What are Equity REITs?

Equity REITs are real estate companies that own or manage income producing properties – such as office buildings, shopping centers and apartment buildings – and lease the space to tenants. After paying the expenses associated with operating their properties, equity REITs pay out annually the bulk of the income to their shareholders as dividends. Equity REITs also generate income from the sale of properties.

Because most REITs operate as equity REITs when the market refers to REITs it is typically discussing listed equity REITs.

Today’s U.S. Equity REIT Market

Public equity REITs constitute the majority of today’s REIT market and help power the U.S. economy. They own more than $2.5 trillion of real estate assets in the U.S. including more than 570,000 structures in all 50 states and the District of Columbia. Equity REITs also comprise a majority of the headline real estate sectors under commonly used industry classification standards.

Housing the Economy

In drafting the original REIT legislation in 1960, Congress established a broad definition of real estate because it understood that the role and uses of real estate in a dynamic economy would change over time along with economic growth and changing technology.

Consequently, there are equity REITs today that own real estate tied to almost all sectors of the economy where we live, work and spend our leisure time. REITs own real estate in a wide range of segments, including apartments, shopping centers, warehouses, hotels, storage facilities, hospitals and clinics, senior living facilities, offices, data centers, telecommunications towers and timberlands.

REITs are an effective way to raise the capital needed to help finance projects that revitalize neighborhoods, enable the digital economy, power community essential services, and build the infrastructure of tomorrow, while creating American jobs and economic activity along the way.

What are the Characteristics of Equity REIT Investing?

Dividend Income

The high dividend payout requirement for REITs means that a larger share of REIT investment returns comes from dividends when compared with other stocks. For this reason, many financial advisors consider equity REITs to be well-suited for investors seeking income, as well as for long-term investors seeking both income plus capital appreciation.

Equity REIT dividend yields have historically been higher than the average yield of the S&P 500 Index. In fact, over the long-term, more than half of equity REIT total returns have come from dividends.

Portfolio Diversification

Equity REITs have historically provided important diversification benefits for investors due to their relatively low correlation with other assets, including other stocks and bonds.

Diversification aims to reduce portfolio volatility, the risk that investors will see large up-and-down cycles in the value of their portfolio holdings. Some investors may seek to reduce volatility by diversifying a portfolio, for example, between small-cap stocks and large-cap stocks.

However, this strategy only divides a portfolio between different parts of the same asset class and does not achieve the full benefit of diversification. A widely accepted approach to portfolio diversification is to also diversify among asset classes.

Equity REITs, for example, have had less of a tendency to move in tandem with other equities when stocks go up or down. Over the 20-year period from the beginning of 2000 to year-end 2019, large-cap equities as represented by the S&P 500 and large-cap equity and listed Equity REIT total returns were only 60% correlated. So, listed equity REITs are effective at achieving portfolio diversification.

Inflation Hedging

A key concern for many investors today is how to ensure enough income for a retirement period that could last for decades. Even in a low-inflation environment, the cumulative effects of inflation over long periods can erode the purchasing power of portfolio assets. The dilemma for retirees is that it can be tough to stay ahead of inflation with fixed income securities, while equities – the traditional inflation hedge – are usually trimmed back to reduce investment risk.

Listed equity REITs have provided, in part, a natural hedge against inflation in ways that match up well with investors’ needs. Commercial real estate rents and values have tended to increase when prices do, which has supported equity REIT dividend growth, providing retirement investors with reliable income even during inflationary period

Total Return Performance

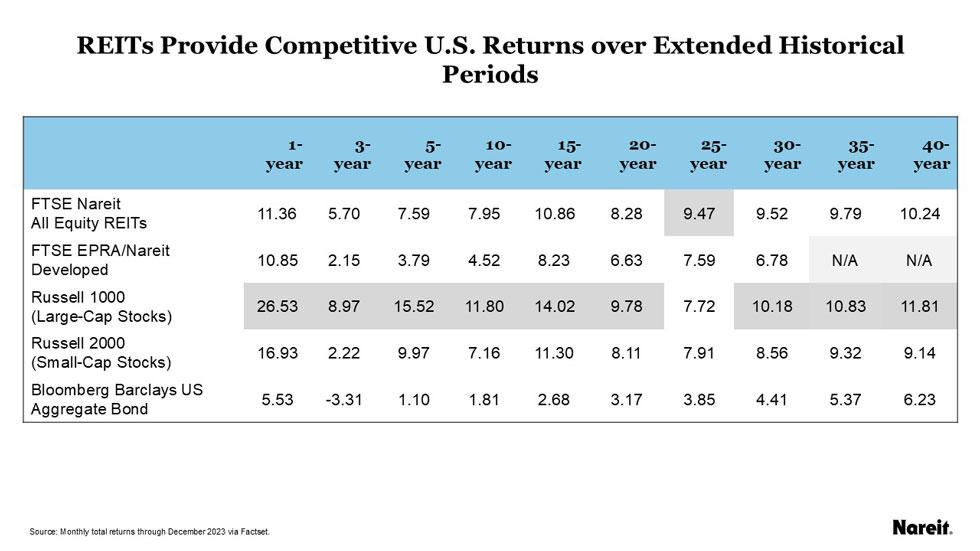

REITs' track record of reliable and growing dividends, combined with long-term capital appreciation through stock price increases, has provided investors with attractive total return performance for many periods over the past 45 years compared to the broader stock market as well as bonds and other assets.

REITs are professionally managed, publicly traded companies that manage their businesses with the goal of maximizing shareholder value. That means positioning their properties to attract tenants and earn rental income, and managing their property portfolios and buying and selling of assets to build value throughout long-term real estate cycles.

This drives total return performance for REIT investors, who benefit from a strong, reliable annual dividend payout and the potential for long-term capital appreciation. For example, REIT total return performance over the past twenty years has outstripped the performance of the S&P 500 Index and other major indices – as well as the rate of inflation.

Liquidity and Transparency

For many years, investors considered real estate an illiquid asset. However, the liquidity of REITs listed on major stock exchanges makes real estate investing as simple and straight-forward as any other stock.

REITs also provide market transparency for investors, with real-time pricing and valuations. As with other stocks, investors can get in and out of their investments to optimize their exposure to real estate. Listed REITs in the U.S. are also registered and regulated by the SEC, ensuring adherence to SEC standards of corporate governance, financial reporting and information disclosure.

A Stabilizing Force in the Real Estate Marketplace

The listed REIT industry is focused on investment for the long-term, and has a track record of generating current income and using moderate leverage. The industry is widely monitored by analysts, investors and the financial media.

Who Invests in Equity REITs?

REITs provide any investor access to diverse portfolios of income-producing assets they would not be able to afford on their own. Listed REITs are prominent in today’s investment landscape. They are included in over 250,000 401(k) plans, and approximately 170 million Americans are invested in REITs through these and other investment plans. There are numerous mutual funds and ETFs dedicated to stock exchange-listed REITs sponsored by major investment management firms. Additionally, REITs are in nearly all target date funds, the fastest-growing retail investment default option, and most pension fund and endowment portfolios.

What are the risks of Equity REIT investing?

Like other stocks, equity REIT share prices are influenced by market conditions and may rise or fall. Additionally, while the real estate market cycle is different from the market cycles for other stocks, commercial real estate remains a cyclical business. Changes in the values of the property portfolios owned by equity REITs affect the valuations of their shares. Contact your broker or financial advisor for additional information about investing in REITs.