The FTSE EPRA Nareit Developed Extended Index rose 3.7% in August, led by Asia and North America. Developed Asia posted a total return of 6.5%, while North America gained 4.3%, and Developed Europe climbed 1.3%. Though questions remain about the direction of global trade policy, many investors have grown more optimistic that the Federal Reserve may be close to easing interest rates as labor markets have softened

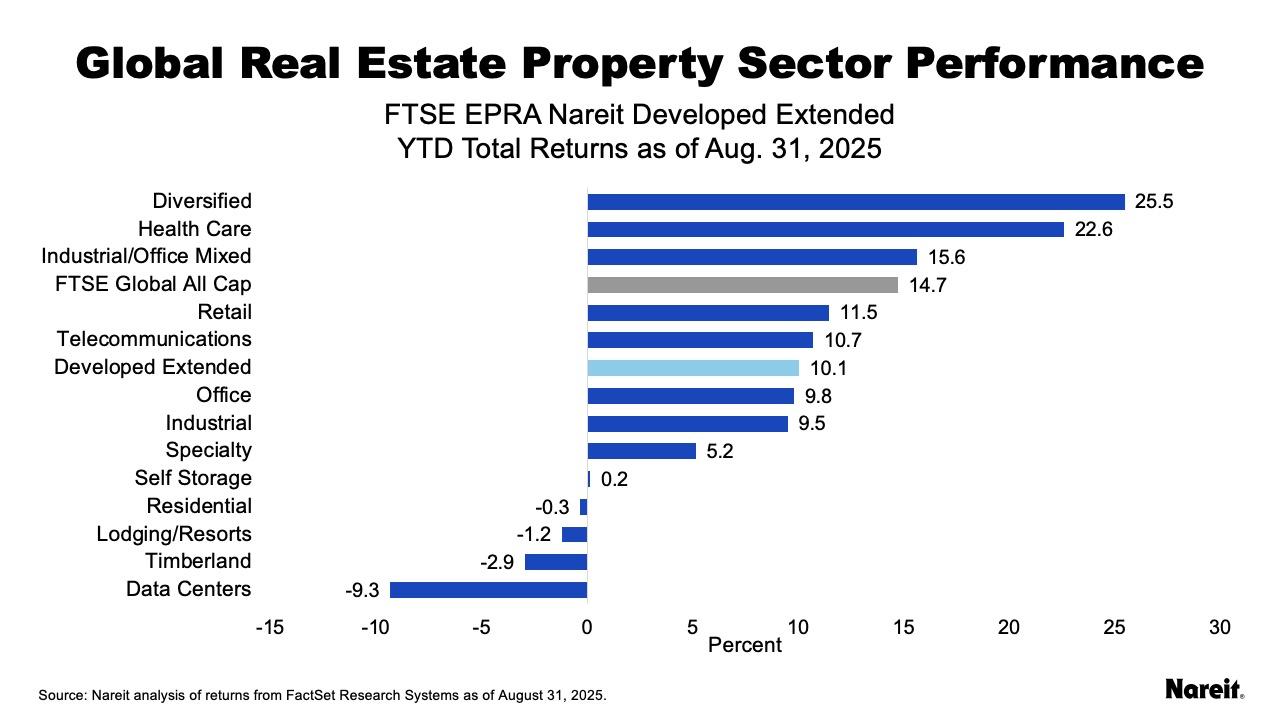

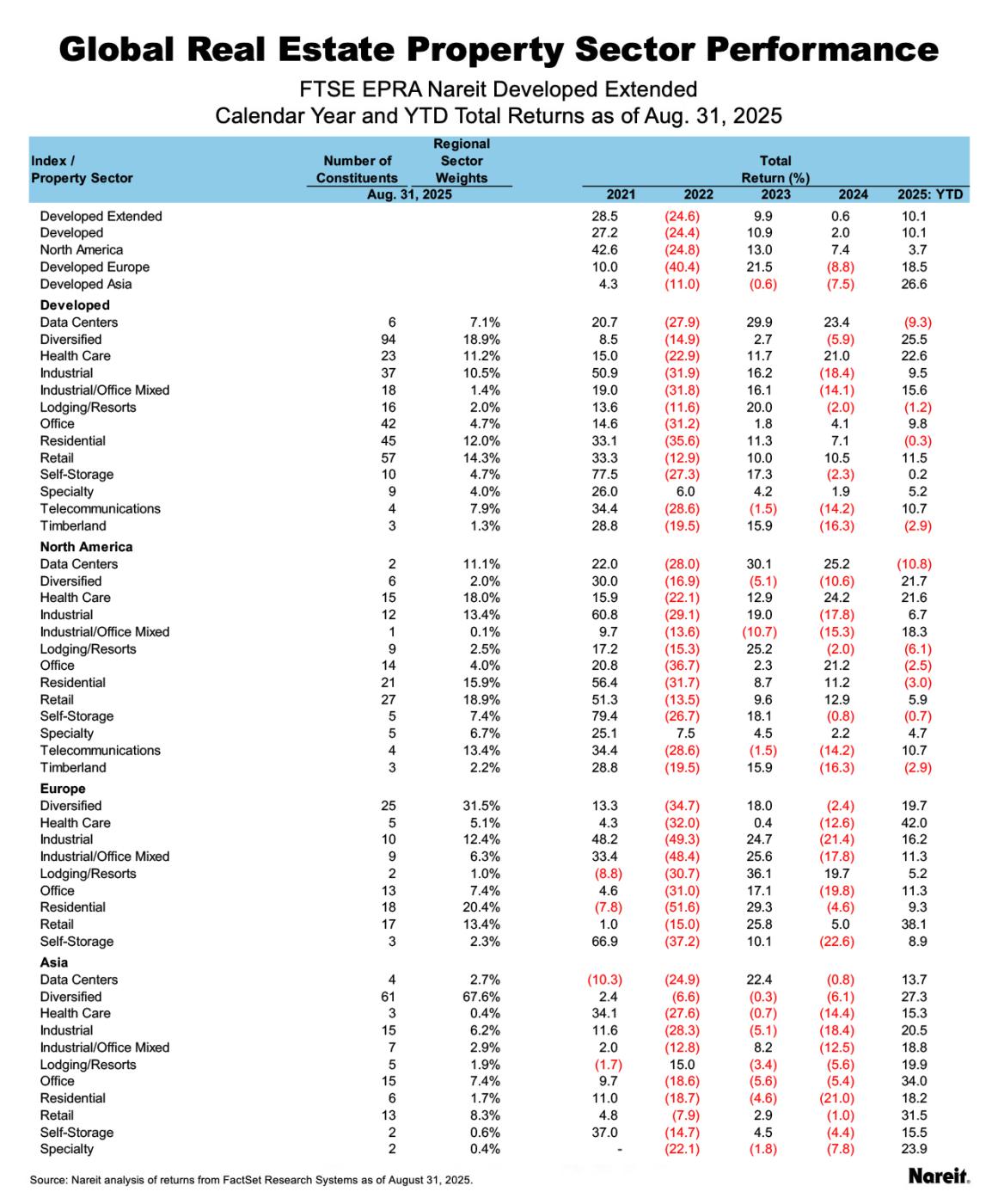

On a year-to-date basis through Aug. 31, the Developed Extended index climbed 10.1%, led by Asia with a return of 26.6%, followed by Europe at 18.5%. North America has trailed with a gain of 3.7% in 2025. The FTSE Global All Cap continues to narrowly outperform global real estate with a year-to-date return of 14.7%.

Property Sector Highlights

As shown in the chart above, diversified, health care, and industrial/office mixed lead on a year-to-date basis, with respective returns of 25.5%, 22.6%, and 15.6%. The data centers sector continues to lag with a return of -9.3% due to North American underperformance, where the sector has declined 10.8%; in Asia, the sector has gained 13.7%.

