Data from CoStar highlight the current state of the commercial real estate market. In the fourth quarter of 2023, the strength of property fundamentals—excess net demand, occupancy rates, and rental growth rates—has generally continued to wane among the four traditional property sectors. This is expected to place further pressure on property operational gains in 2024.

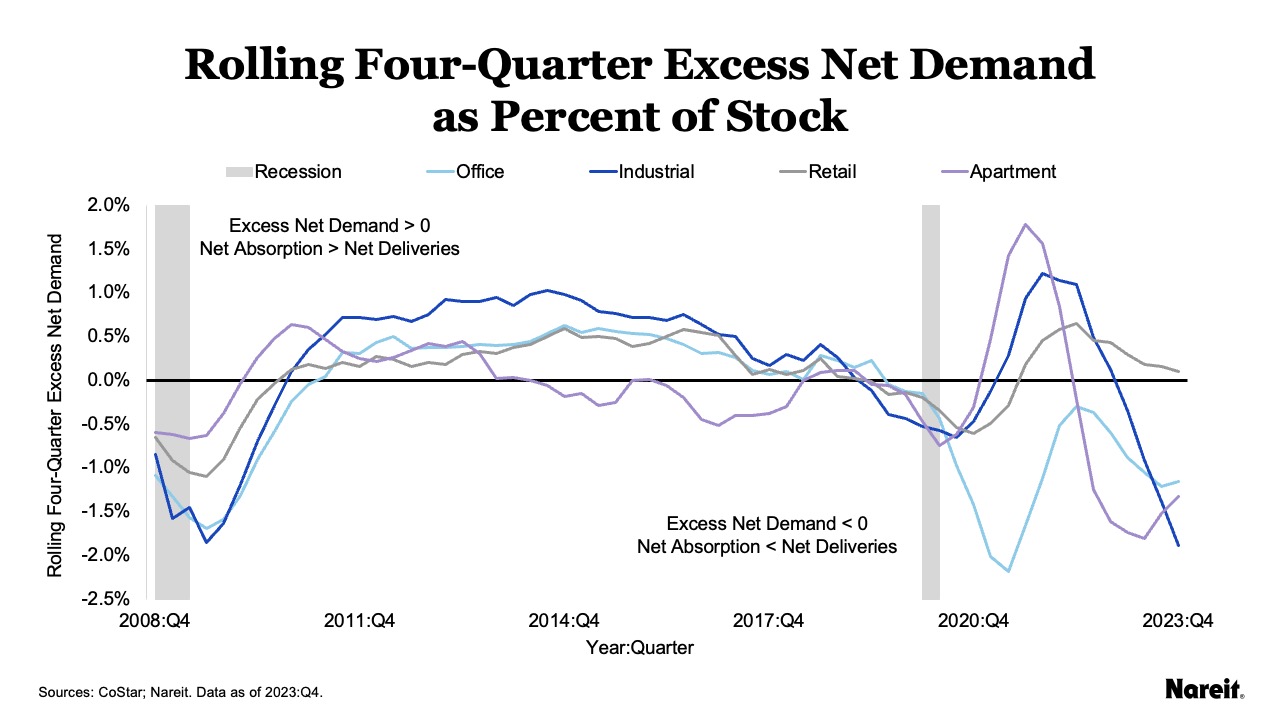

The chart above shows rolling four-quarter excess net demand as a percentage of existing stock by property type from the fourth quarter of 2008 to the fourth quarter of 2023; it also displays U.S. recessions. In the last quarter of 2023, retail was the only property type that maintained a positive excess net demand value. Retail demand has continued to exceed the sector’s limited supply for 10 straight quarters. Excess net demand remained negative for the industrial, apartment, and office property types. Net absorption has fallen short of net deliveries for industrial, apartment, and office for four, seven, and 18 consecutive quarters, respectively. These demand shortfalls have diminished the strength of each sector’s property fundamentals.

