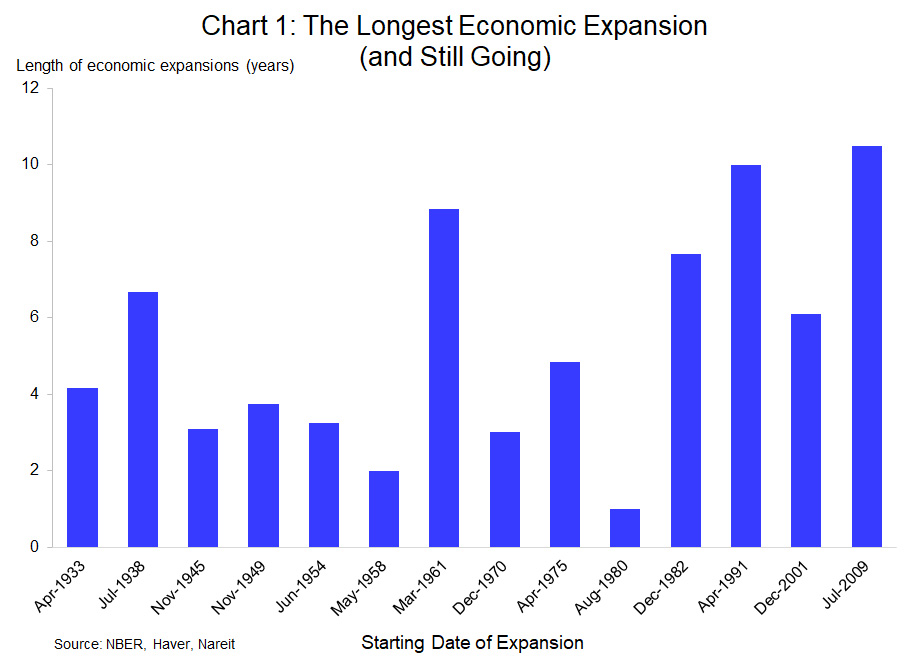

The current economic expansion is the longest in history, at more than ten years—and still going. Demand for commercial real estate has historically been closely tied to macroeconomic cycles. Today’s environment has no historical precedent. What markers can we rely on as the economy and commercial real estate move into uncharted waters?

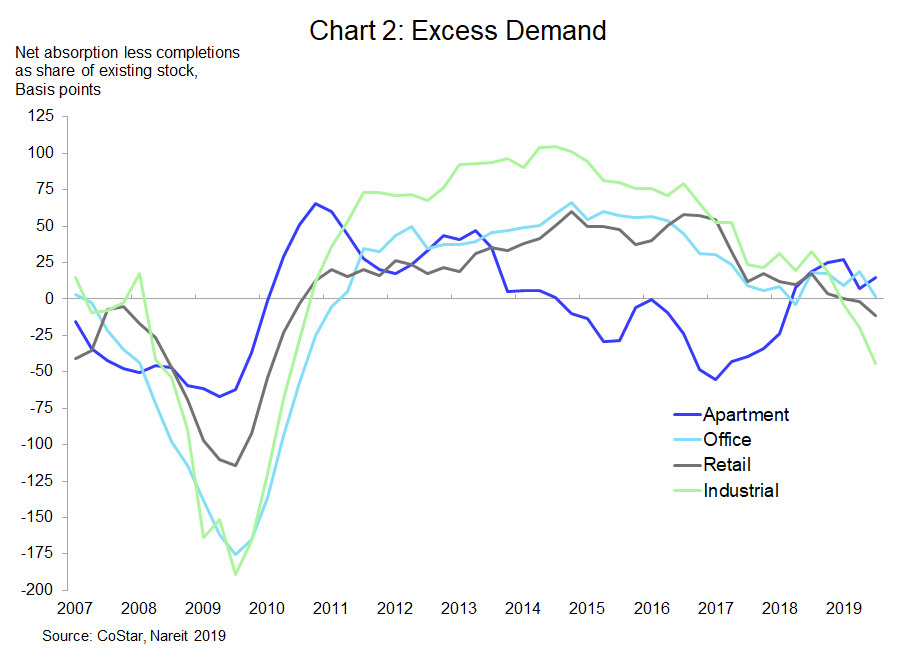

There are features of the overall economy and commercial real estate markets that can help gauge the risks of a downturn in the year ahead. We recently published the Nareit Outlook for the Economy, Real Estate and REITs in 2020: What to Look for in Uncharted Waters. The outlook is positive, with continued economic growth expected to provide support for real estate markets. There are few signs of overbuilding in commercial real estate, as demand and supply are roughly balanced but with little or no excess demand.

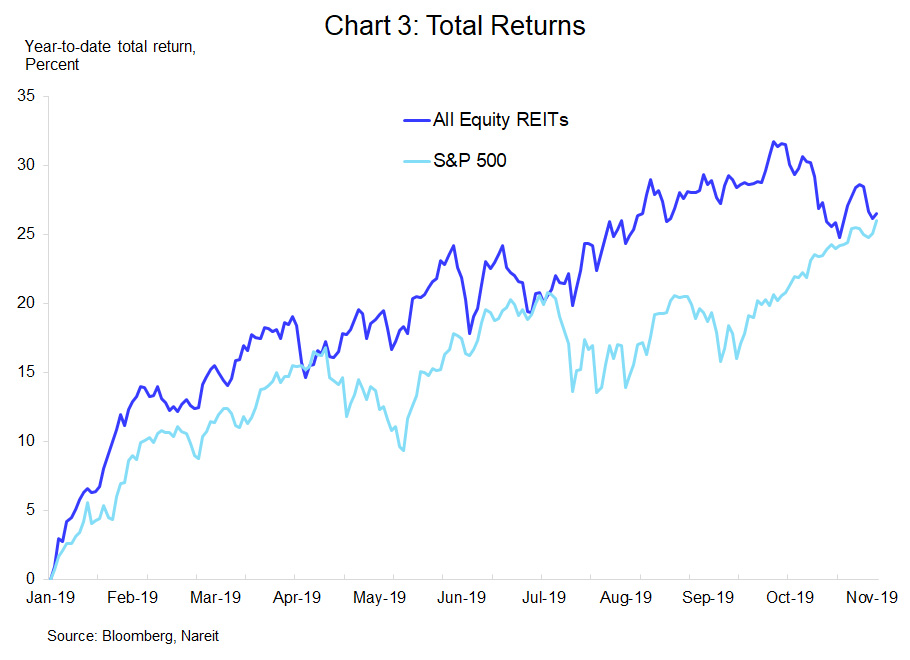

REITs tend to perform well in environments with a growing economy and low vacancy rates. 2019 was no exception, as through the first 11 months REITs posted a total return of 27.9%, the best investment performance since 2014. Despite the risks ahead—we are keeping an eye on new construction, vacancy rates and trends in property prices—most indicators point to another good year for REITs in 2020.