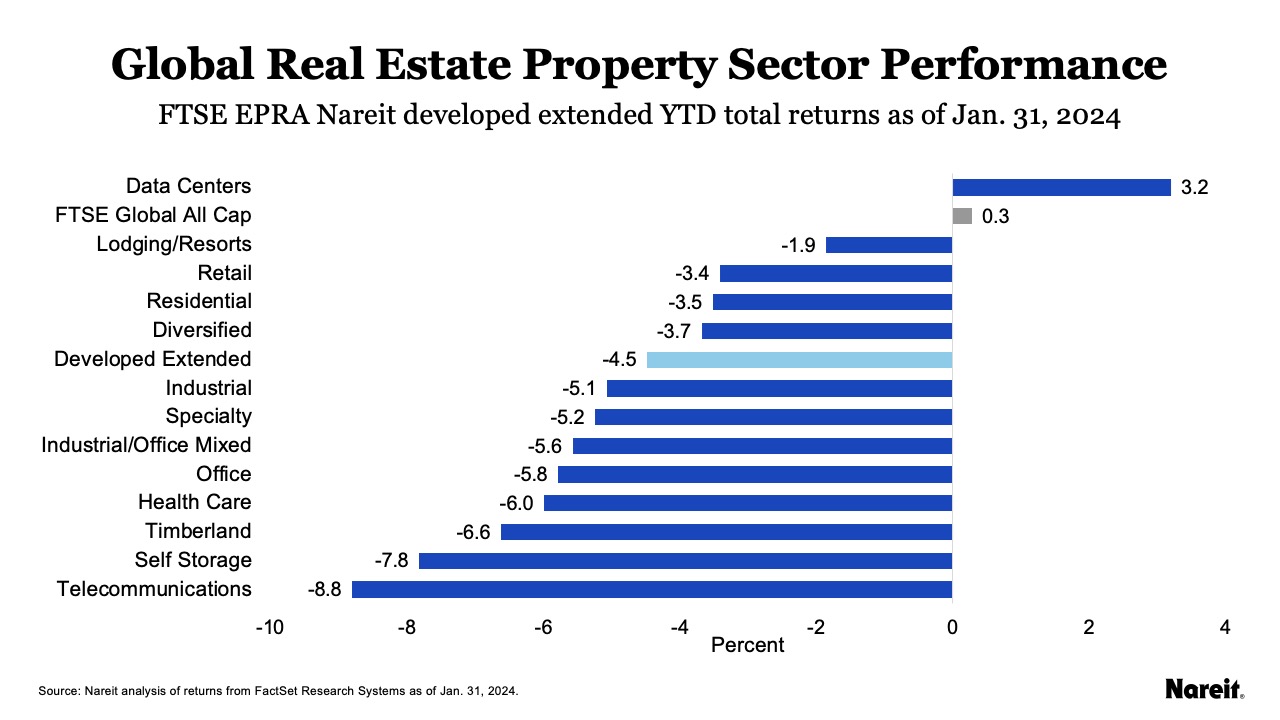

The FTSE EPRA Nareit Developed Extended Index fell 4.5% in January, and posted a total return of 16.0% since Oct. 19, 2023. Though inflationary pressures have continued to ease, central banks are wary of committing to more accommodative monetary policy before greater certainty that inflation is trending to target. While most investors continue to expect more accommodative monetary policy in 2024, some estimates for when to expect an easing of interest rates have been pushed to later in the year. As noted in Nareit’s 2024 REIT Outlook, historically listed real estate has outperformed at the end of central banks’ rate-rising cycles.

