The FTSE EPRA/Nareit Global Real Estate Index Series performed strongly in 2021, with the Developed index posting a total return of 27.2%, while the Global index, which includes both Developed and Emerging Markets, returned 23.0%. The total return for the Emerging Markets index was -13.4%.

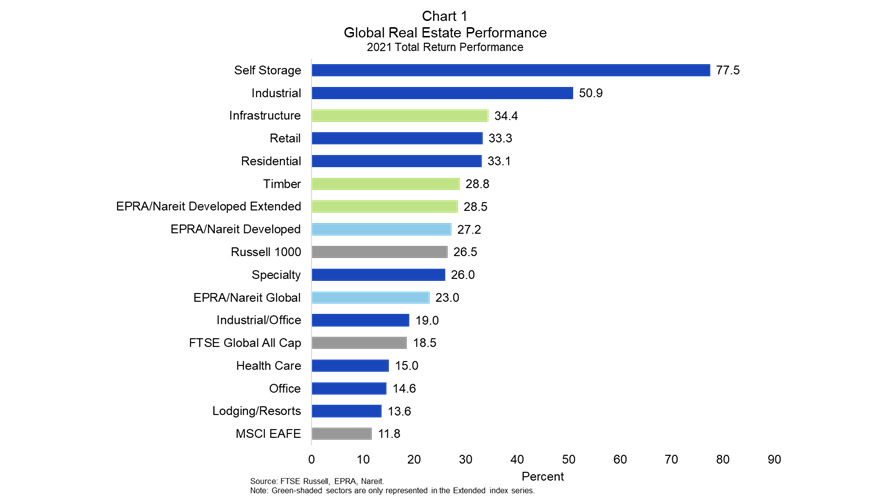

In 2020 Nareit, along with our partners, FTSE Russell and EPRA, announced the launch of the FTSE EPRA/Nareit Extended Index Series. This new index series broadens the scope of property sector coverage to include wireless communications towers and timberlands. The Developed Extended index returned 28.5% compared to 27.2% for the FTSE EPRA/Nareit Developed index that does not include towers and timber. As shown in chart 1, self storage posted the strongest returns at 77.5% followed by industrial at 50.9%. The infrastructure and timber sectors performed 3rd and 6th best, with respective total returns of 34.4% and 28.8%. Since the beginning of the Covid 19 pandemic, the residential sector has rebounded around the world, with returns of 28.1% in North America, 10.3% in Europe, and 4.9% in Asia. Over this same time period, retail has recovered in North America, with returns of 11.6%, but remains lower in Europe and Asia, with respective returns of -32.3% and -1.8%.

Domestic and global broad market indexes were positive for the year as well. The Russell 1000 was up 26.5%, while the FTSE Global All Cap rose 18.5% and the MSCI EAFE 11.8%.

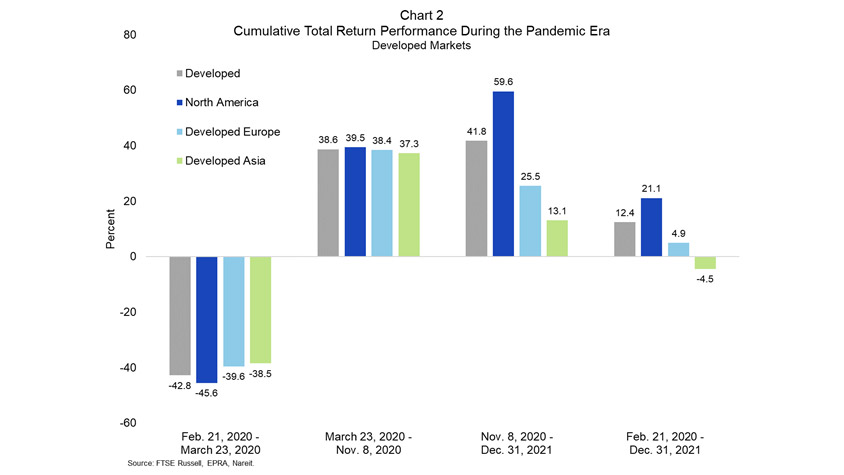

Chart 2 provides regional performance since the beginning of the Covid 19 pandemic. During the first two phases of the pandemic, the global regions responded relatively uniformly. During the initial phase from Feb. 21, 2020 – Mar. 23, 2020, as economic activity shut down due to the pandemic, North America declined -45.6%, Europe declined -39.6%, and Asia declined -38.5%. From Mar. 23, 2020 – Nov. 8, 2020, as economies began to reopen, the regions rebounded similarly with total returns of 39.5% for North America, 38.4% for Europe, and 37.3% for Asia. From Nov. 8, 2020 – Dec. 31, 2021, after the announcement of successful tests of vaccines against Covid 19, the regions begin to show notable divergence. Over this period, North America posted a total return of 59.6%, compared to 26.5% for Europe and 13.1% for Asia.

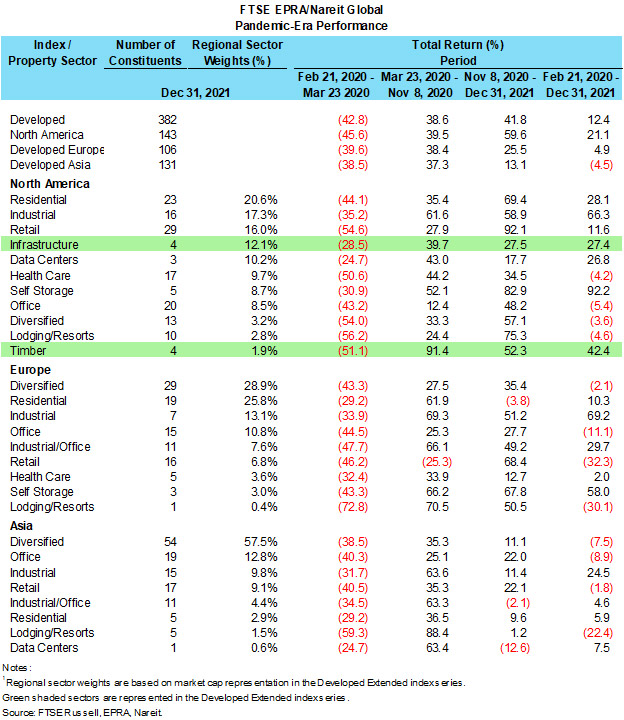

The table above lays out the performance of the global regions broken down by property sector over the course of the Covid 19 pandemic. In North America self storage has fared best over the course of the disease, with returns of 92.2%, followed by industrial at 66.3%. The office sector has lagged the broader recovery with returns of -5.4%. Asia was led by industrial at 24.5%, while lodging/resorts trailed at -22.4%. Finally, the strongest sector in Europe was industrial, with returns of 69.2%, while retail and lodging/resorts were weakest.

Comparing the performance of property sectors across regions, we see a number of similarities, for example, industrial and self storage were top performers across the regions. Office returns were surprisingly consistent across regions despite the different paces of return-to-office across the regions, underscoring the point that the current pace of return-to-office is less important for office valuations than the long-term equilibrium, as Calvin Schnure notes in a recent market commentary. Retail stands out as the sector with the largest dispersion across regions reflecting different government policies and consumer behaviors across the regions.