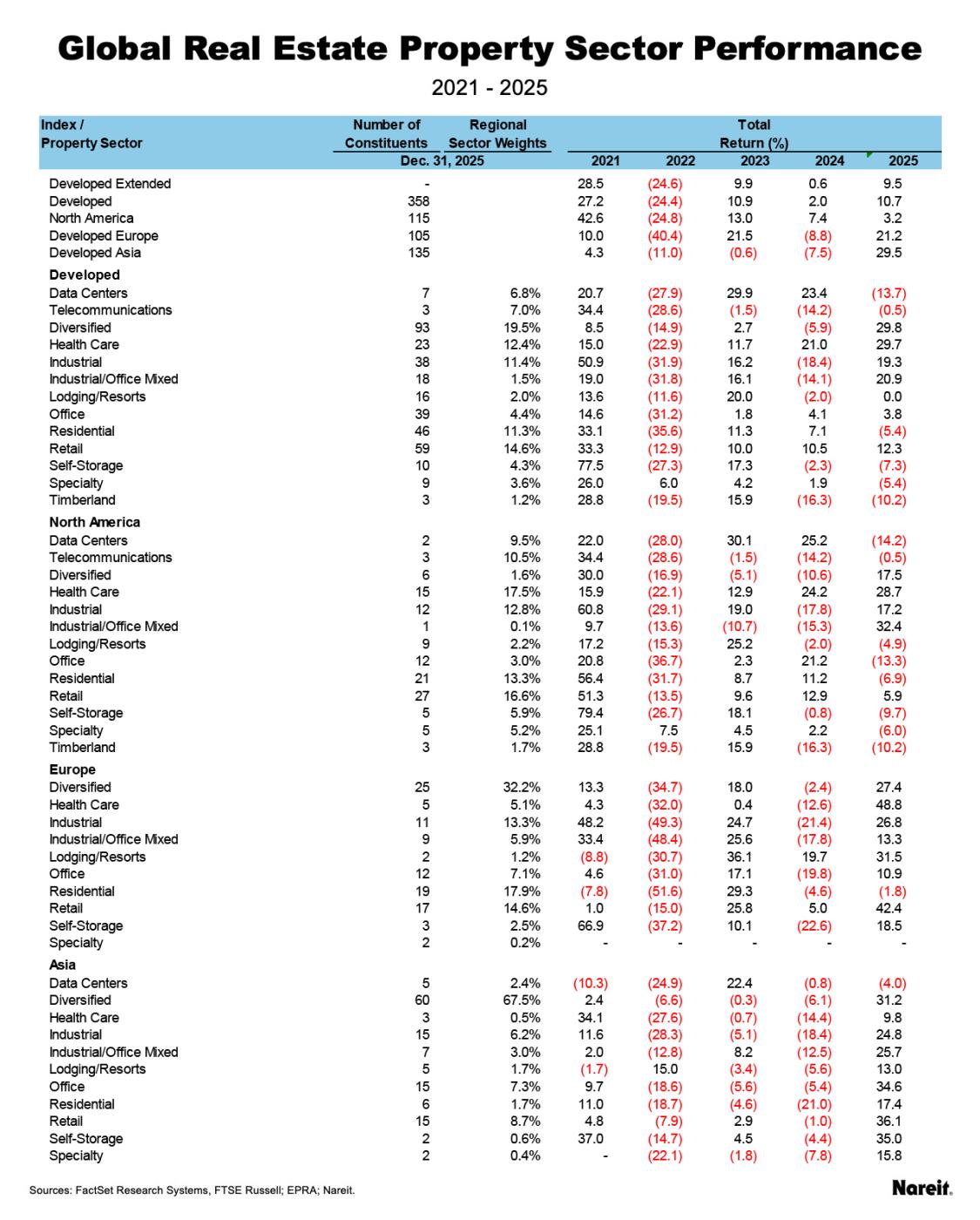

The FTSE EPRA Nareit Developed Index posted a total return of 10.7% in 2025, while the FTSE EPRA Nareit Developed Extended Index returned 9.5% for the year. Performance was notably divergent across regions, with Developed Asia and Developed Europe posting double-digit gains, while North America lagged significantly.

