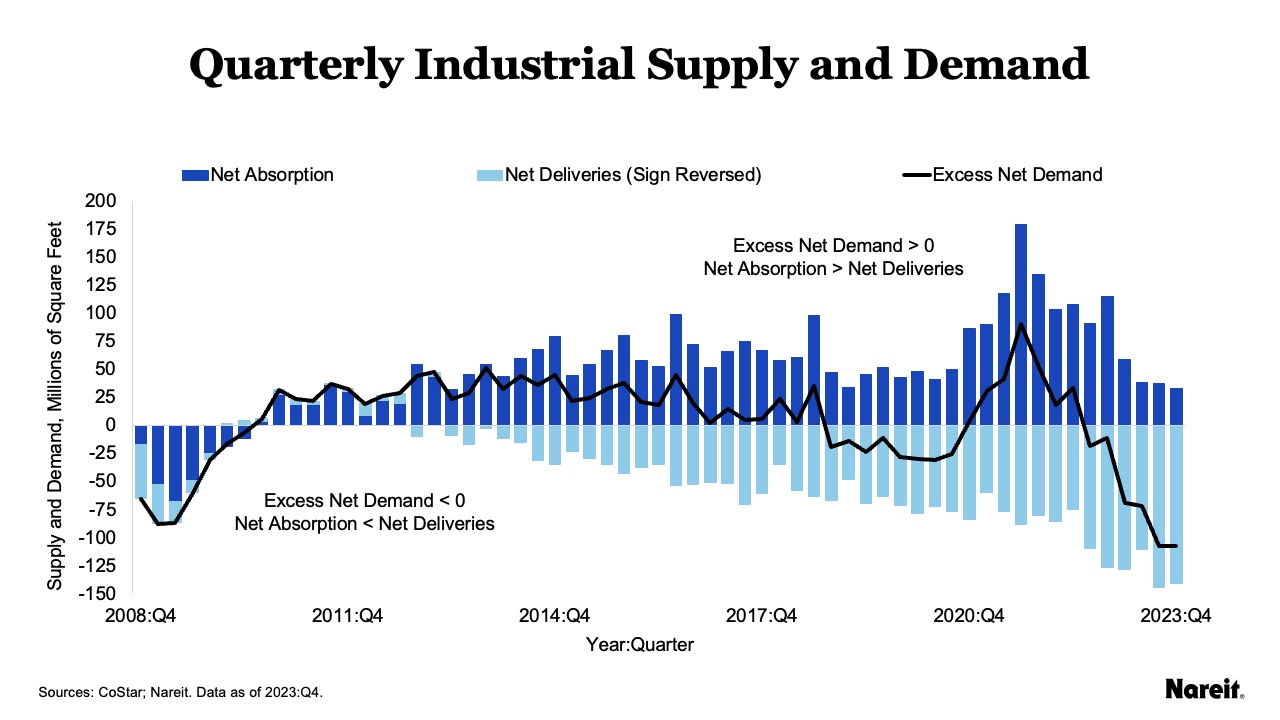

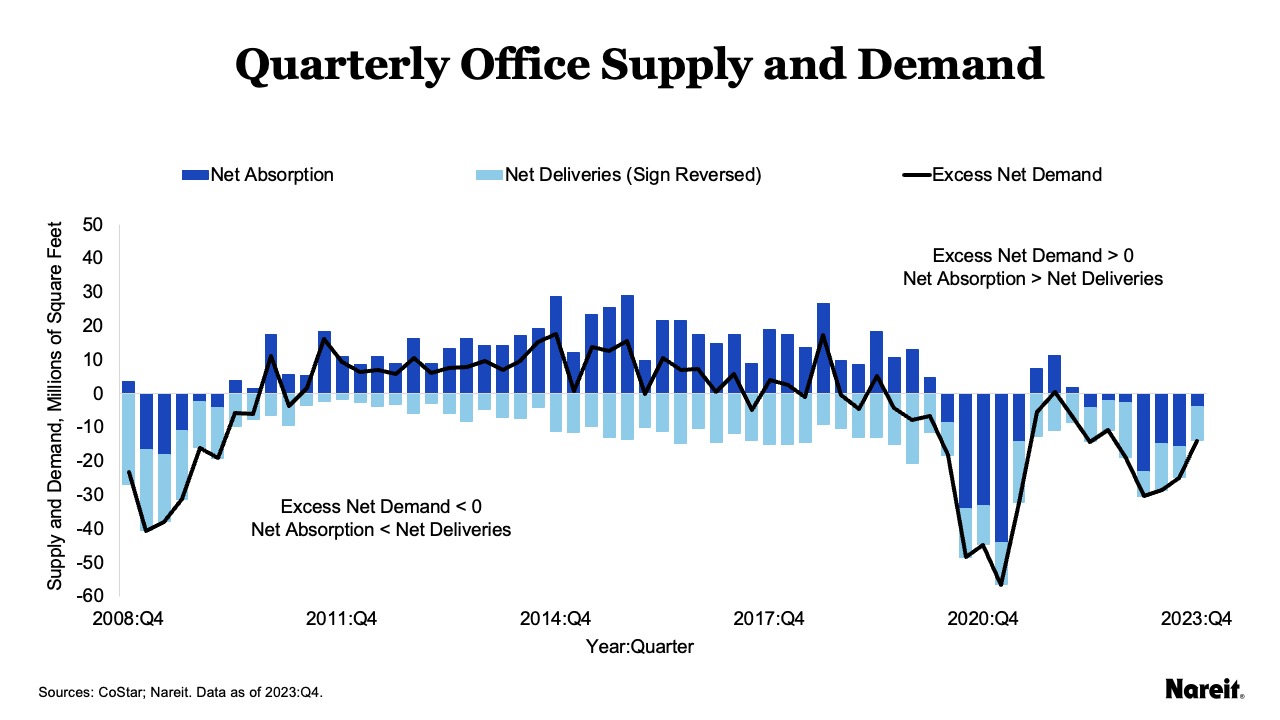

Space market fundamentals can differ markedly across property types. Net absorption (demand) and net deliveries (supply) for the four traditional property types (retail, apartments, industrial, and office) highlight the ups and downs of the space markets and can illustrate excess net demand (net absorption less net deliveries) for each sector. Recent data from CoStar showcase the supply and demand differences across property types. In the fourth quarter of 2023, retail was the only sector where demand exceeded supply. For the other property types, net absorption continued to fall short of net deliveries. These demand shortfalls have diminished the strength of each sector’s property fundamentals.

The chart above displays quarterly retail net absorption and net deliveries, as well as excess net demand from the fourth quarter of 2008 to the fourth quarter of 2023. After more than two years of lackluster performance, retail space market fundamentals enjoyed a reversal of fortune in 2021. Since that time, net absorption has remained positive and net deliveries have been modest from an historical perspective, resulting in excess net demand generally maintaining positive values.

The chart above presents rolling four-quarter apartment net absorption and net deliveries, as well as excess net demand from the fourth quarter of 2008 to the fourth quarter of 2023. Driven by strong demand and high rents in 2021 and 2022, apartment supply surged last year. At the same time, demand experienced an uptick from positive albeit historically low levels. As of the fourth quarter of 2023, rolling four-quarter excess net demand has been negative for seven consecutive quarters.

The chart above shows quarterly industrial net absorption and net deliveries, as well as excess net demand from the fourth quarter of 2008 to the fourth quarter of 2023. For the past decade, the industrial sector has enjoyed strong demand with analogous supply responses. Like apartments, robust demand and lofty rents have accelerated industrial net deliveries to historically high levels in 2023. At the same time, net absorption dropped off precipitously. The last quarter of 2023 marked the sixth straight quarter of negative industrial excess net demand.

The chart above depicts quarterly office net absorption and net deliveries, as well as excess net demand from the fourth quarter of 2008 to the fourth quarter of 2023. The office sector has been facing battles on two fronts. While office demand challenges are well known, the property type has also suffered from supply issues. Years of negative net absorption have not curtailed office net deliveries that have continued at roughly the same pace since late 2014. Negative excess net demand has generally persisted since the first quarter of 2019.

The stories underpinning current supply-demand imbalances in the commercial real estate markets are nuanced. Recent demand shortfalls in apartments, industrial, and office have exhibited persistence. They have also adversely impacted each sector’s property fundamentals. These conditions are expected to place further pressures on property operational gains in 2024.