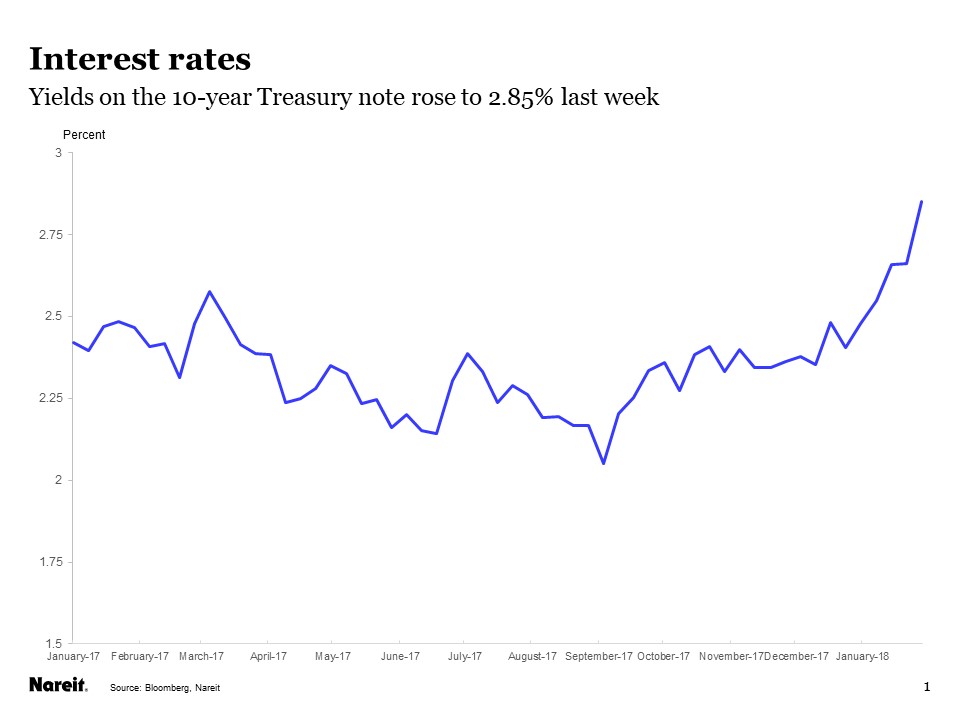

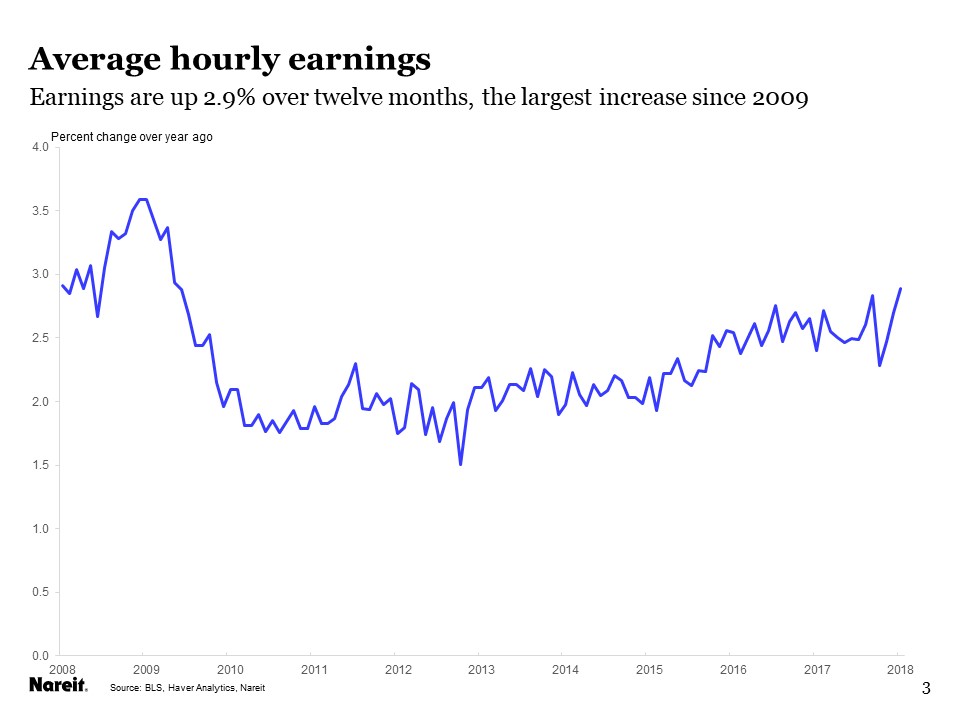

Stock prices took a sudden downturn in early February, with the S&P 500 erasing all the gains for the year, and then some. REITs were down as well, with the FTSE Nareit All Equity REITs index declining to the lowest level in 14 months. Most analysts pointed to rising interest rates as the proximate cause of the market decline, as yields on the 10-year Treasury note reached 2.85 percent, up 20 bps from one week earlier, and 50 bps above their mid-December 2017 levels. Inflation fears, specifically worries about accelerating wage growth in the January employment report and that the job market might overheat if it tightens further, contributed to rising interest rates.

These market developments beg two questions:

- Is a tight job market causing wage gains (and also inflation) to accelerate too much, eventually forcing the Fed to raise short-term interest rates more aggressively? And,

- Is the fundamental response of the REIT market for share prices to fall when interest rates rise?

The short answers are, (1) no, and (2) no.

Wage-push inflation is a thing of the past. During the Great Inflation of the 1970s, wage increases appeared to lead inexorably to accelerating inflation, which in turn led to demands for still-higher wages. Indeed, an econometric regression of inflation (measured by the price deflator for personal consumption expenditures excluding food & energy—the Fed’s preferred inflation measure) on 12 months of lagged changes in average hourly earnings finds that wage growth explains 50 percent of the total month-to-month variations in inflation for the period from 1970 through 2017. (For the data wonks, the coefficients on the first six monthly lags are positive and statistically significant, with T-stats ranging from 2.77 to 3.55.)

But today’s economy is much different from the 1970s. Unionized labor, especially in heavy manufacturing industries, has a much smaller footprint in the economy, while flexible work schedules and a “gig” economy have grown. Deregulation has opened markets to competitive forces, and globalization helps keep domestic prices from getting out of line with prices abroad. These developments have all weakened the impact of wage growth on inflation.

We can conduct a rigorous test of how the link between wages and prices has changed by repeating the econometric regression cited above, for the period from 1990 through 2017. (Changing the start and end dates of this regression by a few years does not affect the results.) The model, when estimated over this more recent period, finds essentially no relationship between the month-to-month changes in wages and the subsequent inflation rate. (For the data wonks again, the adjusted R-squared is 0.006, and none of the coefficients on the 12 monthly lags of average hourly earnings is statistically significant.)

