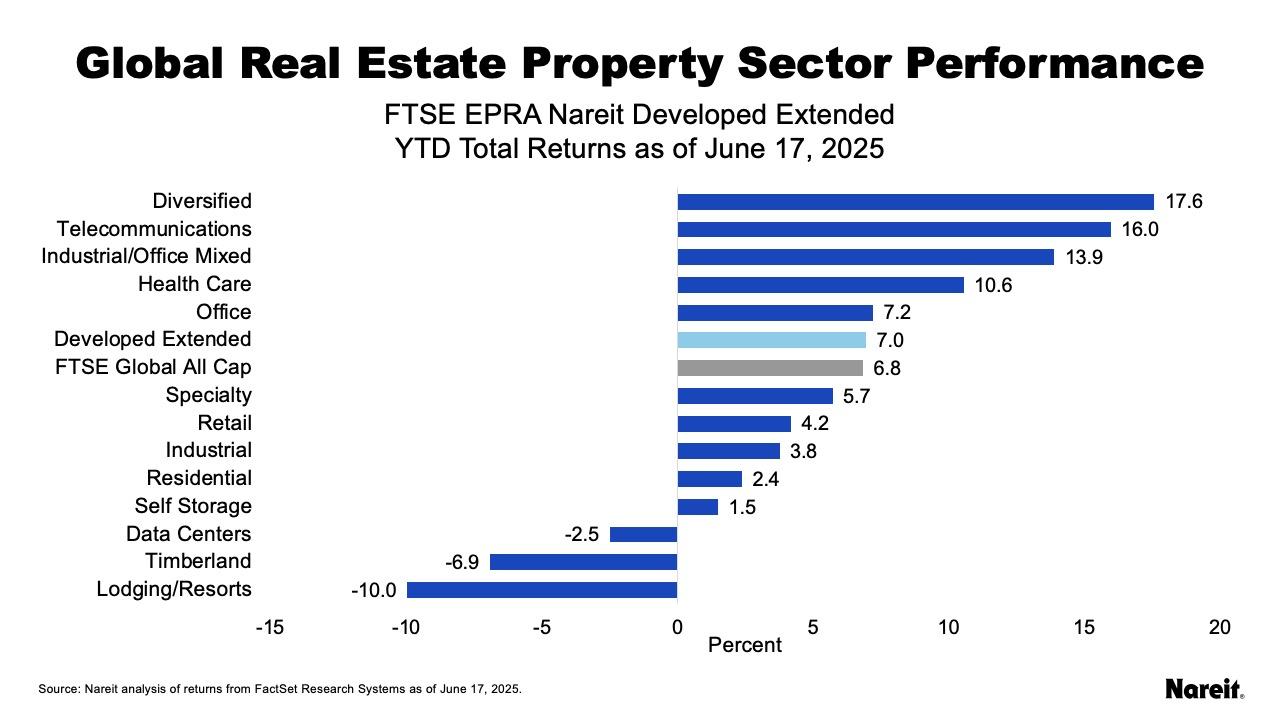

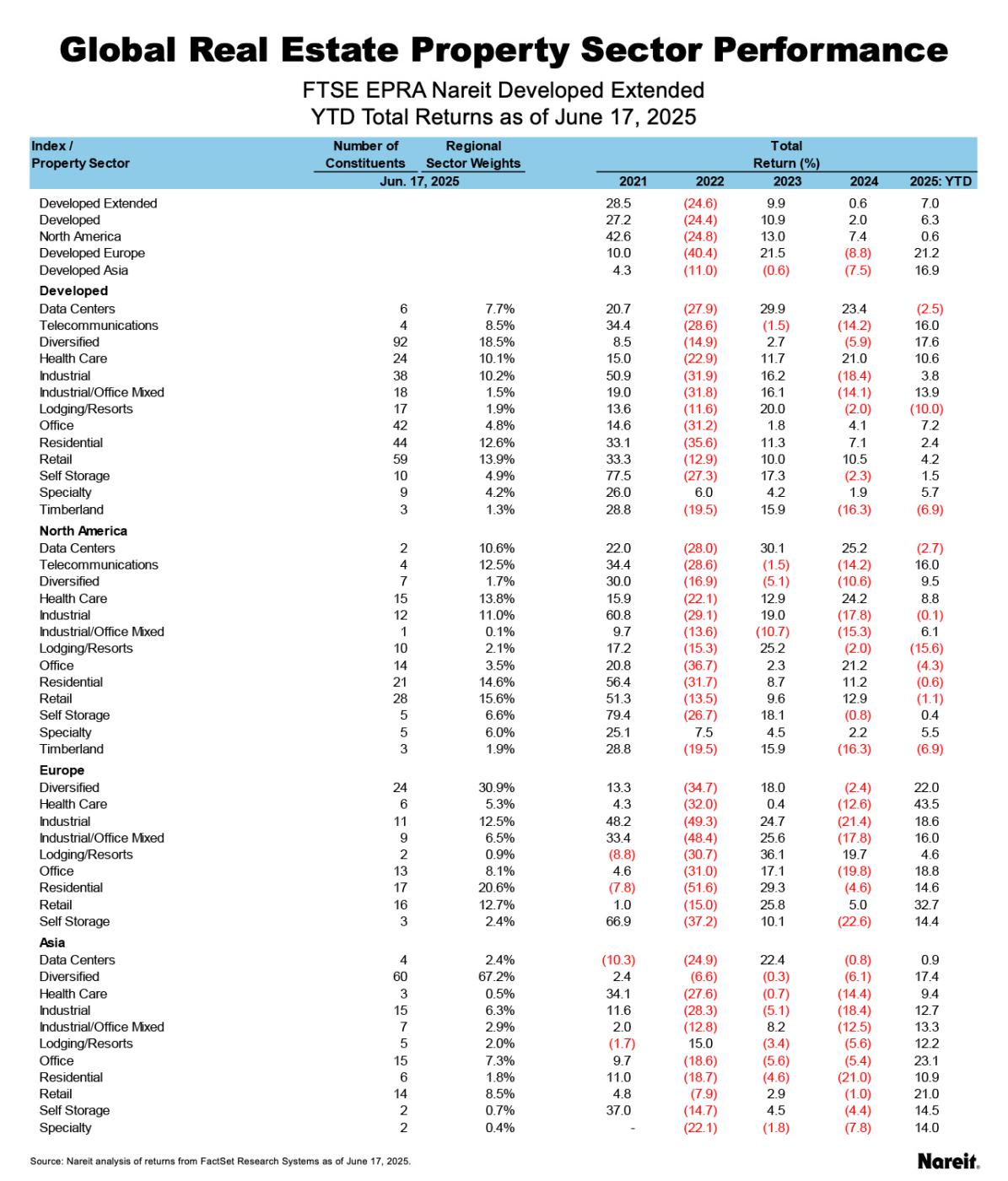

The FTSE EPRA Nareit Developed Extended Index has risen narrowly since global tariff disputes subsided in May. On a year-to-date basis through the end of May, the index was up 6.3% and has returned an additional 0.7% through June 17, putting the index up 7% on a year-to-date basis. Global equities have slightly underperformed global listed real estate on a year-to-date basis, with the FTSE Global All Cap rising 6.8% through June 17.

Property Sector Highlights

As shown in the chart above, diversified, telecommunications, and industrial/office mixed lead on a year-to-date basis, with respective returns of 17.6%, 16.0%, and 13.9%. Lodging/resorts has bounced back, but continues to lag with a total return of -10.0%. Timberland and data centers have returned -6.9% and -2.5%, respectively

