Sectors Hardest Hit by Pandemic Deliver Largest Gains

WASHINGTON, DC, (Jan. 8, 2021) — In the fourth quarter, U.S. REIT share prices continued their recovery from declines early in the pandemic. Equity REITs finished the year with a -5.12% total return.

In the fourth quarter, the FTSE Nareit All Equity REIT Index rose 8.15%, compared to the 1.19% gain in the third quarter, and the FTSE Nareit Mortgage REITs Index increased 26.22%, compared to the 6.41% rise in the third quarter.

“REIT share prices across most sectors increased in the fourth quarter,” said Nareit Executive Vice President of Research and Investor Outreach John Worth. “It’s worth noting that the sectors hardest hit by shutdowns and social distancing requirements earlier in the year delivered the biggest gains in the fourth quarter as investors anticipated the recovery that access to COVID-19 vaccines could provide.

COVID-19-Battered Sectors See Signs of Recovery

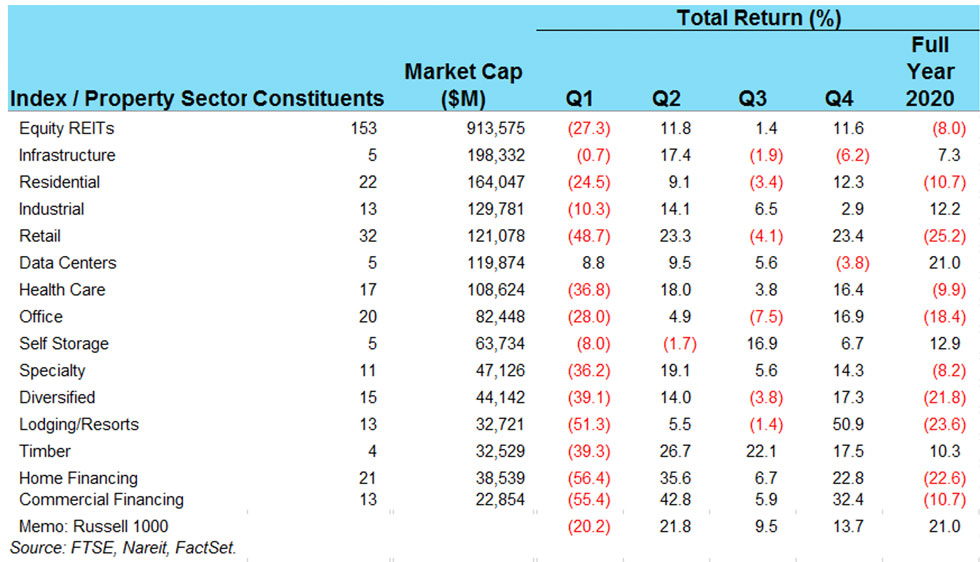

Among the REIT sectors most impacted by the pandemic was the lodging/resorts sector, which gained 50.9% in the fourth quarter after a 1.41% loss in the third quarter. Retail, another hard-hit sector, was up 23.45% in the fourth quarter after falling 4.09% in the third quarter. The office sector, which some investors expressed concern about being permanently impacted by the work-from-home trend, rose 16.87% in the fourth quarter compared to a decline of 4.09% in the third quarter. The residential sector also saw significant growth in the fourth quarter, up 12.28%, after a decline in the third quarter of 3.41%.

Digital economy sectors, the REIT sectors that provide real estate underpinning data centers, digital communications, and e-commerce, including data centers, industrial, and infrastructure, saw a slight loss in the fourth quarter, but remained the highest performing sectors for all of 2020. Data Centers declined 3.8% in the fourth quarter but were up 21% for all of 2020; infrastructure lost 6.2% in the fourth quarter but was up 7.3% for the year; and industrial gained 2.9% in the fourth quarter and was up 12.2% for the year.

The total equity market capitalization of the 223 REITs in the FTSE Nareit All REITs Index, the broadest REIT index, containing both equity and mREITs, at the end of the fourth quarter was $1.25 trillion, with the REITs in the FTSE Nareit All Equity REITs Index totaling a market capitalization of 1.175 trillion. Both of these numbers are up slightly from the previous quarter.

“The outlook for 2021 is for most REIT sectors to continue to recover, with the pace of improvement driven by the availability and effectiveness of a vaccine,” said Nareit Senior Economist Calvin Schnure. “Conditions are likely to be mixed in the first half of the year, with strengthening in the second half, and a more complete recovery in 2022,” he said. Nareit published its 2021 outlook in December, and the full report is available here.

Public Capital Offerings Down Year-Over-Year

REITs conducted a total of 27 equity and debt offerings in the fourth quarter, raising $10.2 billion. In comparison, in the fourth quarter of 2019, REITs conducted 54 offerings and raised $21.3 billion. The capital raised in the fourth quarter included $3.87 billion in common shares, $538 million in preferred shares, and $5.08 billion in secondary debt offerings. REITs conducted a total a 205 equity and debt offerings throughout 2020, raising $100.025 billion. In comparison, in 2019 REITs conducted 246 offerings and raised $112.95 billion.

REITs Continue to Pay Significant Dividends

Throughout 2020, REITs offered a substantial dividend yield, with the FTSE Nareit All Equity REITs Index reporting a 3.84% yield as of Dec. 31, 2020. This is more than double the 1.51% dividend yield paid by the S&P 500.

The dividend yield of the FTSE Nareit Mortgage REITs Index on Dec. 31, 2020 was 8.99%, with Home Financing REITs yielding 9.66% and Commercial Financing REITs yielding 7.86%.

About REITs:

REITs are real estate working for you. Through the diverse array of properties they own, finance, and operate, REITs help provide the essential real estate we need to live, work, and play. REITs of all types collectively own more than $3.5 trillion in gross assets across the U.S., with stock-exchange listed REITs owning over $2.5 trillion in assets. U.S. listed REITs have an equity market capitalization of more than $1 trillion. In addition, more than 145 million Americans live in households with in REIT investment through their 401(k) and other investment funds.

About Nareit:

Nareit serves as the worldwide representative voice for REITs and real estate companies with an interest in U.S. real estate. Nareit’s members are REITs and other real estate companies throughout the world that own, operate, and finance income-producing real estate, as well as those firms and individuals who advise, study, and service those businesses.