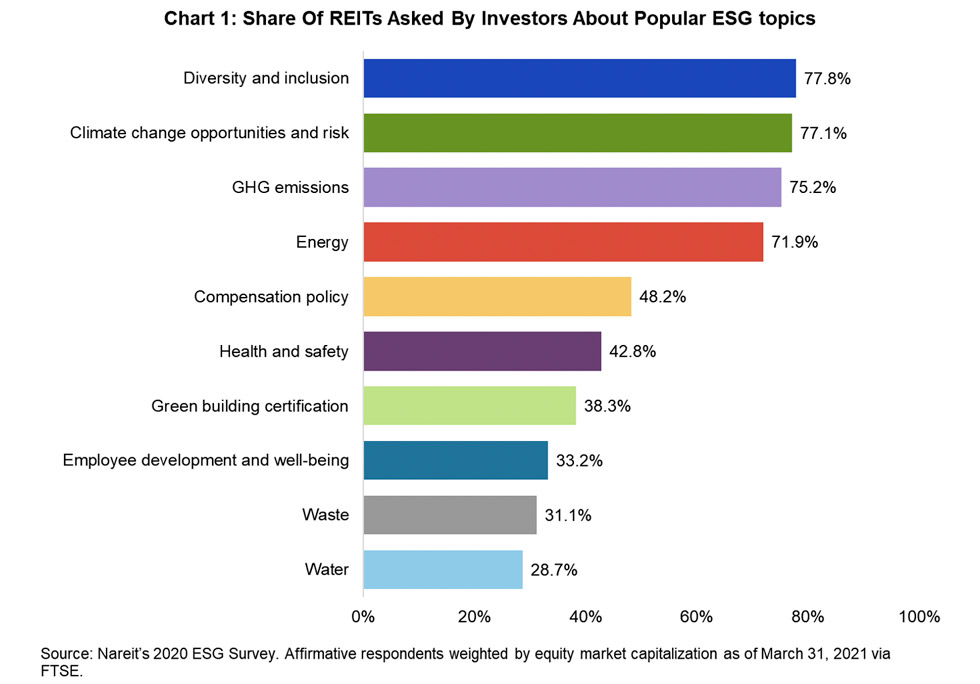

Investors are regularly asking REITs about their latest developments in ESG practices. Eighty-five equity REITs participated in Nareit’s 2020 ESG survey of the REIT industry. This represents 76% of the equity REIT share of FTSE Nareit All REITs Index’s equity market capitalization. In the survey, 95% of respondents by market capitalization indicated investors requested information about various ESG topics. These REITs reported that the top two topics they were asked about by investors last year were diversity and inclusion (77.8% by market capitalization) and climate change opportunities and risk (77.1% by market capitalization). Chart 1 shows the breakdown of popular ESG topics.