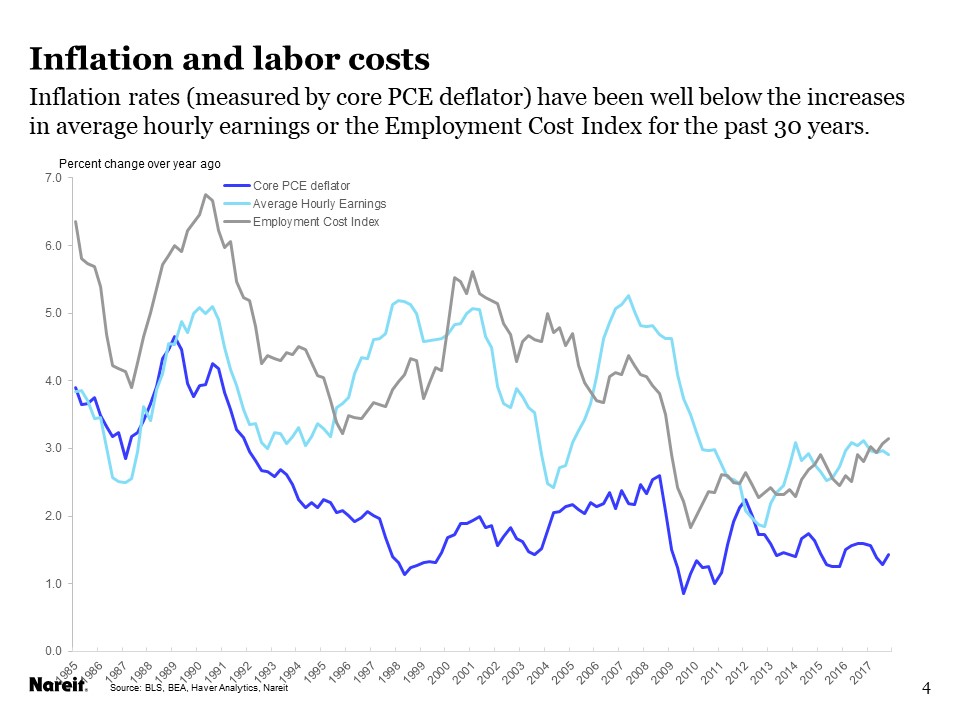

It is normal for average hourly earnings to rise more rapidly than inflation, as indeed they have for the past 30 years (chart; dark blue line is inflation, light blue line and grey line are two measures of labor costs). In fact, the gap between labor costs and inflation is currently much narrower than it was during the 1990s and early 2000s, suggesting that, based on these historical relationships, wage gains could accelerate to a 4 percent or 5 percent pace without necessarily driving inflation pressures higher. A broader measure of labor costs, the Employment Cost Index (ECI), includes not only wages but also benefits, and has also consistently risen faster than wages.

Rising interest rates have some effects that are negative for REIT share prices, but others that are positive. It’s important to identify the different channels by which higher rates can affect REITs in order to understand which forces may dominate at any given time:

- Higher long-term interest rates reduce the present value of future dividends. This interest rate channel has an unambiguously negative impact on the value of REIT shares, as well as corporate equities and most other financial investments. These direct effects on valuations, however, are rather small compared to recent stock price movements.

For example, it is straightforward to calculate the direct price effect of a 20 bp rise in interest rates on the value of a 10-year Treasury note (you can also use the yield and spread analysis function “YAS” on your Bloomberg terminal to perform this calculation). The impact of higher rates on the value of future dividends is similar to the impact on the value of future bond coupon payments. The 20 bp rise in 10-year Treasury yields during the recent market turmoil resulted in a 1.6 percent decline in the price of the Treasury note—a small fraction of the more than 6 percent decline in the S&P 500 on February 2nd & 5th.

- Federal Reserve efforts to raise short-term interest rates to slow an overheating economy may also trim the demand for commercial real estate. In past cycles of aggressive Fed tightening, the overall economy slowed, including retail spending and the growth of office employment, as well as key drivers of other sectors of commercial real estate. As rent growth slowed or stalled, REIT earnings, and earnings of the rest of corporate America, weakened as well.

