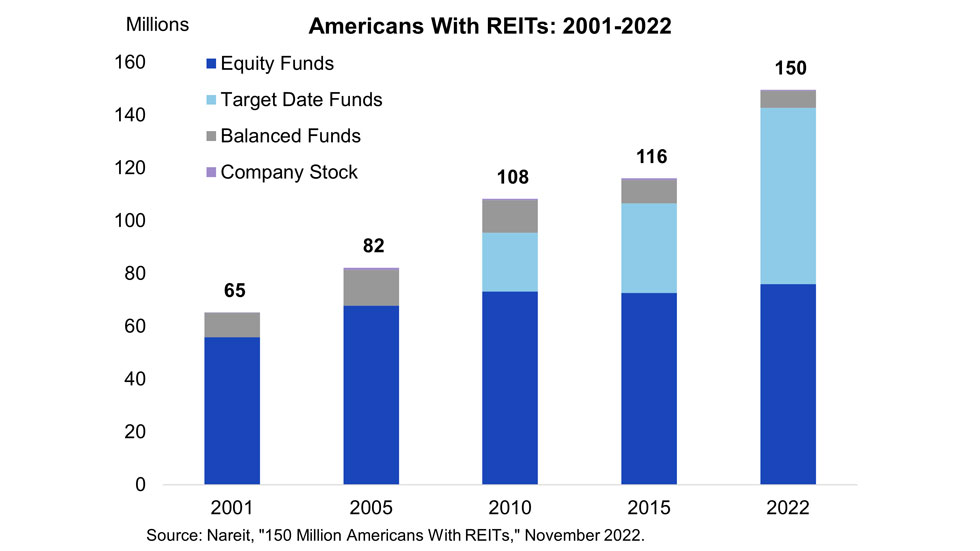

An estimated 150 million Americans live in households that are invested in REIT stocks in 2022 directly or indirectly through mutual funds, ETFs, or target date funds, new research by Nareit shows. This figure, totaling roughly 45% of American households, is more than double the 2001 estimate of 65 million Americans invested in REITs, with growth fueled by the establishment and increasing popularity of target date funds.

Research by Morningstar, Wilshire, and others have consistently affirmed the importance of meaningful commercial real estate allocations in retirement portfolios. Today, the vast majority of Americans with commercial real estate in their investment portfolios are getting that exposure through REITs.

The chart above shows the growth of Americans invested in REITs by each fund type, with the share of total Americans with REITs for that year by fund type labeled for 2001 and 2022. Starting in 2001, 65.3 million Americans owned REITs. Approximately 86% of these REIT holdings were through equity funds tied to retirement accounts, with another 14% in balanced funds. The share of retirement assets held in equity funds and balance funds has decreased with the establishment and popularity of target date funds starting in 2007.

By 2010, 108 million Americans lived in households with REITs, 79% invested in REITs through equity and balanced funds, and 21% invested in REITs through target date funds. Most recently in 2022, the share invested through target date funds has grown to 45% with equity and balanced funds at 55%. As target date funds have increased in popularity, so too has their REIT ownership, leading to growth in the number of Americans with REITs.