August 24, 2020 - Nareit conducts a monthly survey of REIT rent collections in the wake of the COVID-19 pandemic and related economic dislocation. Given that rent collections in the industrial, office, and healthcare sectors have stabilized at high levels, the August survey focuses on three property subsectors: apartments, free standing retail, and shopping center retail. The results show gains made last month for retail have held steady for free standing and improved further for shopping centers. Apartments show no change despite the expiry of federally subsidized unemployment. Rent collections for apartments have remained high and steady over the whole five-month period.

Nareit’s survey includes listed equity REITs that combined own and operate between 10% and 20% of commercial real estate in the U.S.

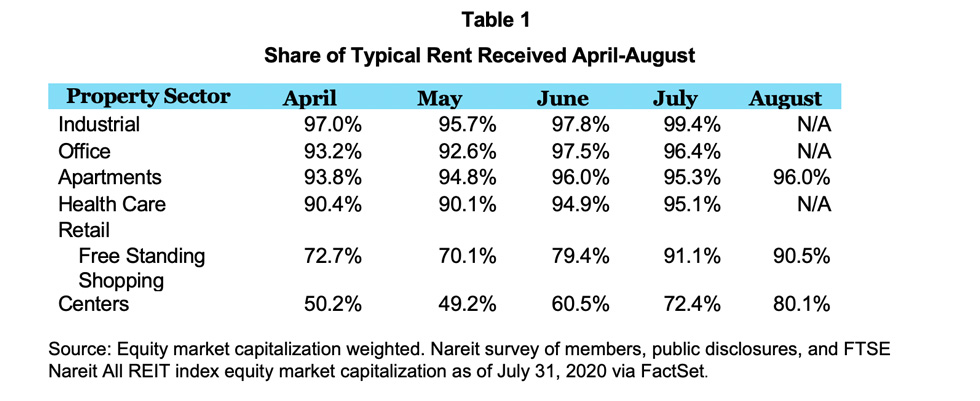

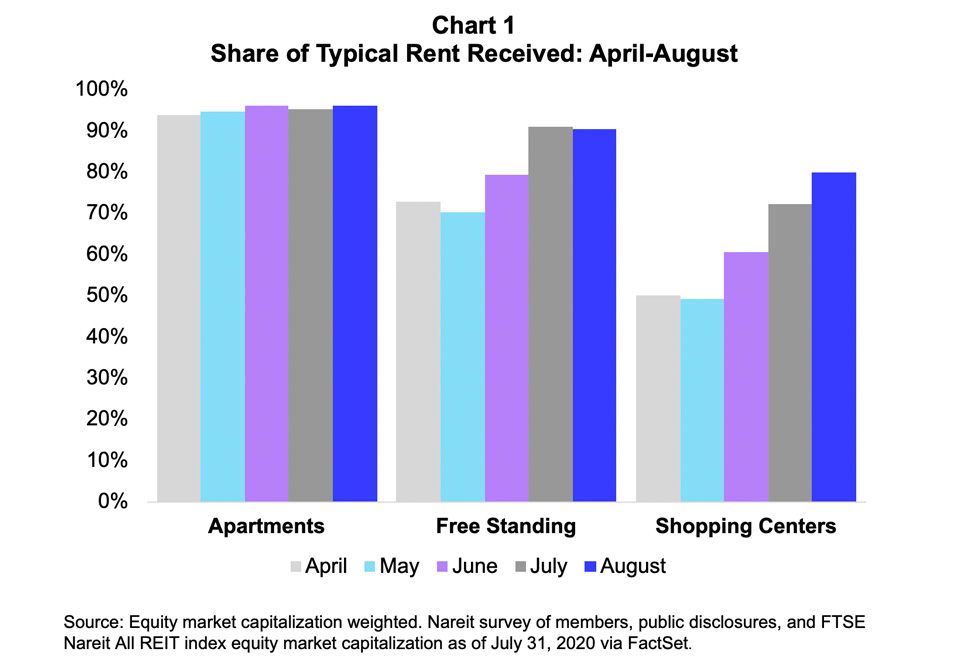

Table 1 shows the estimated REIT rent collections from April to August as a share of typical rent collections. A visualization of the results is in Chart 1. The results are displayed by property sector and are weighted by respondent REIT equity market capitalization.

The survey participants represent 72% of the FTSE All REITs total equity market capitalization for the three covered property sectors (apartments, free standing retail, and shopping centers).