The tales behind the apartment, industrial, and office supply-demand imbalances are nuanced. Recent apartment and industrial supply surges were driven by strong demand and high rents over the past several years. As completions accelerated in the last year, apartment net absorption maintained consistent levels with its recent past, but industrial demand dropped off precipitously. Office demand challenges are well known, but the sector has also suffered from supply issues. Years of negative net absorption have not curtailed office net deliveries.

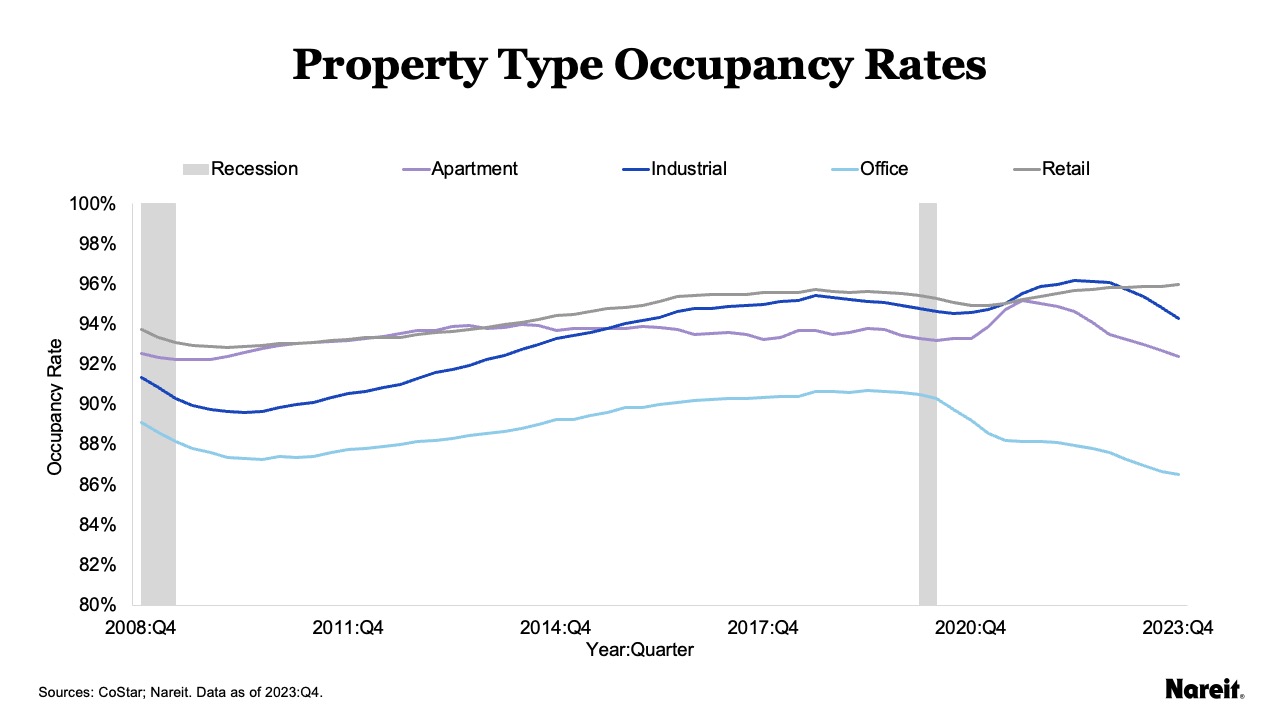

The chart above depicts occupancy rates for the four traditional property types, as well as U.S. recessionary periods from the fourth quarter of 2008 to the fourth quarter of 2023. While the retail occupancy rate continued its ascent to reach an all-time high, industrial, apartment, and office occupancy rates maintained their declines. Industrial occupancy has declined for six consecutive quarters, but it remained at a level consistent with those prior to the pandemic. The apartment occupancy rate has fallen to a level not seen since 2010. Office occupancy has continued the descent that it started in 2019. As of the fourth quarter of 2023, it stood at 86.5%—its lowest level since 2000.

