The FTSE EPRA Nareit Developed Extended Index showed resilience in a tumultuous April, posting a total return of 1.3%. On a year-to-date basis, the index has returned 4.4%. Broad market equities have underperformed over these periods, with the FTSE Global All Cap rising 1.0 % for the month while declining 0.3% for the year. The Dow Jones U.S. Total Stock Market fell 0.7% in April and is down 5.5% year-to-date.

Disputes over global trade policy led to a volatile April, with the FTSE EPRA Nareit Developed Extended Index declining 10.0% from April 2 – 8 before rising 9.4% from April 8 – 17.

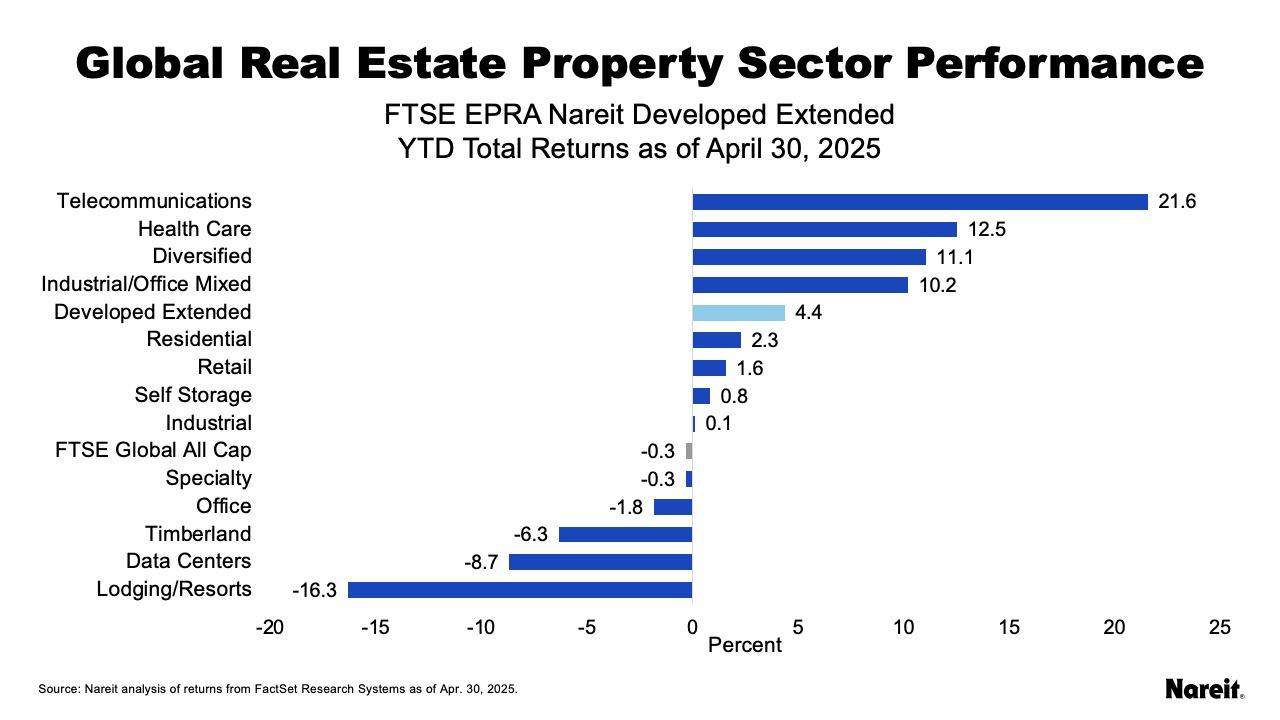

Property Sector Highlights

As shown in the chart above, telecommunications leads on a year-to-date basis, followed by health care, and diversified, with respective total returns of 21.6%, 12.5%, and 6.5%. Lodging/resorts lags with a total return of -16.3%, followed by data centers at -8.7%, and timberland at -6.3%.

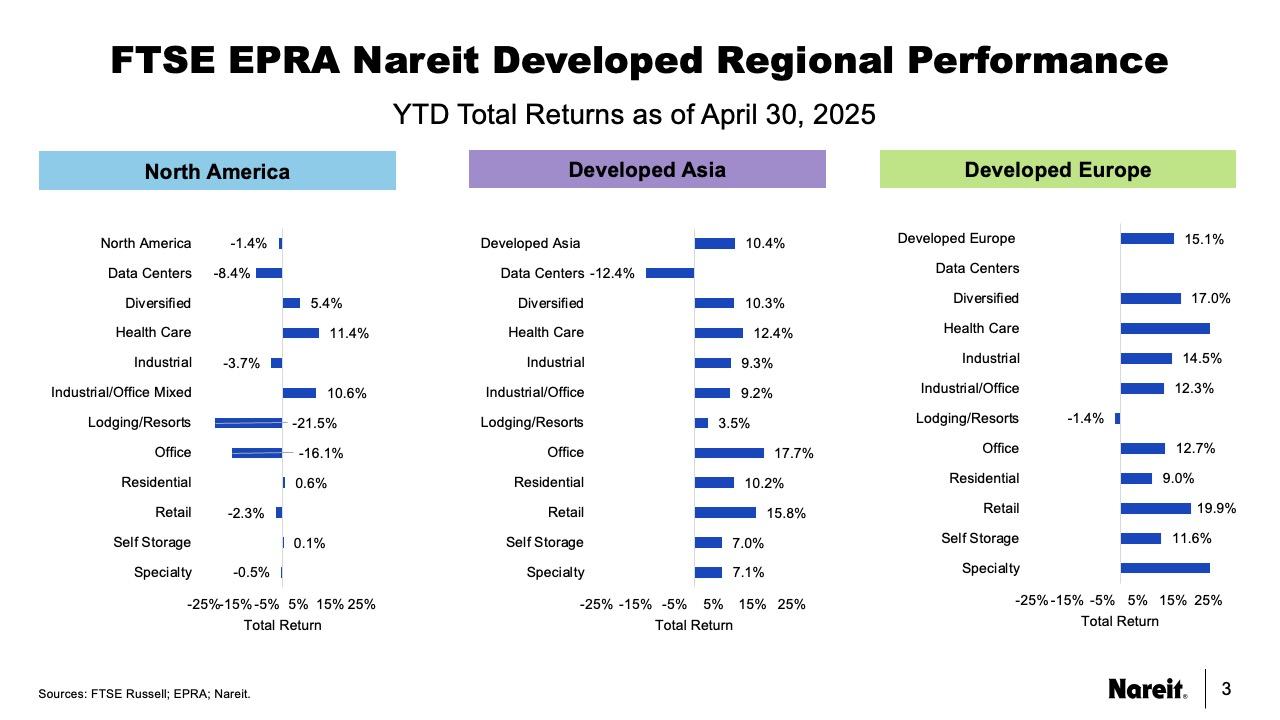

Regional Performance

On a year-to-date basis, Developed Europe leads with a total return of 15.1%, followed by Developed Asia at 10.4%, and North America at -1.4%, as shown above. Europe was led by health care, specialty, and retail, while Asia was led by office, retail, and health care. In North America, telecommunications led, followed by health care and industrial/office mixed. These returns are reflected in U.S. dollars; the currency has weakened considerably against other major currencies during the current dispute over tariffs.

The preceding chart shows lodging/resorts lagging in North America, along with office. Europe and Asia have been broadly positive, with health care leading in Europe and office outperforming in Asia. Data centers continue to show weakness in both North America and Asia over concerns about over-building in the sector.