Effective with the 2023: Q2 quarterly review, the FTSE Nareit U.S. Real Estate Index Series has launched a property sector devoted to gaming REITs. The sector launches with two constituents, VICI Properties Inc. (NYSE: VICI) and Gaming and Leisure Properties, Inc. (Nasdaq: GLPI). Gaming REITs focus on acquiring real property assets and leasing them to gaming operators, typically through long-term, triple net lease structures. For a new property sector to be created and included in the FTSE Nareit U.S. Real Estate Index Series, the companies included in such property sector must have a minimum combined sector level weight greater than 3% of the FTSE Nareit All Equity REITs Index by investable market capitalization for two consecutive quarters. Previously classified in the specialty sector, the two gaming REITs surpassed the 3% threshold in 2022.

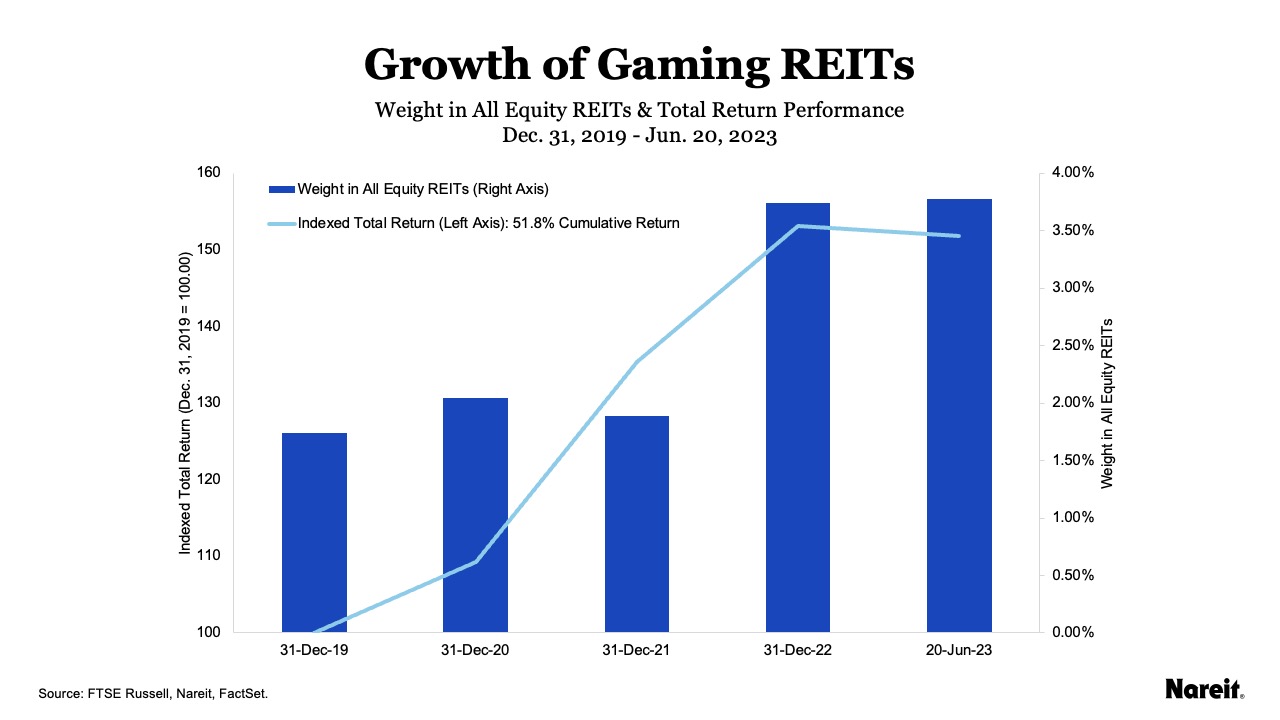

As shown in the above chart, the weight of gaming REITs in All Equity REITs grew from 1.7% at the end of 2019 to 3.8% as of June 20, 2023. During this time period, the sector posted a cumulative total return of 51.8%. Under the REIT approach, new business models can grow quickly and efficiently: From 2019–2022, the FFO of gaming REITs grew from $1.2 billion to $2.0 billion and the leverage ratio of the sector declined from 33.8% to 31.5%. The FTSE Nareit Equity Gaming REITs Index officially launched on June 19, 2023.