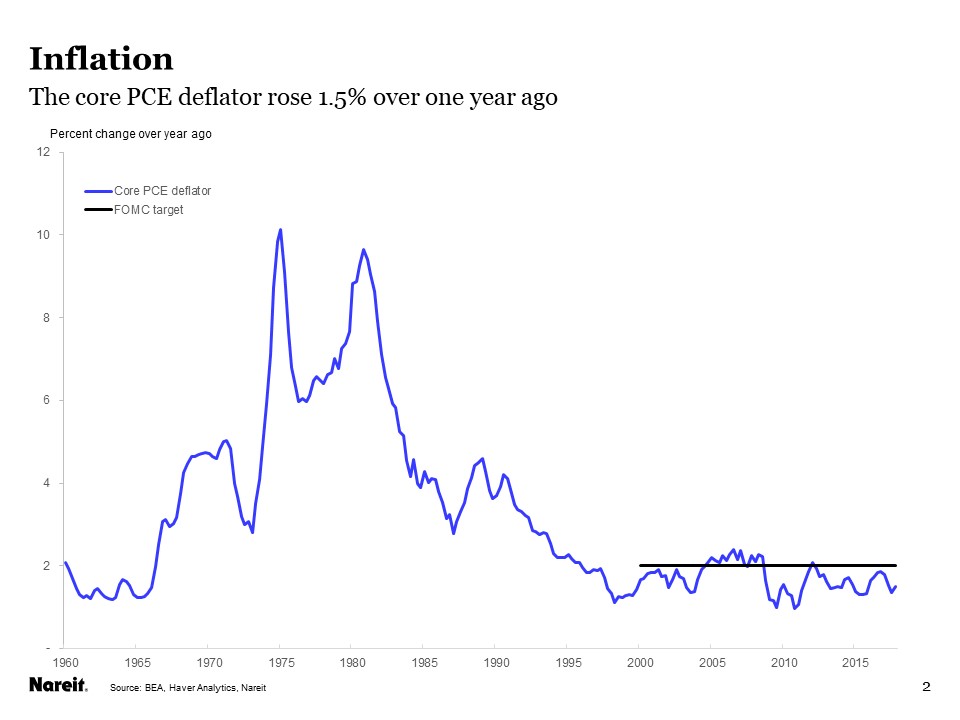

The Fed is not behind the curve of rising inflation, though, and the risks that they need to raise rates aggressively are low. Current measures of inflation, after all, as still well below the Fed’s target (chart). If the Fed is viewed as being in the driver’s seat of the economy, they are taking their foot off the accelerator but not in need of tapping the breaks. (See my Market Commentary on the three warning signs of an economic downturn: overbuilt, overheated or overleveraged. None of these three warning signs is flashing red today.)