Global Real Estate Performance

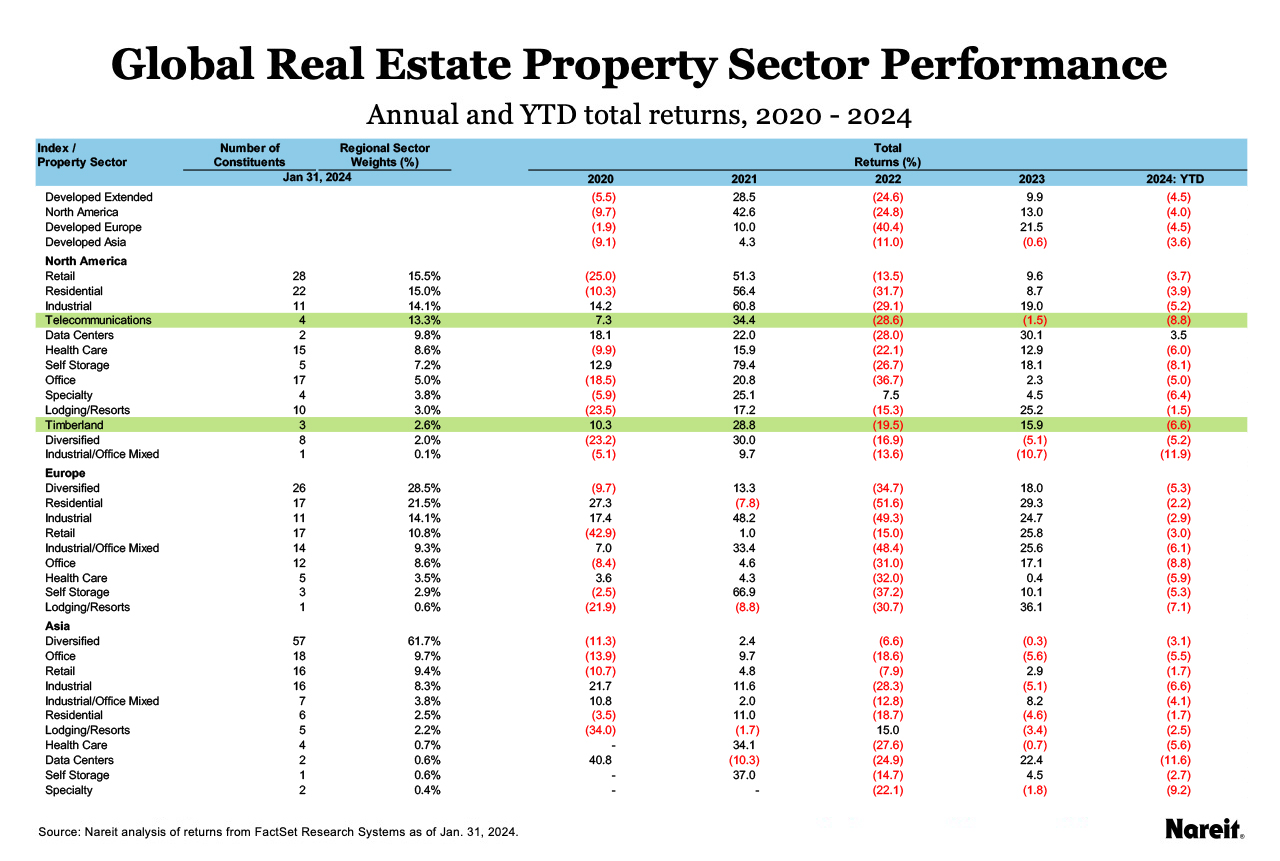

While all property sectors in the FTSE EPRA/Nareit Global Real Estate Index Series are positive since mid-October, only data centers have posted positive returns in 2024. As shown in the above table, the Developed Extended Index posted a total return of 16.0% from Oct. 19, 2023, through Jan. 31, 2024, and was down 4.5% in January. Telecommunications lagged in January, with a total return of -8.8%.

Broader Market Performance

Broader equity markets were up narrowly in January. Large cap U.S. stocks set the pace as the Russell 1000 rose 1.4%, followed by the Dow Jones U.S. Total Stock Market at 1.1%, MSCI EAFE at 0.6%, and the FTSE Global All Cap at 0.3%. In 2023, the Russell 1000 was up 26.5%, the Dow Jones U.S. Total Stock Market was up 26.1%, the MSCI EAFE rose 18.9%, and the FTSE Global All Cap returned 22.2%.

Property Sector Highlights

Data centers led all sectors in January with a total return of 3.2%, followed by lodging/resorts at -1.9% and retail at -3.4%. Telecommunications declined 8.8% in January and self-storage fell 7.8%. Respectively, these sectors are up 24.1% and 18.9% since mid-October.

Regional Performance

Within the EPRA Nareit Developed series, Asia declined 3.6% in January, followed by North America at -4.0% and Europe at -4.5%.

In Asia, residential and retail declined 1.7%, followed by lodging/resorts at -2.5%. Data centers, specialty, and industrial lagged, with returns of -11.6%, -9.2%, and -6.6%, respectively.

In North America, data centers, lodging/resorts, and retail led, with respective returns of 3.5%, -1.5%, and -3.7%. Industrial/office mixed trailed with a return of -11.9%, followed by telecommunications at -8.8%, and self-storage at -8.1%.

In Europe, residential led with a total return of -2.2%, followed by industrial at -2.9%, and retail at -3.0%. Data centers were down 11.6%, specialty declined 9.2%, and industrial fell 6.6%.