A unique feature of the REIT industry is the importance of dedicated asset managers. Using Morningstar Direct data on mutual funds and ETFs, we find that real estate has the largest specialist ownership base across GICS sectors. An estimated 14.5% of total listed U.S. real estate equity is held by these specialist real estate funds. This is more than $208 billion, including almost $14 billion in U.S. real estate assets held in specialist funds with an international focus. Importantly, this does not include assets managed in separate accounts or collective investment trusts.

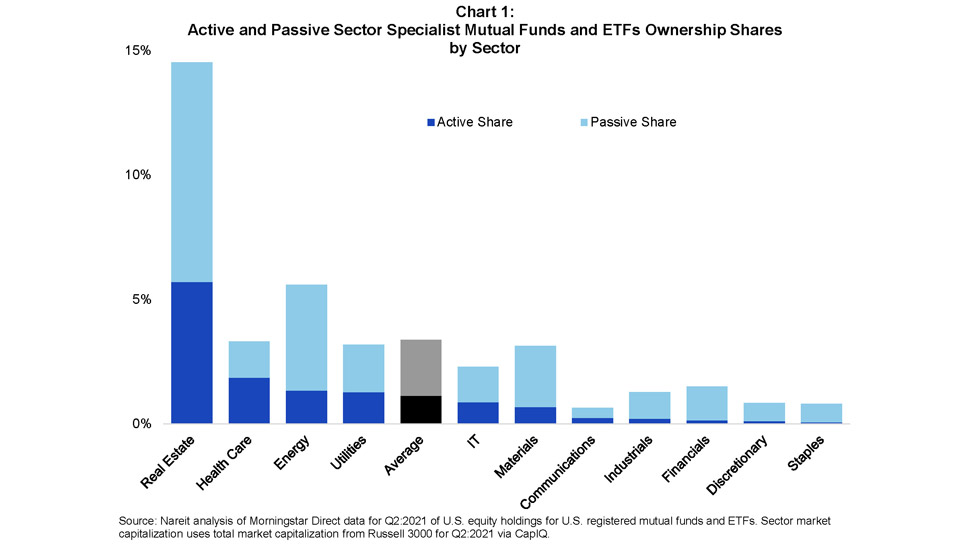

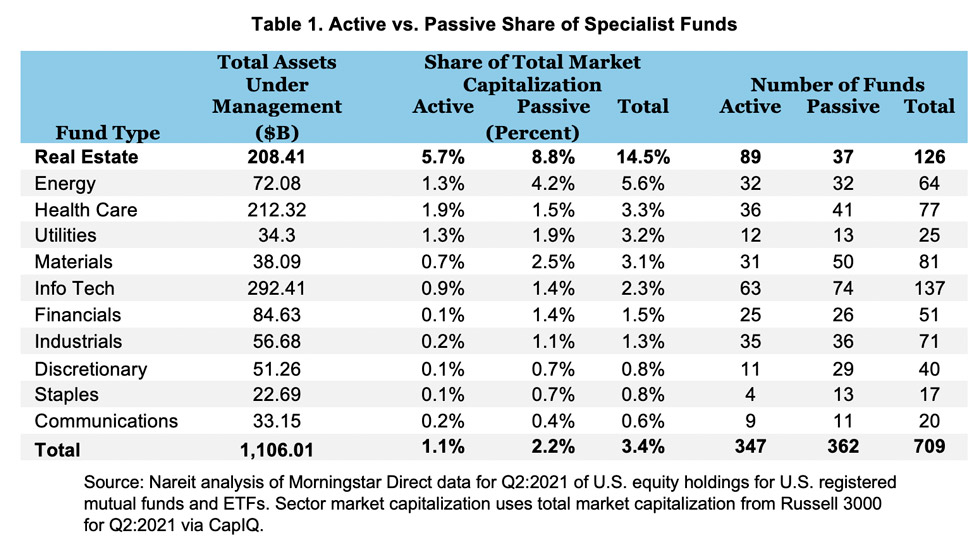

Analysis of Morningstar Direct data on mutual funds and ETFs estimates activist specialist funds owned 5.7% of the REIT equity market capitalization in the Russell 3000 as of the second quarter of 2021 and passive specialist funds owned 8.8% REIT equity market capitalization. Table 1 and Chart 1 show the breakdown by GICS sector of the active and passive shares of the ownership base for specialist funds investing in U.S. equities.

As the graph shows, REITs have the largest share of total market capitalization in specialist funds. The energy sector has the second highest specialist ownership share at 5.6%, just over one-third of the REIT share. As Table 1 shows, REITs also have the second largest number of specialist funds with 126 funds, information technology has the largest number of funds at 137.

The large specialist ownership base for REITs can help investors in direct and indirect ways. A previous market commentary on generalist funds shows that the underweighting of REITs by active managers in funds benchmarked to major indexes is decreasing, but has not disappeared. Specialist funds can be a correction to this underweighting for investors and allow investors to align their portfolios with expert views of the optimal allocation to real estate. For example, see the recent Morningstar study that suggests allocations to REITs ranging between 4% and 13%. Specialist funds also offer access to a broader set of REITs than are included in large cap indexes. This gives investors more depth in REIT property sectors and expands access to smaller cap companies that generalist funds tend not to include.

Having a large number of active managers with expertise and long-term commitment to REITs indirectly benefits investors by providing market discipline. Active managers keep companies accountable to the market through focused monitoring and investment choices. The presence of active managers also creates a market for information about the REIT sector and individual REITs. These benefits accrue to all REIT investors.