In 2021, consumer prices rose dramatically as the economy worked through supply chain issues during the ongoing recovery from COVID-19 induced shut-downs. Annual inflation measured by the Consumer Price Index reached 7.0% in 2021, the highest annual rate since 1981. While inflationary pressures are expected to persist well into 2022, this analysis shows that REITs have historically provided protection against inflation and outperformed the broader stock market during periods of moderate and high inflation. In 2021, with inflation running well above recent trends, REITs outperformed the S&P 500 by 12.6 percentage points.

REITs’ operating performance has generally more than kept pace with inflation over the past few decades. Long term leases typically have inflation protection built-in, and shorter-term leases are based on current price levels. Also, REITs keep a portfolio of leases, a portion of which are negotiated every year, so even REITs with longer-term leases have opportunities to reprice. Finally, as owners of real assets, REITs typically enjoy an appreciation in portfolio value along with the price level. With rents and values tending to increase with prices, REIT dividends help provide a reliable stream of income even during inflationary periods.

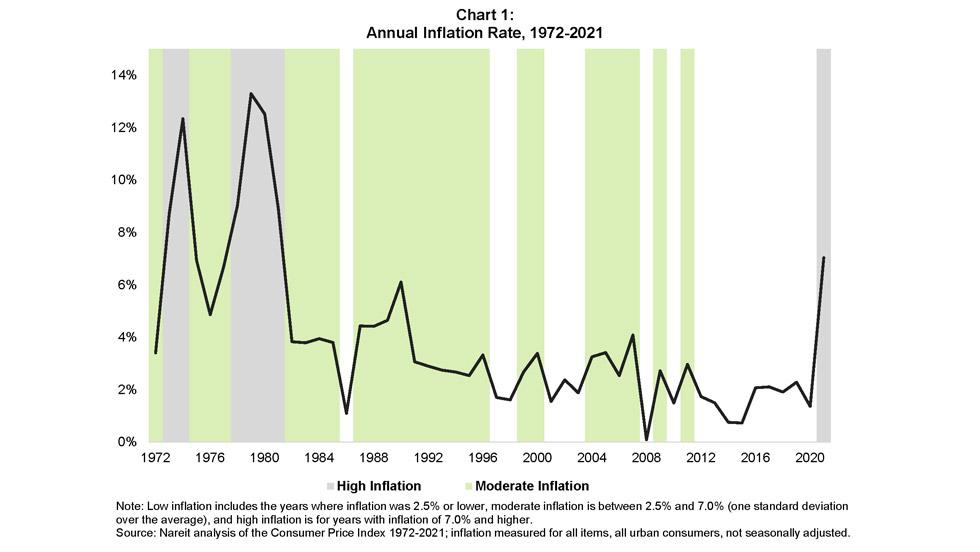

This past year represents the first year of high annual inflation since 1981 and the first year after the modern REIT era as shown in Chart 1. We define high inflation as greater than one standard deviation from the time period’s average of 3.9%, greater than 7.0%. Moderate inflation is between 7.0% and 2.5% (based on the Federal Reserve target average), and low inflation is below 2.5%. With 2021’s annual rate of 7.0%, the rate ended nine straight years of low inflation starting in 2012. Inflation hasn’t been above the historical average since 2007 when it reached 4.1%.

While 2021’s rate is historically high, it is not approaching the double-digit rates of the 1970s and 80s. The increased rate is due both to continued supply chain issues as well as increased energy costs including the recovery of gas prices to pre-pandemic levels. Given the persistence of these issues, inflation is likely to stay below the double digits, mostly in the moderate range.

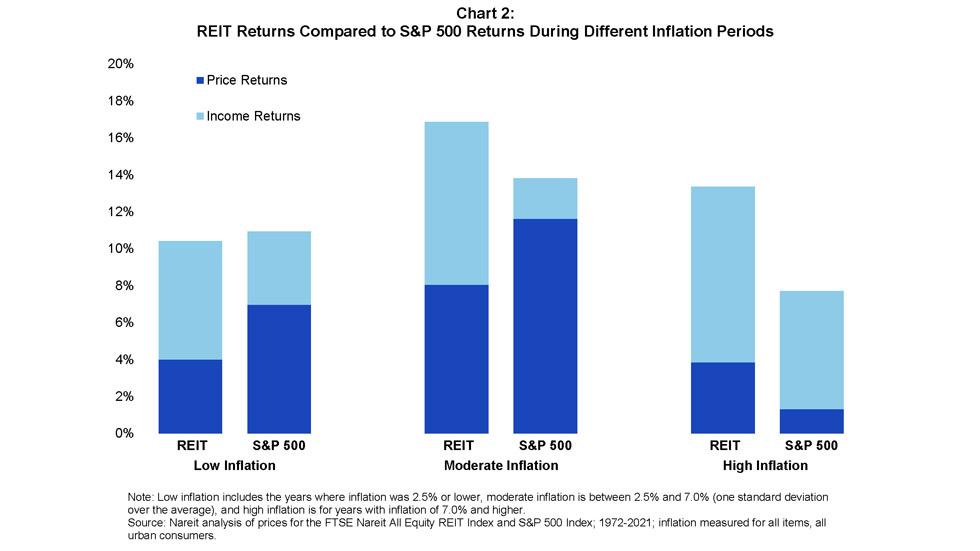

Chart 2 compares the performance of equity REITs and the S&P 500 in these three periods as demonstrated in Chart 1. In 2021, considered a high inflation year (7.0% or greater), REITs outperformed the S&P 500 by 12.6 percentage points with an annual return of 41.3% compared to 28.7% for the S&P 500. REITs tend to outperform in the high inflation periods, with strong income returns offsetting falling REIT prices. On average, REITs outperformed the S&P 500 by 5.6 percentage points during these periods. In periods of moderate inflation (between 2.5% and 7.0%), REIT dividends more than compensated for the higher price returns on the S&P, leading total returns on REITs to exceed the S&P by 3.1 percentage points. In periods of low inflation (under 2.5%), REIT returns fall below the S&P 500 as the income portion does not make up for superior price returns on the S&P 500.