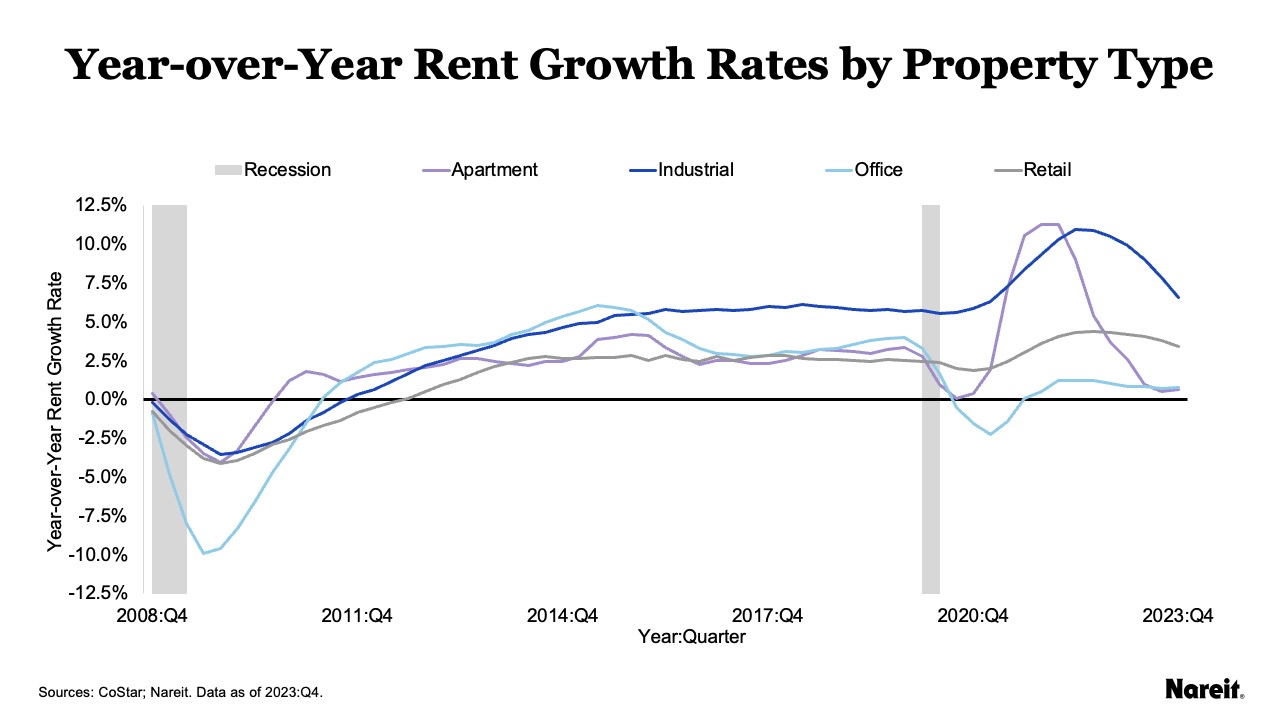

The chart above presents year-over-year rent growth rates by property type, as well as periods of U.S. recession from the fourth quarter of 2008 to the fourth quarter of 2023. After reaching double digits in 2022, the industrial rent growth rate dropped to 6.6% at year-end 2023. Retail followed a similar but more modest downward trend, declining from a peak of 4.4% in the third quarter of 2022 to 3.4% in the fourth quarter of 2023. Both industrial and retail rates remained above their respective pre-pandemic levels. The apartment rent growth rate reached an historical high of 11.3% at the beginning of 2022. It has since plunged to near zero. As of the fourth quarter of 2023, it was 0.7%, the lowest level of growth among the four property types. Despite falling occupancy rates, office maintained a positive rental gain in the last quarter of 2023. It posted year-over-year rent growth of 0.8%.

The commercial real estate market has not been immune from economic and financial market challenges. Today’s property market is generally marked by supply-demand imbalances, declining occupancy rates, and moderating rental growth rates. These conditions will likely place further pressures on property operational performance gains in 2024.