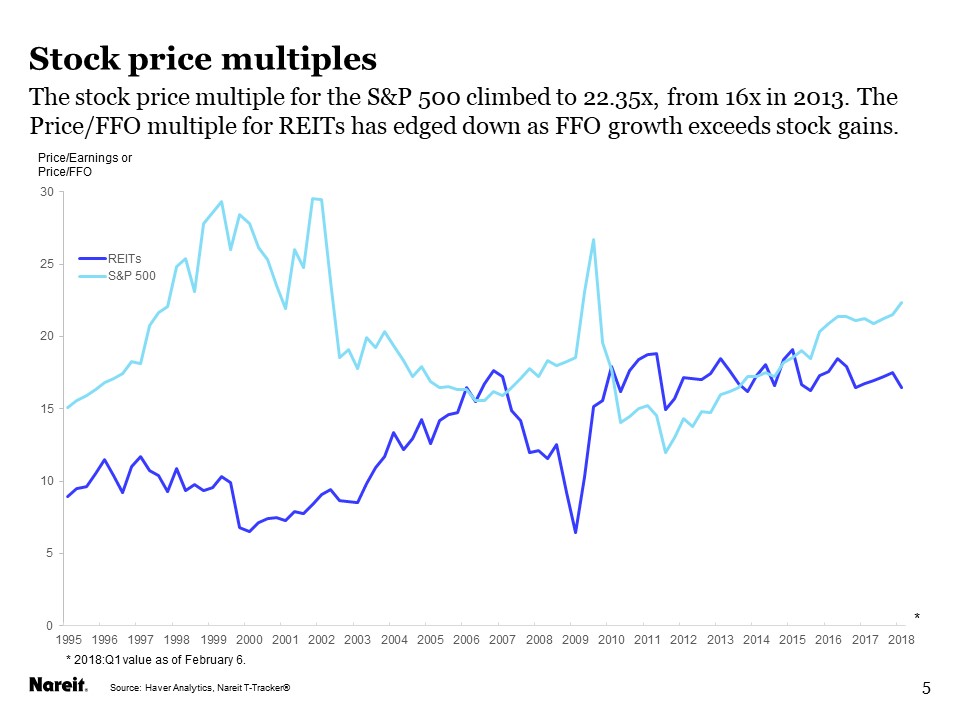

- Robust economic growth may create greater demand for credit, with a stronger economy boosting corporate earnings while also raising interest rates. This third channel of stronger growth on interest rates is unambiguously positive for REITs. REIT earnings growth currently has momentum, supporting stock valuations. The most recent data from the Nareit T-Tracker® show funds from operations (FFO) rising at an 8 percent rate or more in recent years.

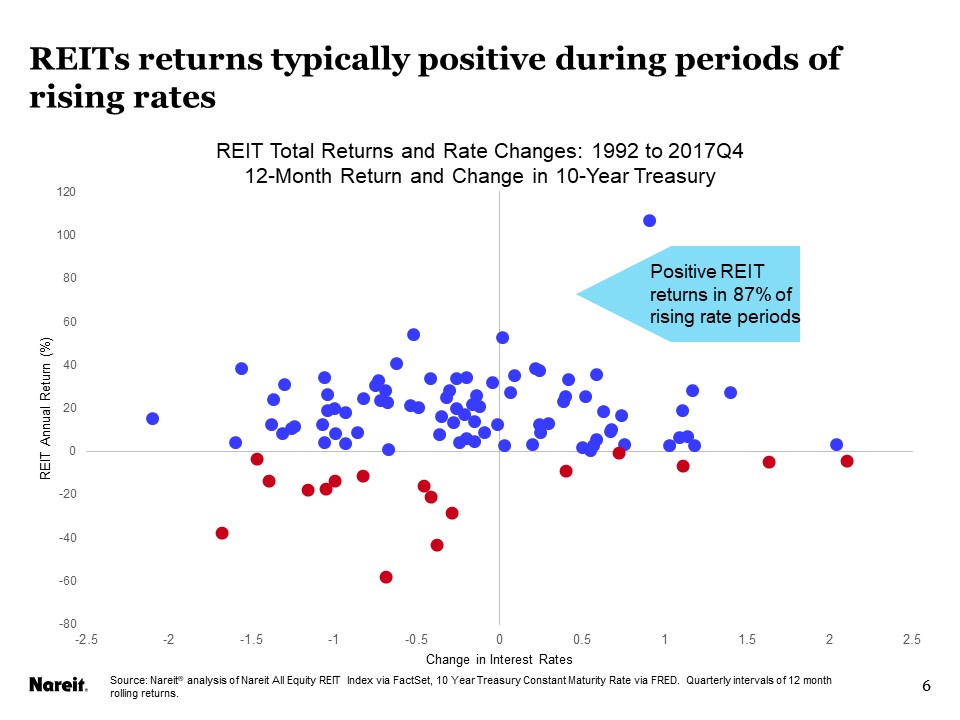

For much of the modern REIT Era (1992 through the present), the third factor, stronger growth, has dominated the others, and REIT share prices have generally moved higher during periods of rising interest rates. Since the “Taper Tantrum” of 2013, however, the immediate response of REIT share prices to rising interest rates has been to decline. While price/earnings multiples of the S&P 500 climbed higher and higher in recent years, the price/FFO multiple for REITs in the FTSE Nareit All Equity REITs Index has been stable.

REITs remain more conservatively priced relative to earnings, while the higher price multiples on the S&P 500 are one reason that many analysts have viewed the broader stock market as “frothy”. It is important for investors to keep these longer term trends in mind during periods of market turmoil, as REIT valuations are supported by solid growth of FFO and have upside potential, regardless of current trends in interest rates.