April 1, 2021 - Nareit has released its 2021 first quarter REIT performance report showing REIT returns continued to recover from their pandemic-driven downturn and outpaced the S&P 500 in the quarter.

Some key findings include:

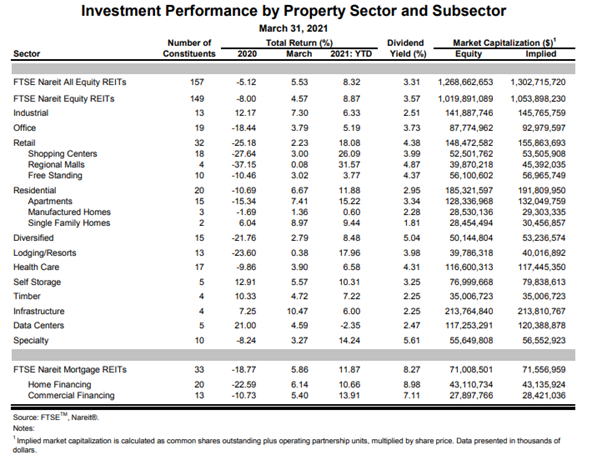

In the first quarter of 2021, the FTSE Nareit All Equity REIT Index rose 8.32% and the FTSE Nareit Mortgage REITs Index increased 11.87%, compared to the 6.17% gain for the S&P 500.

The top performing REIT sectors in the first quarter were among those hardest hit by the pandemic in 2020, including:

- Regional Malls – up 31.57%

- Shopping Centers – up 26.09%

- Lodging and Resorts – up 17.96%

REITs conducted 38 equity and debt offerings in the first quarter 2021 raising $22.2 billion, including:

- $7.63 billion in common shares

- $53 million in preferred shares

- $14.4 billion in secondary debt offerings

The FTSE Nareit All Equity REITs Index reported a dividend yield of 3.31% in Q1, more than double the 1.41% dividend yield paid by the S&P 500.

Below are some key takeaways that can be attributed to Nareit Senior Economist Calvin Schnure on REIT performance in the first quarter of 2021:

- “Recent news on vaccine distribution and economic stimulus make it likely that activity will return to more normal patterns, including travel, shopping, restaurant dining and entertainment, faster than previously believed. That’s boosting expectations for economic growth this year, and will help drive demand for all types of commercial real estate.”

- “REIT share prices continue to recover with an 8.3% total return for the All Equity REITs Index. The rebound is especially strong among those sectors that felt the brunt of the social distancing during the first phase of the pandemic, including lodging/resorts (+18.0%) and retail (+18.1%), as the outlook for these sectors continues to brighten.”

The entire 2021 first quarter report can be found here.