Q2 Data Highlights All-Time High FFO, NOI; Pre-Pandemic Occupancy Rates

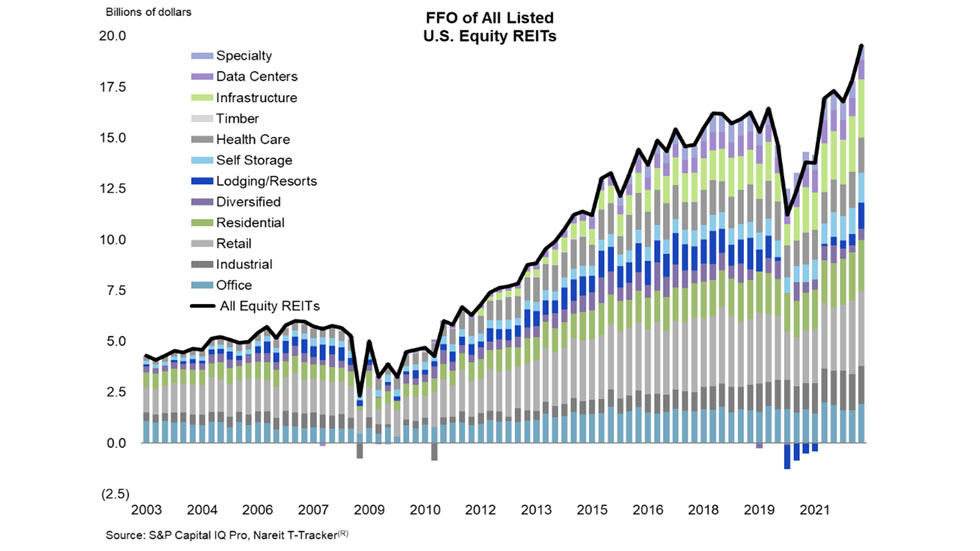

WASHINGTON, D.C. (August 15, 2022) – REITs posted record-high funds from operations (FFO) as they navigate ongoing interest rate increases and high inflation, according to new Q2 data from the Nareit Total REIT Industry Tracker Series (T-Tracker®) report released today.

The quarterly report also underscores REITs’ recovery from the pandemic; the new data show that occupancy rates of total REIT-owned properties reached and exceeded pre-pandemic levels for the first time.

“REITs delivered strong operating performance despite concerns about a slowing economy,” said Nareit Executive Vice President of Research and Investor Outreach John Worth. “REITs and the publicly traded real estate industry have not been immune to stock market volatility, but operating performance is holding up.”

All-Time High FFO, NOI Underscore REITs’ Resilience

The T-Tracker® data for the second quarter of 2022 show that FFO reached a record high of $19.6 billion—a 9.8% increase from last quarter. Nearly 84% of REITs reported increased FFO from a year ago, and almost every sector achieved quarter-over-quarter FFO growth, including:

- Lodging/resorts FFO rose 129.8% to $1.3 billion.

- Diversified FFO rose 71% to $566 million.

- Self storage FFO rose 14.7% to $1.5 billion.

- Data Centers FFO rose 5.8% to $950 million.

- Industrial FFO rose 4% to $1.8 billion.

Meanwhile, net operating income (NOI) reached an all-time high of $28.5 billion, which is 3.9% higher than last quarter—and 9.9% higher than one year ago. Ninety-two percent of REITs reported an increased NOI from one year ago.

Increasing Occupancy Rates Show Ongoing Recovery from Pandemic

Occupancy of total REIT-owned properties increased to 93.7%, according to T-Tracker® results. This is the first quarter that they reached and exceeded pre-pandemic levels. Notably, retail occupancy rates grew more than 100 basis points (bps) from the previous quarter to 96.9%.

Industrial and office REIT occupancy changed slightly from the previous quarter, with industrial and office REITs increasing to 97.1% and 90%, respectively.

Balance Sheets Continue to Have Low Levels of Leverage, Well-Structured Debt

REITs continue to be well-prepared for a period of higher interest rates by maintaining historically low levels of leverage along with well-structured, long-term debt. For example, T-Tracker® data show that:

- Leverage ratios remained low compared to the historical average: Debt-to-book assets fell more than 37 bps to 49.5% and debt-to-market assets remained near historic lows at 33.1%.

- Interest coverage increased to 6.1 times.

- Net interest expense as a percent of NOI declined to a record low of 16.8%, from 17.7% in the prior quarter.

- Weighted average term to maturity of REIT debt was more than 7 years—or 87 months—which is up from 85.5 months in the prior quarter.

Rising Interest Rates Affect Acquisitions

Increasing interest rates have affected the volume of commercial property transactions, and REITs also have seen transactions dip as evidenced by net acquisition data from T-Tracker®. The data show that net acquisitions in the quarter were $11.0 billion, down from $16.7 billion in the first quarter. “Though there was still more activity than we expected to see, both acquisitions and dispositions fell for the quarter,” said Nareit Vice President of Research Nicole Funari.

Additional Key Data from T-Tracker®

The T-Tracker® report details other data showing that:

- Same Store NOI increased 8.3% over the last four quarters.

- Dividends for equity REITs were $12.7 billion total, while dividends for mREITs were $1.9 billion.

For more data, please read the complete Q2 2022 Nareit T-Tracker® report.