Divergent sector weights across regions offer an interesting glimpse into comparative sector performance. The diversified sector is up 21.7% in North America, but represents only 2% of regional market cap, whereas in Asia the sector makes up 67% of the region and has returned 27.3% in 2025. In Europe, diversified is 32% of the region with a total return of 19.7%. Office presents a similar story, making up 7% of both Asia and Europe, with respective returns of 34.0% and 11.3%, compared to North America with a weight of 4% and a total return of -2.5%.

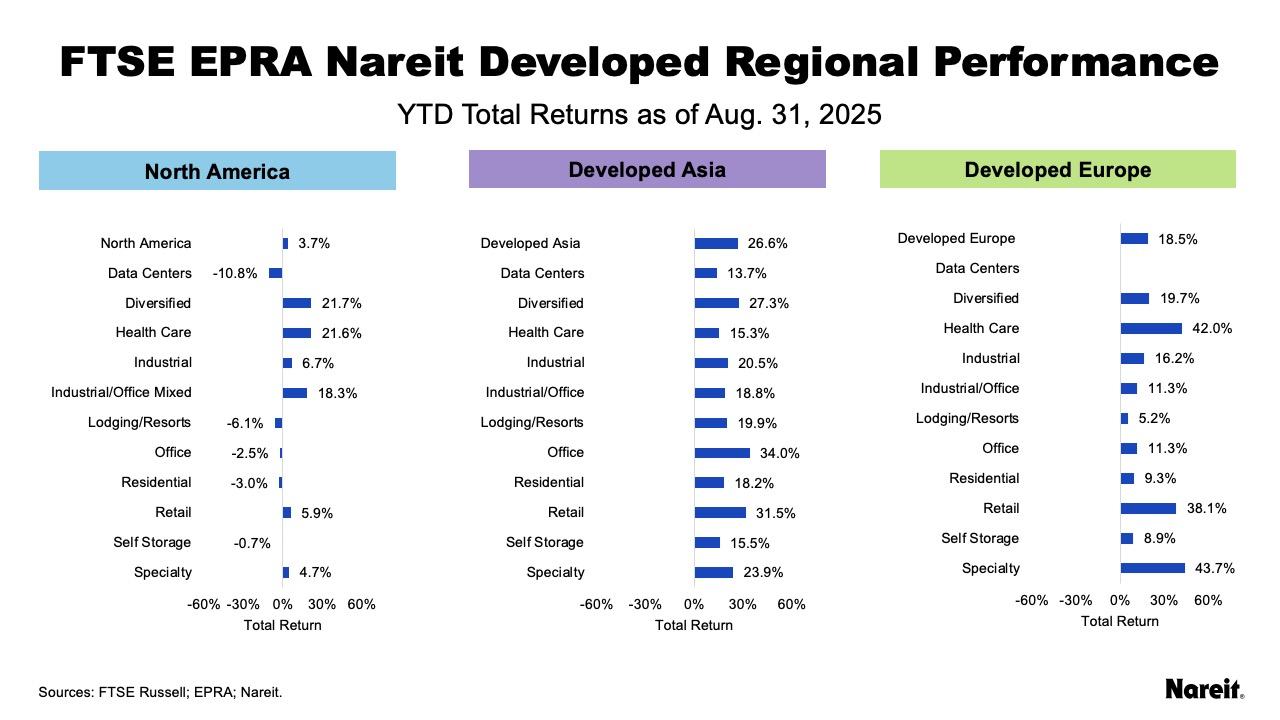

Regional Performance

On a year-to-date basis, Developed Asia leads with a total return of 26.6%, followed by Developed Europe at 18.5%, with North America posting a total return of 3.7%, as shown in the table above. Sector leadership has remained static in Asia and Europe. In Asia, office, retail, and diversified lead, while health care, retail, and diversified have outperformed in Europe. North America is led by diversified, followed by health care, and industrial/office mixed.

The above graphic reflects the broad outperformance of Asia and Europe in the FTSE EPRA Nareit Global Real Estate Index Series. In these regions, all property sectors continue to trade positively in 2025. Though North America has presented a more mixed picture, diversified and health care have risen alongside gains in Asia and Europe.