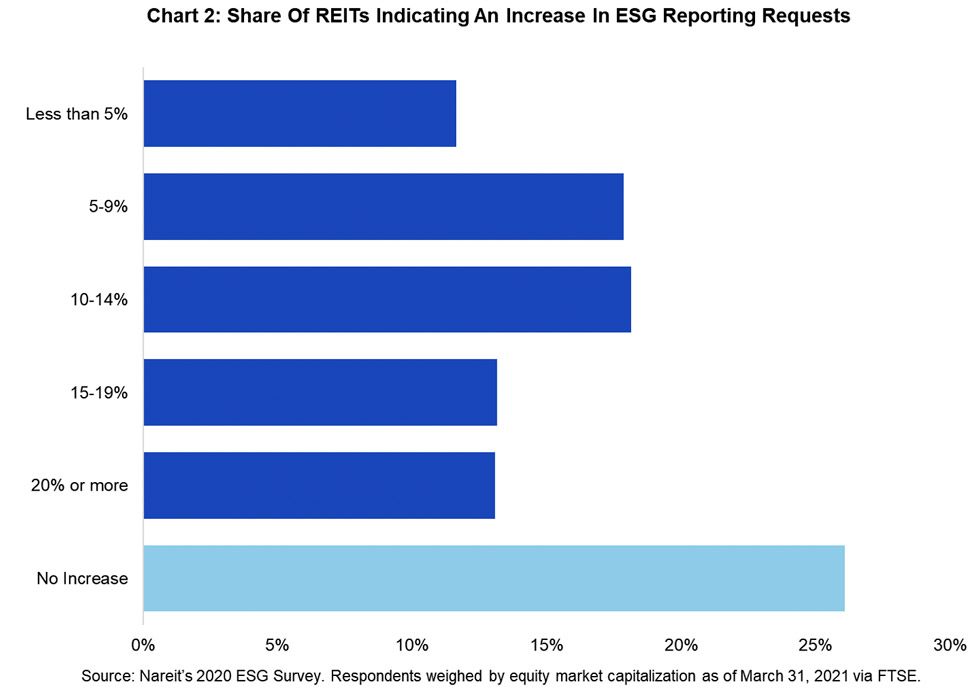

Among survey respondents more than 62% of REITs by equity market capitalization indicated that they experienced an increase in ESG reporting requests from investors between 2019 and 2020. When asked how much of an increase in requests they experienced, more than 62% responded that the number of requests increased by more than 5% year-over-year with 13% of the respondents seeing an increase of 20% or more in ESG reporting requests. Chart 2 shows the breakdown of responses for those REITs that saw an increase weighted by market capitalization.

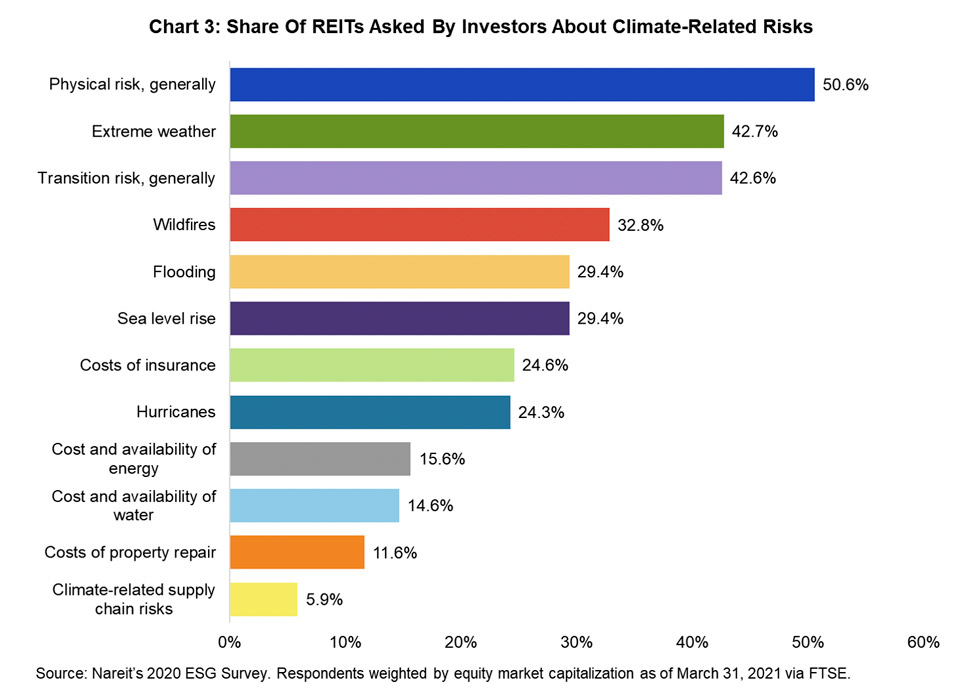

Of the total survey respondents, 77% indicated that investors requested information about climate related risks in their portfolios. Of those that responded yes, the risk topics top of mind for REIT institutional investors include physical risk, generally (50.6%), extreme weather (42.7%), and transition risk, generally (42.6%). Chart 3 shows a breakdown of responses for those REITs that had investors requested information about climate risks.

For more information about REIT ESG practices and disclosures, see the 2021 REIT Industry ESG Report published in June 2021 and the REIT ESG Dashboard.