The FTSE EPRA Nareit Developed Extended Index fell 1.4% in July. Developed Asia posted a return of 0.9%, while North America fell 0.8%, and Developed Europe trailed with a total return of -6.1%. In July, the United States and the European Union successfully completed negotiations on new trade terms, avoiding a more wide-ranging trade dispute.

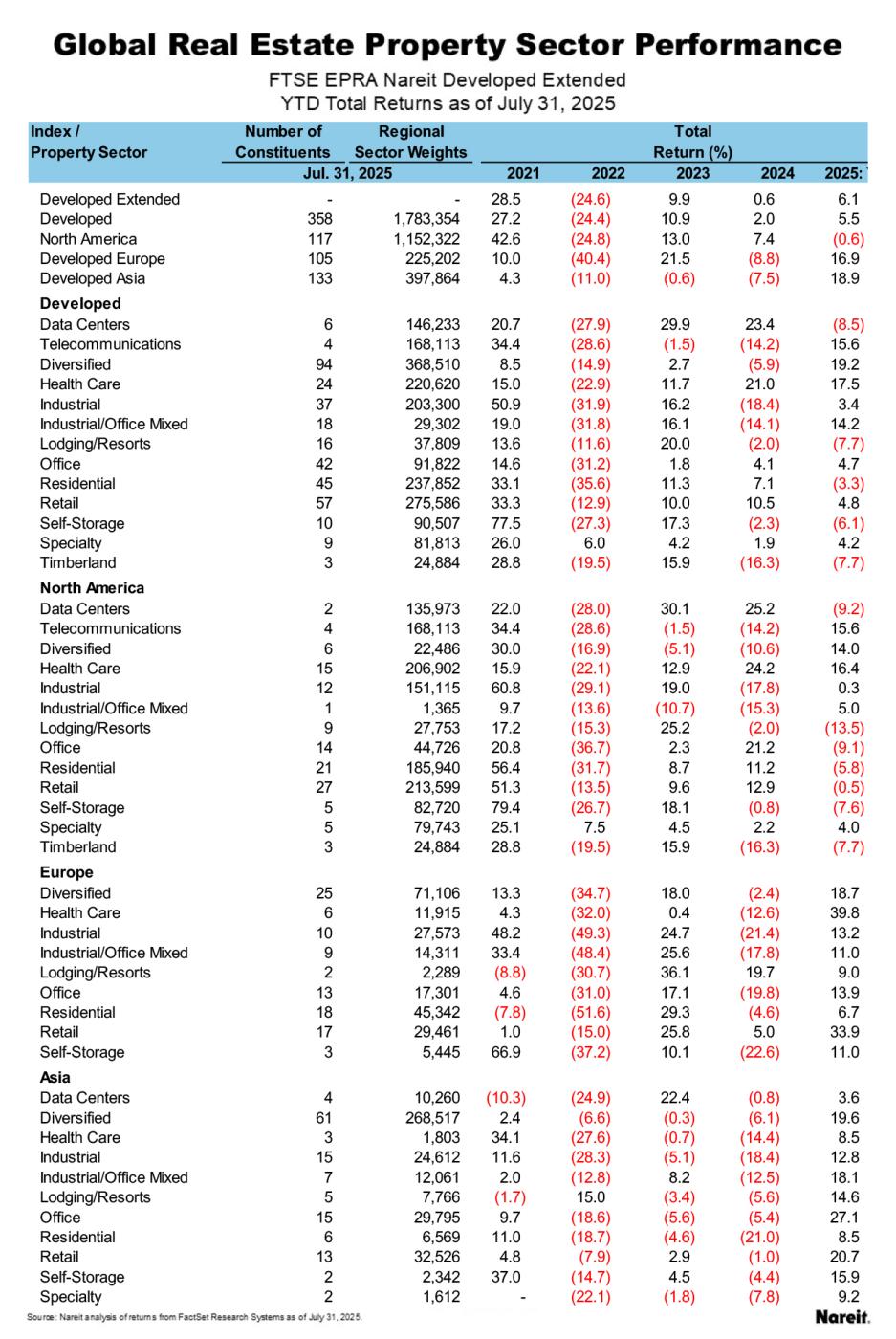

On a year-to-date basis through July 31, the Developed Extended index is up 6.1%, led by Asia with a return of 18.9%, followed by Europe at 16.9%. North America has posted a narrow loss of -0.6% in 2025. Global equities continue to outperform global listed real estate, with the FTSE Global All Cap climbing 11.7% on a year-to-date basis through July.

Property Sector Highlights

As shown in the chart above, diversified, telecommunications, and health care lead on a year-to-date basis, with respective returns of 19.2%, 17.5%, and 15.6%. Data centers lead to the downside with a return of -8.5%, followed by timberland and lodging/resorts down 7.7%.

Regional Performance

On a year-to-date basis, Developed Asia leads with a total return of 18.9%, followed by Developed Europe at 16.9%, with North America down 0.6%, as shown in the table above. Health care, retail, and diversified continue to lead in Europe while office, retail, and diversified continue to outperform in Asia. In North America, health care leads, followed by telecommunications, and diversified.

As reflected in the previous graphic, the FTSE EPRA Nareit Developed Series has been led by Asia and Europe, which have seen all property sectors trade positively in 2025. In Asia, office, retail, and diversified have led, while specialty, health care, and retail lead in Europe. North America has presented a more mixed picture, with health care, diversified, and industrial/office mixed leading.