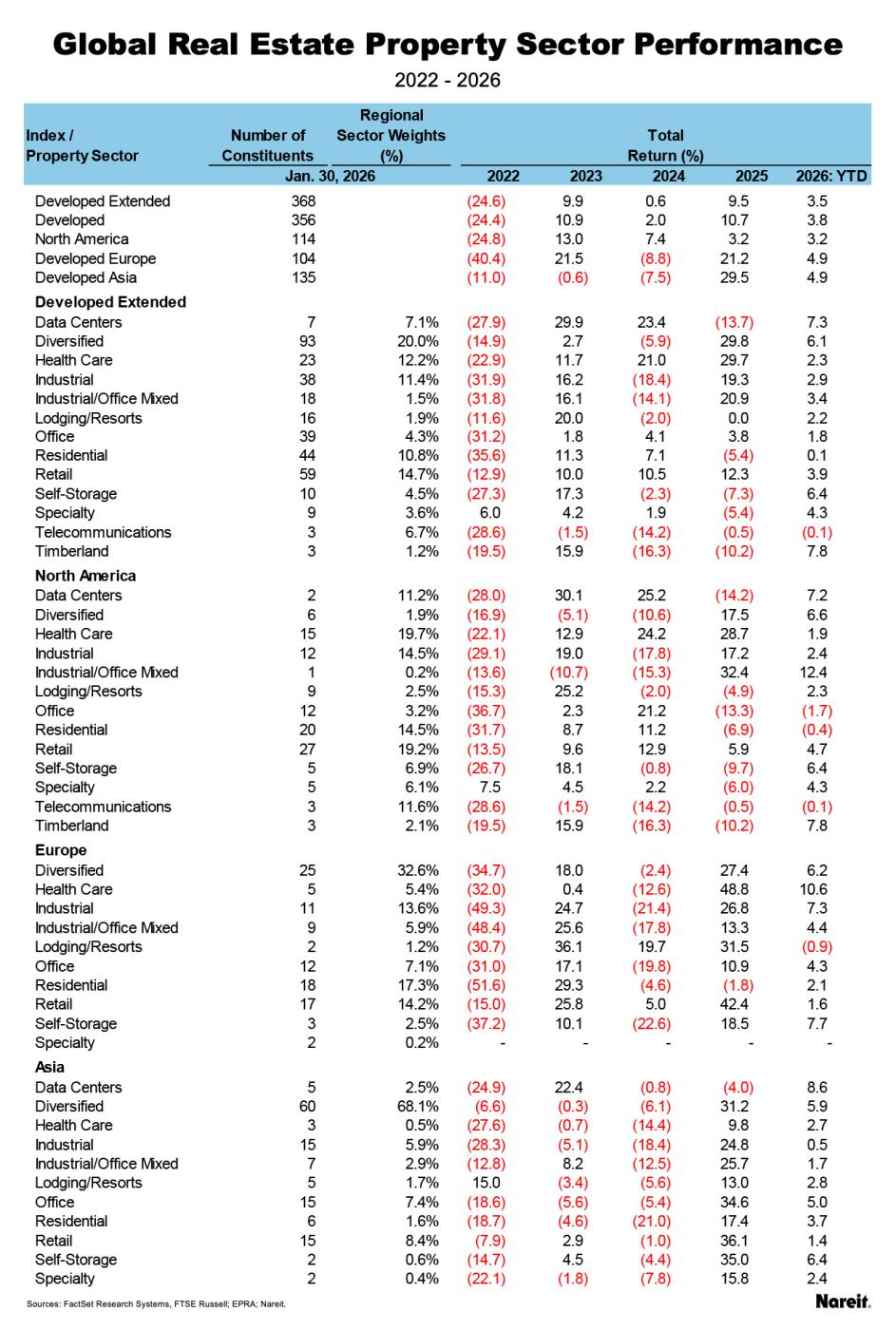

The FTSE EPRA Nareit Developed Index posted a total return of 3.8% in January, while the FTSE EPRA Nareit Developed Extended Index returned 3.5%. Regional performance was led by Developed Asia, which delivered a total return of 4.9%, closely followed by Developed Europe also at 4.9% after rounding adjustments. North America showed more moderate growth with a total return of 3.2%. Global real estate narrowly outperformed global equities as the FTSE Global All Cap rose 3.2%.