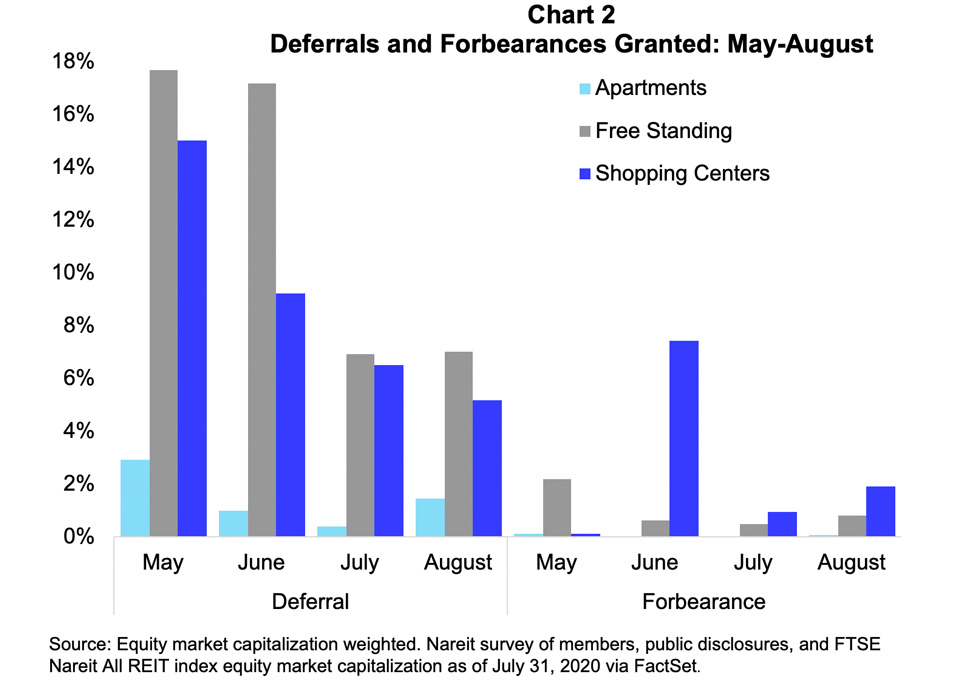

Chart 2 shows the percentage of rent owed granted deferral or forbearance by equity market cap. Survey respondents had shown a mostly steady decline in deferrals and forbearance from May to July across the three property subsectors. Apartments saw a small uptick in deferrals in August, while free standing was unchanged from July and shopping centers declined. Forbearance remains low, but all three subsectors saw a very slight increase in August from July.

Results

- Apartment collections remained substantially the same at 96% of typical rents collected in August. Since May, rent collections have hovered around the 95-96% mark.

- August survey respondents reported an uptick in rent deferrals granted. Deferrals had been declining since May’s high of 3% of rent owed, falling to less than 1% of rent in July by equity market cap. August deferrals increased slightly to 1.4%.

- There are more than 16,000 REIT-owned free standing retail establishments across the U.S., including big box stores, pharmacies, convenience stores and restaurants. Free standing held onto gains made in July at 91%. While May and June survey respondents in free standing reported granting rent deferrals for over 17% of their May and June rent, July deferrals were down to 7%. August deferrals remained at 7%.

- The U.S. has nearly 2,700 REIT-owned shopping centers. Shopping center REITs continued to make gains in August up to 80% of typical August rent collected, up almost 8 percentage points. Rent deferrals showed improvement, down to 5.2% in August from 6.5% in July. However, the sector’s forbearance rate for August survey respondents was up to 1.9% in August from 0.9% in July.

Methodology

This research note uses data from Nareit’s April through August rent surveys and publicly disclosed data matched to July’s month-end equity market capitalization. Adding public disclosures did not significantly change results.

The rents for April, May, and July are from either the Nareit surveys or public disclosures while June and August data are from survey respondents only. A comparison analysis using a matched sample of REITs with valid rent collection data for all months from April to August produced very similar results. In general, the results do not differ significantly if we use all the available data for each month, restrict the sample to only Nareit survey respondents, or use only those REITs present in the sample for all months.

Several REITs both responded to the surveys and publicly disclosed their April, May, and July rents; the survey data is used in this analysis. The survey asked respondents both the percent of rent collected and the percent of rent typically collected in the same month. In public disclosures, some REITs only disclosed the percent of rent collected. In those cases, we assume typical rent collected is 100%. Some REITs collected more than their typical amount of rent in May. We top coded the share of rent received at 100%.