Regional performance was led by Developed Asia, which delivered a total return of 29.5%, followed by Developed Europe at 21.2%. North America trailed with a total return of 3.2%. These results highlight the impact of regional sector specializations and varying economic conditions on global real estate markets.

Property Sector Highlights

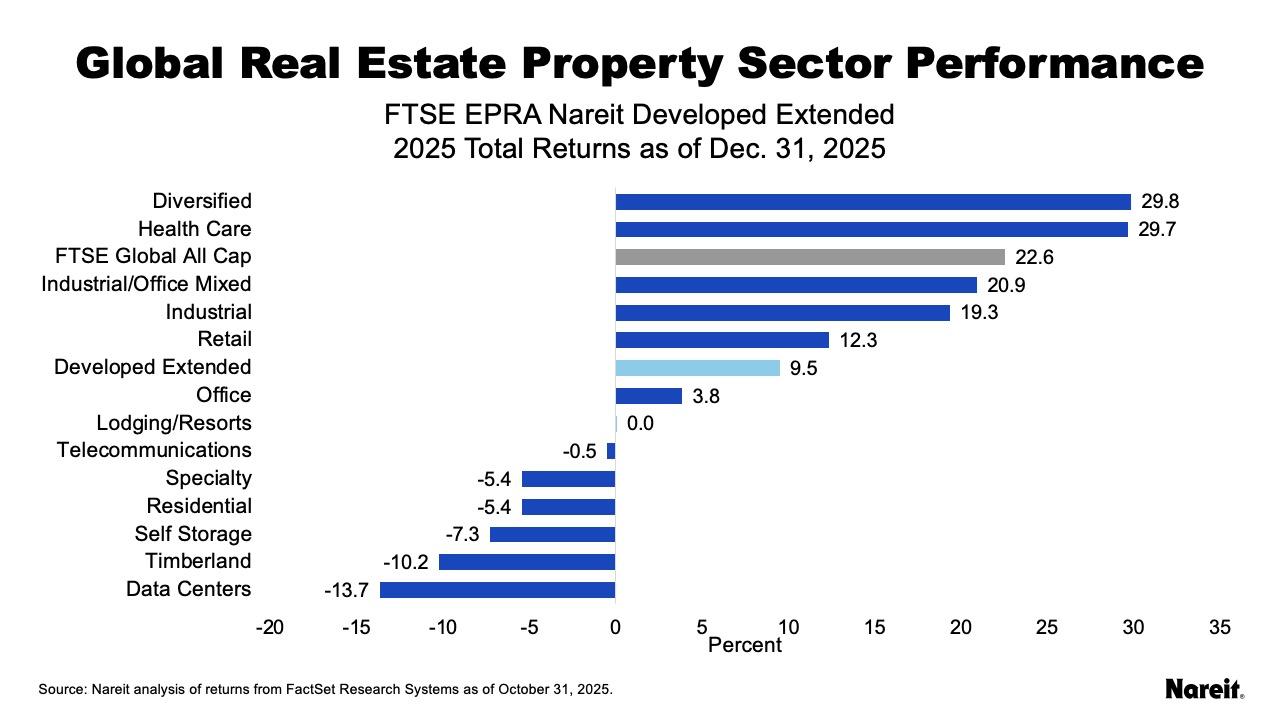

At a global level, the diversified and health care sectors were the top performers in 2025, delivering total returns of 29.8% and 29.7%, respectively, as reflected in the above table. The industrial/office mixed sector also performed well, posting a 20.9% return.

Conversely, the data centers and timberland sectors faced significant headwinds. Data centers ended the year down 13.7%, while timberland declined 10.2%.

The above table reflects the more concentrated nature of Developed Asia and Developed Europe, where Diversified is the largest sector, while North America is more balanced, with no sector making up more than 18% of the region.