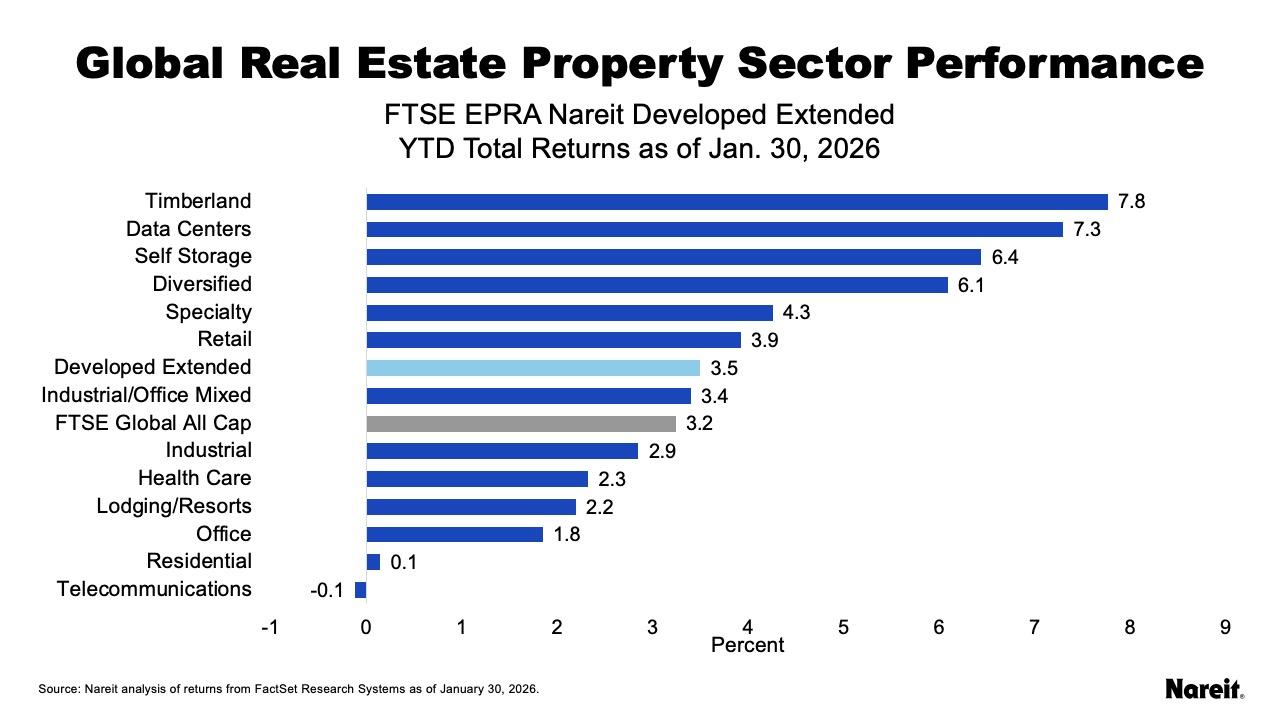

Property Sector Highlights

As shown in the chart above, property sector performance was broadly positive, with nearly all sectors posting gains. Timberland, data centers, and self-storage were the top performers in January, delivering total returns of 7.8%, 7.3%, and 6.4%, respectively. Telecommunications and residential faced headwinds compared to the other sectors, but ended the month essentially flat.

