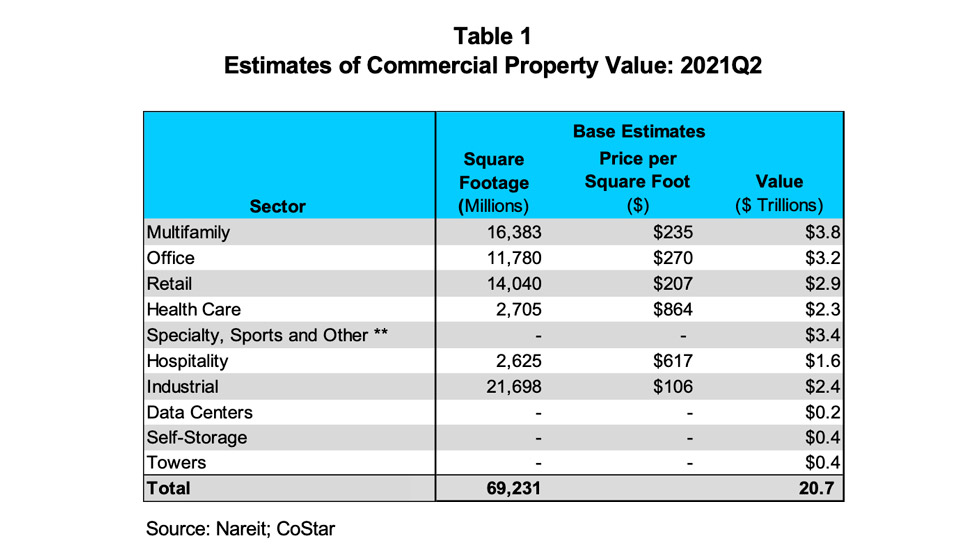

Nareit has updated our estimate of the total dollar value of the commercial real estate (CRE) market in the U.S., finding a total value of $20.7 trillion as of the second quarter of 2021. We have also updated our estimate of the REIT share of the total CRE market.

Using data from CoStar on square footage and price per square foot for the top 200 metros in the United States, we estimate the total size of the CRE market by property sector, quality rating, and metro grouping. Table 1 shows our estimates of the total value by property sector. The largest CRE property sector is Multifamily which has a dollar value of $3.8 trillion.

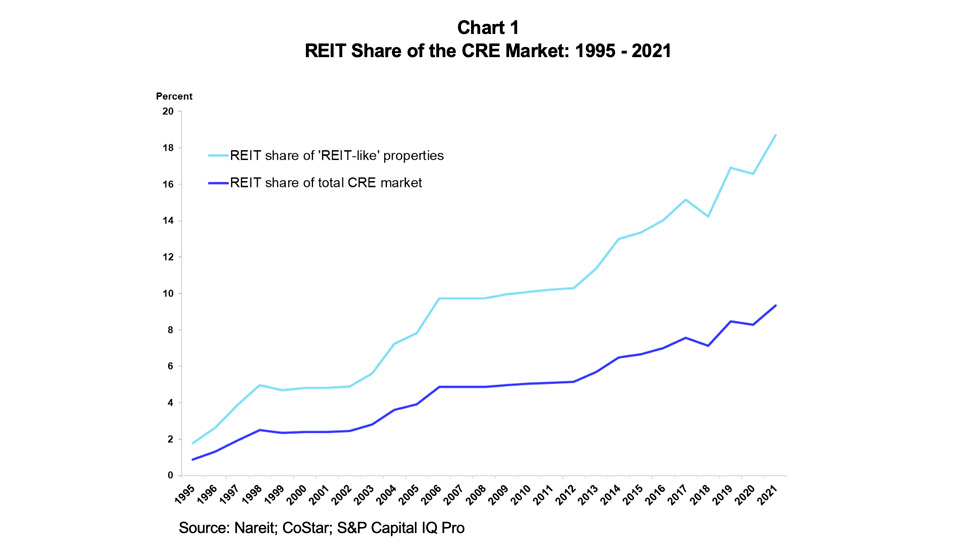

We also estimate the REIT holdings of commercial real estate using data from S&P Capital IQ Pro. For the second quarter of 2021, REITs made up an estimated 9.4% of the total CRE market. In addition to this number, it is also informative to estimate the share of “REIT-like” properties. REIT holdings tend to be institutional grade properties of higher quality, larger, and newer than many other properties in the CRE market. We estimate that the REIT share of “REIT-like” properties is 18.7% for the second quarter of 2021. Chart 1 shows a time series of both REIT share of the total CRE market and of “REIT-like” properties from 1995 – 2021.

The REIT share of the total CRE market has risen steadily over the past 2-1/2 decades. At the beginning of the Modern REIT Era in the early 1990s, REITs held a small share of total CRE, estimated to be just 1% of total commercial real estate and 2% of “REIT-like” properties. REITs increased their market share both through new entrants into the sector as well as acquisitions of additional properties by existing REITs. The REIT market share of institutional-grade properties had risen to 10% by 2005. REITs continued to grow over the subsequent decade. According to the Nareit T-Tracker, REITs made net acquisitions of $433 billion between 2010 and 2021Q3, contributing to a rise in the REIT share of institutional-quality properties to 18.7%.