Regional Performance

Developed Asia

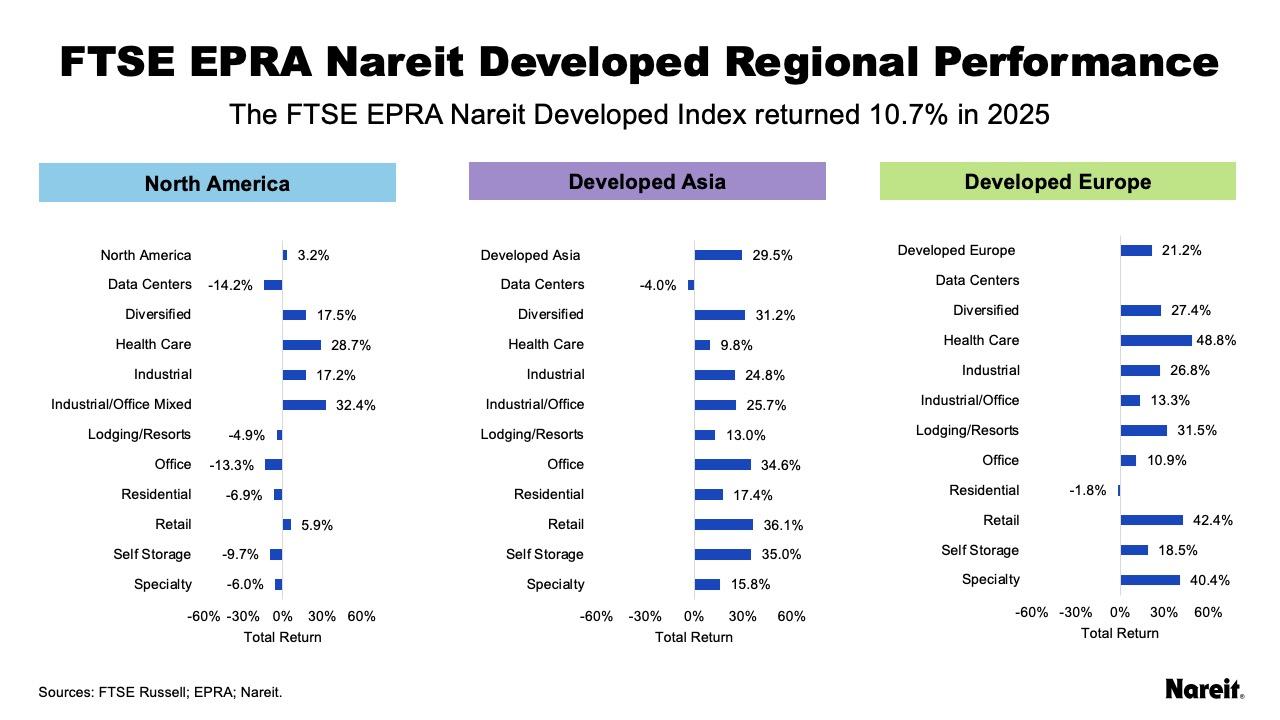

The U.S. dollar (USD) weakened over the course of 2025, providing a tailwind to U.S.-based investors. As reflected in the above exhibit, Developed Asia led in 2025 with a 29.5% USD total return. The impact in Japanese yen was less noticeable than some other currencies, and total return for the region was 29.1%. The region benefited from broad-based strength across multiple property types. The retail sector surged 36.1%, while self-storage and office also posted impressive gains of 35.0% and 34.6%, respectively. The diversified sector, which constitutes 68% of the region, returned 31.2%.

Developed Europe

Europe delivered a USD total return of 21.2%, driven by exceptional performance in health care and retail. Health care rose 48.8%, the highest return of any single sector, while retail returned 42.4%. Lodging/Resorts also contributed positively with a 31.5% return. The currency impact on Europe was more pronounced, with total returns in euros declining to 6.8% and 12.8% in British pounds.

North America

North America posted a modest 3.2% return, weighed down by weakness in technology-centric real estate, however, pockets of strength emerged; health care gained 28.7% and diversified and industrial both returned more than 17%. Data centers fell 14.2% and office declined 13.3%.