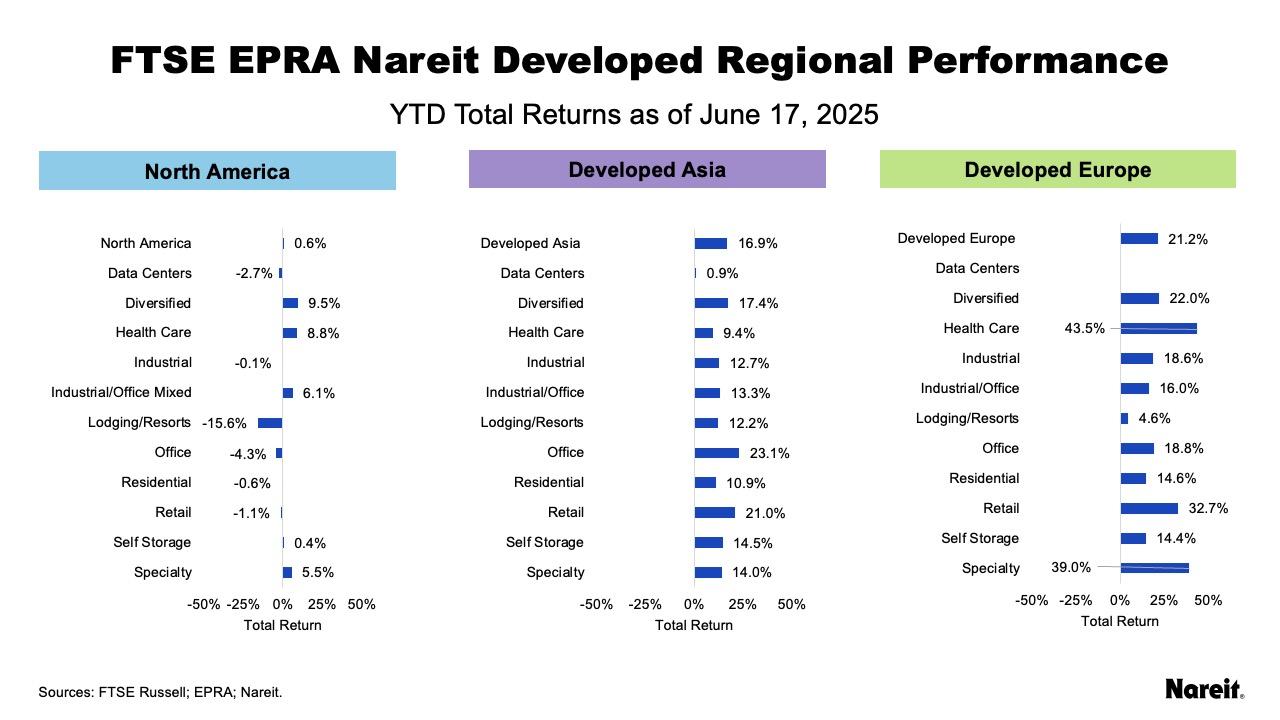

Regional Performance

On a year-to-date basis, Developed Europe continues to lead with a total return of 21.2%, followed by Developed Asia at 16.9%, and North America at 0.6%, as shown above. Europe was led by health care, retail, and diversified while Asia was led by office, retail, and diversified. In North America, telecommunications leads, followed by diversified, and health care.

The preceding chart shows diversified, health care, and industrial/office mixed leading in North America. In Asia, office, retail, and diversified lead, while in Europe health care, specialty, and retail have outperformed.