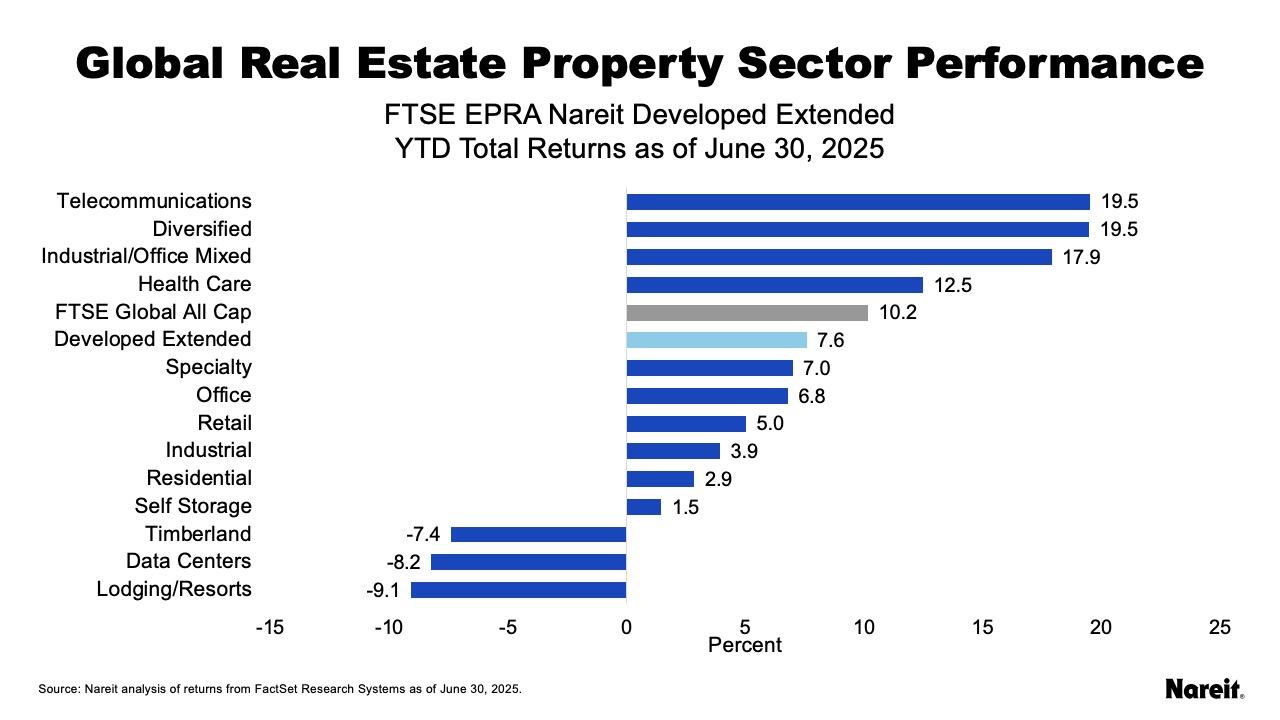

The FTSE EPRA Nareit Developed Extended Index rose 1.2% in June. On a year-to-date basis through June 30, the index was up 7.6%, led by Asia and Europe, with the U.S. posting a narrow gain. Global equities have outperformed global listed real estate on a year-to-date basis, with the FTSE Global All Cap rising 10.2% through June.

Property Sector Highlights

As shown in the chart above, telecommunications, diversified, and industrial/office mixed lead on a year-to-date basis, with respective returns of 19.5%, 19.5%, and 17.9%. Lodging/resorts continues to lag with a total return of -9.1% followed by data centers with a return of -8.2% and timberland at -7.4%. Data centers fell sharply through early April in part due to fears of over-building related to the heightened interest in artificial intelligence. From the time when data centers made their year-to-date low on April 8, they have posted a total return of 17.6% as of June 30.

