FTSE Nareit All REITs Index Shows 1.46% Gain in Q3

WASHINGTON, DC, (Oct. 9, 2020) — U.S. REIT returns edged higher in the third quarter but finished the third quarter down 12.27% year-to-date.

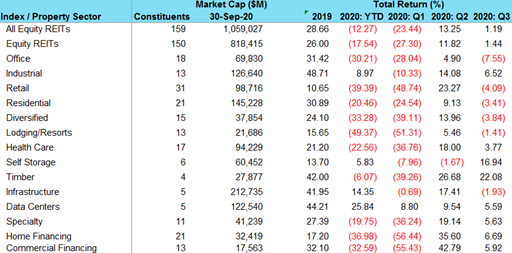

The FTSE Nareit All Equity REIT Index rose 1.19%, compared to the 13.25% gain in the second quarter, and the FTSE Nareit Mortgage REITs Index increased 6.41%, compared to the 37.85% rise in the second quarter.

“REIT share prices rose in the third quarter after experiencing a strong rebound in the second quarter as the economy began to reopen.” said Nareit Executive Vice President of Research and Investor Outreach John Worth. “While REIT share prices continued to recover in the third quarter, it occurred at a slower pace from the second quarter as investors expressed uncertainty about the likely pace of recovery in a number of REIT sectors.”

FTSE Nareit U.S. Real Estate Index Series

Investment Performance by Property Sector and Subsector

*Source FTSE, Nareit, Factset.

21st Century REITs Show Strong Performance

REIT sectors that have provided communications and e-commerce services throughout the pandemic delivered significant gains for shareholders in the first nine months of the year. Data centers gained 5.59% in the third quarter and 25.84% in the first nine months of the year. The industrial sector, which includes logistics REITs that are essential components in the e-commerce product delivery chain, was up 8.97% in the third quarter and 6.52% in the first nine months of 2020. The infrastructure sector, the bulk of whose equity market capitalization is made up of cell tower REITs, was up 14.35% year to date and fell slightly in the third quarter 1.93%. Another sector that saw a substantial increase in the third quarter was self-storage, which gained 16.94%.

The total equity market capitalization of the 222 REITs in the FTSE Nareit All REITs Index at the end of the quarter was $1.14 trillion, with the REITs in the FTSE Nareit All Equity REITs Index totaling a market capitalization of 1.083 trillion. Both of these numbers are up slightly from the previous quarter.

Public Capital Offerings Down Year-Over-Year

REITs conducted a total of 60 equity and debt offerings in the third quarter, raising $26.2 billion, including $4.7 billion in equity. In comparison, in the third quarter of 2019, REITs conducted 81 offerings and raised $34.2 billion, including $11.7 billion in equity. The capital raised in the third quarter included $3.95 billion in common shares (including $795 million from 2 IPOs), $697 million in preferred shares, and $21.56 billion in secondary debt offerings.

REITs Continue to Pay Significant Dividends

Throughout 2020, REITs have paid a substantial dividend yield, with the FTSE Nareit All Equity REITs Index reporting a 3.84 yield as of September 30. This is more than double the 1.69% dividend yield paid by the S&P 500.

The dividend yield of the FTSE Nareit Mortgage REITs Index on September 30 was 10.54%, with Home Financing REITs yielding 10.66% and Commercial Financing REITs yielding 10.32%.