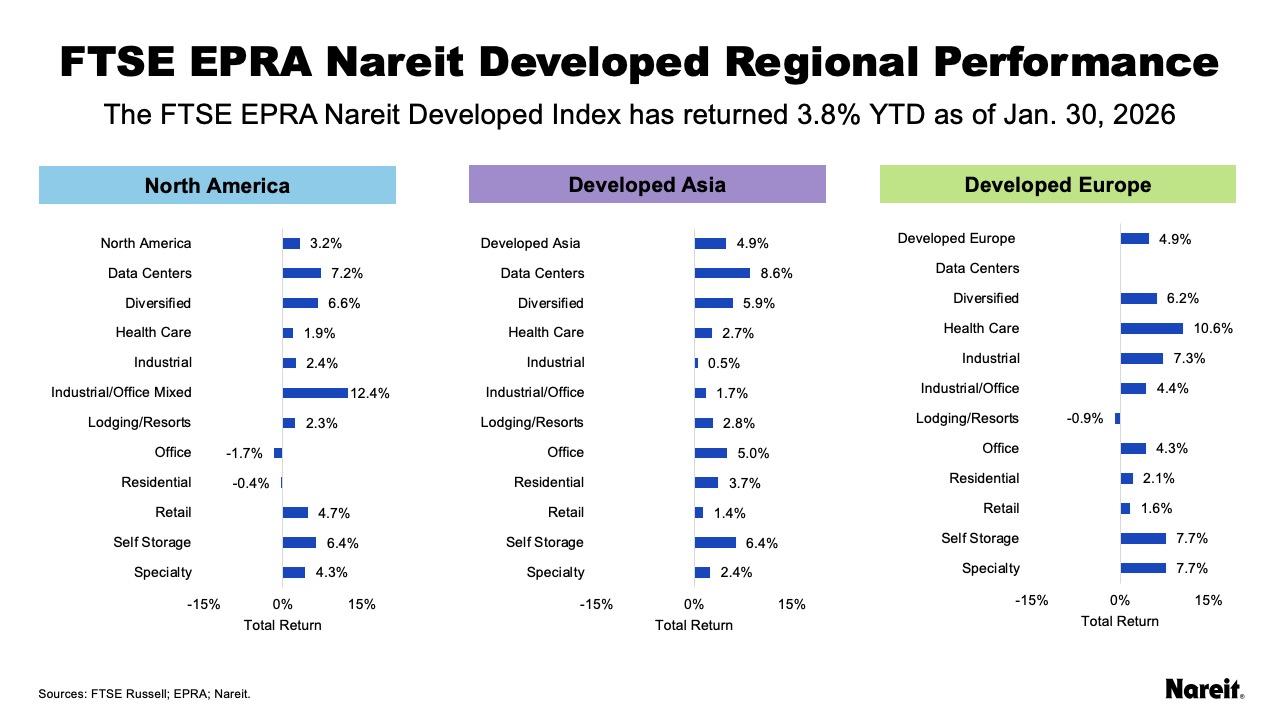

Regional Performance

As reflected in the preceding exhibit, Developed Asia and Developed Europe led regionally in January, each posting a total return of 4.9%, while North America rose 3.2%.

Developed Asia

Asia benefited from significant strength in technology-adjacent real estate and traditional hubs. The data center sector climbed 8.6%, while self-storage gained 6.4%. The diversified sector, which constitutes 68% of the region, returned 5.9%, and the office sector contributed a 5.0% gain. Industrial lagged but was still narrowly positive with a total return of 0.5%.

Developed Europe

Europe was driven by strong performance in health care, self-storage, and specialty. Health care rose 10.6%, while self-storage returned 7.7%. Industrial assets also contributed positively with a 7.3% return. Diversified, which also has an outsized weight of 32% in the region, rose 6.2%. The only sector in Europe to notch a decline during the month was lodging/resorts, which fell 0.9%.

North America

Despite the overall lower regional return in North America, nearly all sectors posted positive returns. The industrial/office mixed sector led with a return of 12.4%, followed by timberland at 7.8%, and data centers returning 7.2%. The office sector lagged with a decline of 1.7%, and the residential sector fell 0.4%. These two sectors make up roughly 18% of the region.

As previously noted, and reflected in the preceding table, North America presents a more balanced landscape with no sector accounting for more than 20% of the region, while Asia and Europe are more concentrated, with the diversified sector carrying outsize weight in each region.