Regional Performance

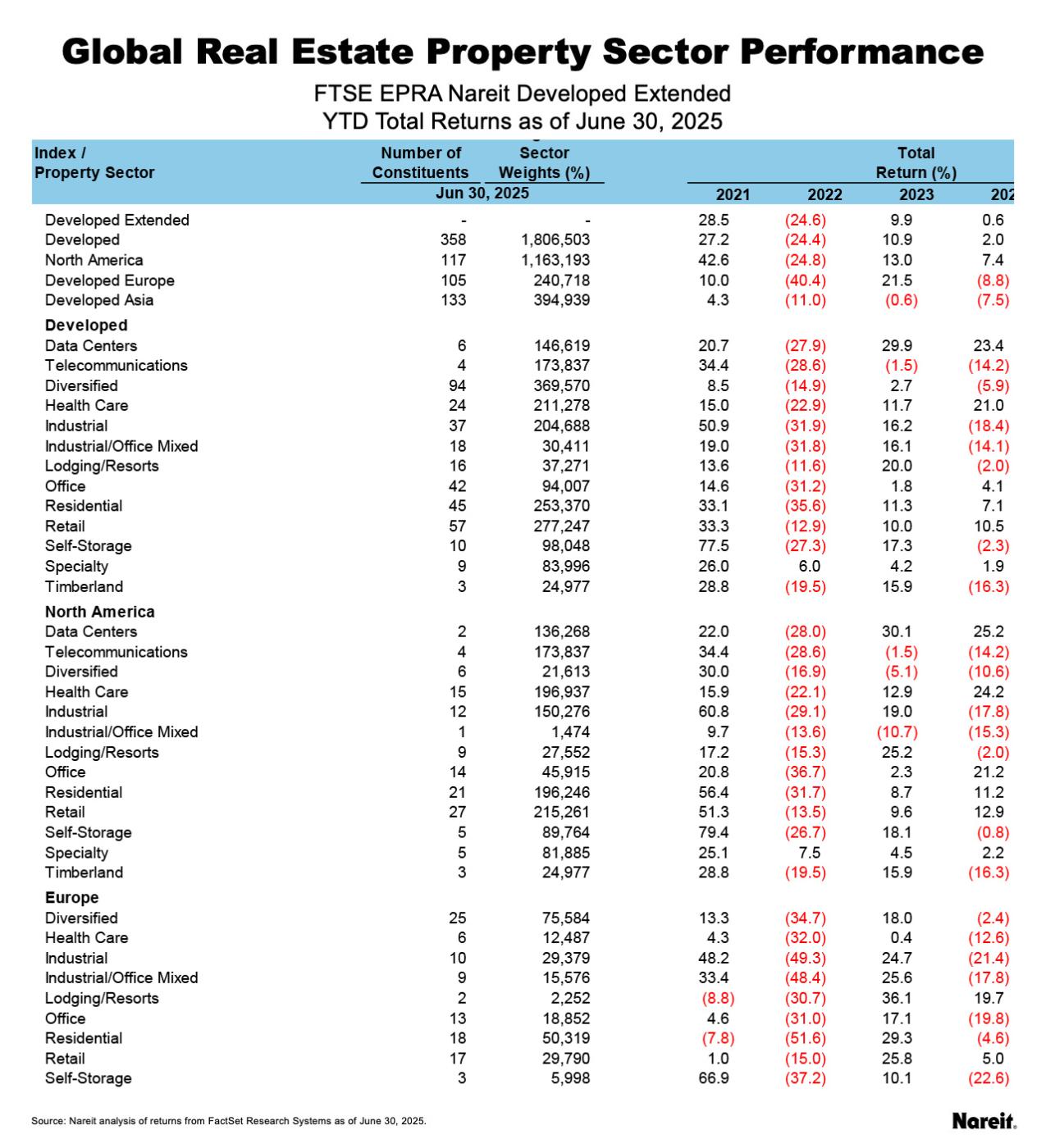

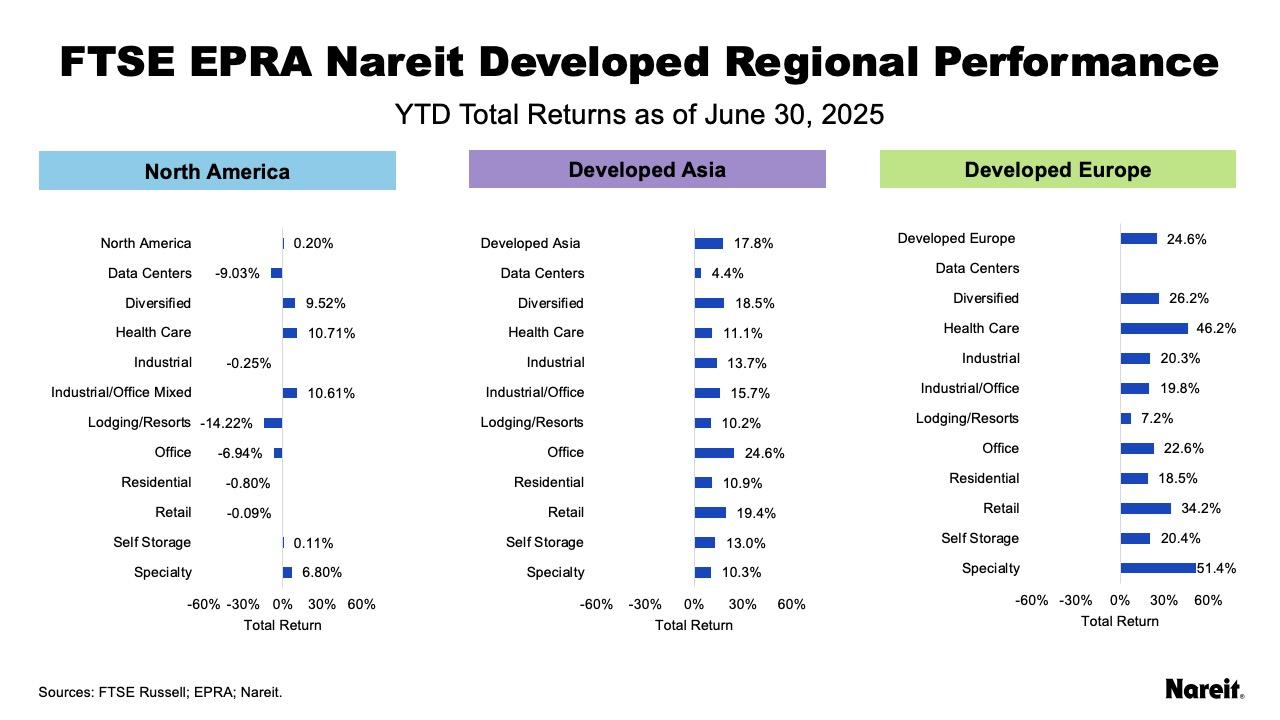

On a year-to-date basis, Developed Europe leads with a total return of 24.6%, followed by Developed Asia at 17.8%, with North America up 0.2%, as shown in the table above. Europe continues to be led by health care, retail, and diversified. Asian leadership also remains unchanged with office, retail, and diversified outperforming. In North America, telecommunications narrowly leads diversified, followed by industrial/office mixed.

The preceding chart further reflects the broad degree to which Europe and Asia have outperformed North America in the FTSE EPRA Nareit Developed series, which does not include telecommunications companies. The FTSE EPRA Nareit Developed Extended Index was designed in large part to include coverage of global telecommunications real estate. On a year-to-date basis, the Developed index is trailing the Developed Extended Index by 0.9%.