Nareit’s REIT Industry Sustainability Report 2025 analyzed REIT reporting on governance practices, building resilient real estate, and engagement with stakeholders over time. New metrics included in the report focused on the board characteristics of NYSE-listed REITs, diving deeper to look at directors’ tenure, age, and the skills and perspectives they provide to help guide REIT management to maximize value and long-term growth.

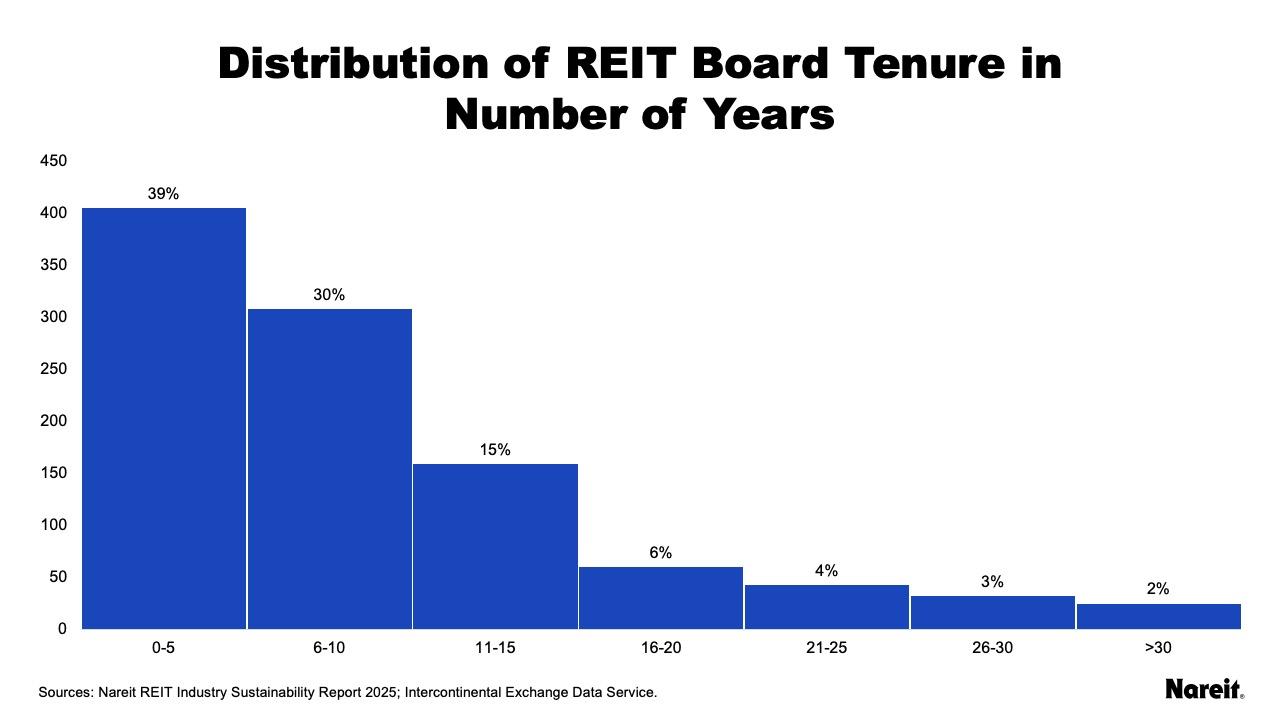

The chart above depicts the distribution of REIT board tenure in the number of years served. Seven out of 10 REIT directors have served on the REIT’s board for 10 years or less, with the largest group being those who have served for five years or less. With an average board tenure of nine years and a median tenure of seven years, REITs are bringing new voices and fresh insights into their management practices.

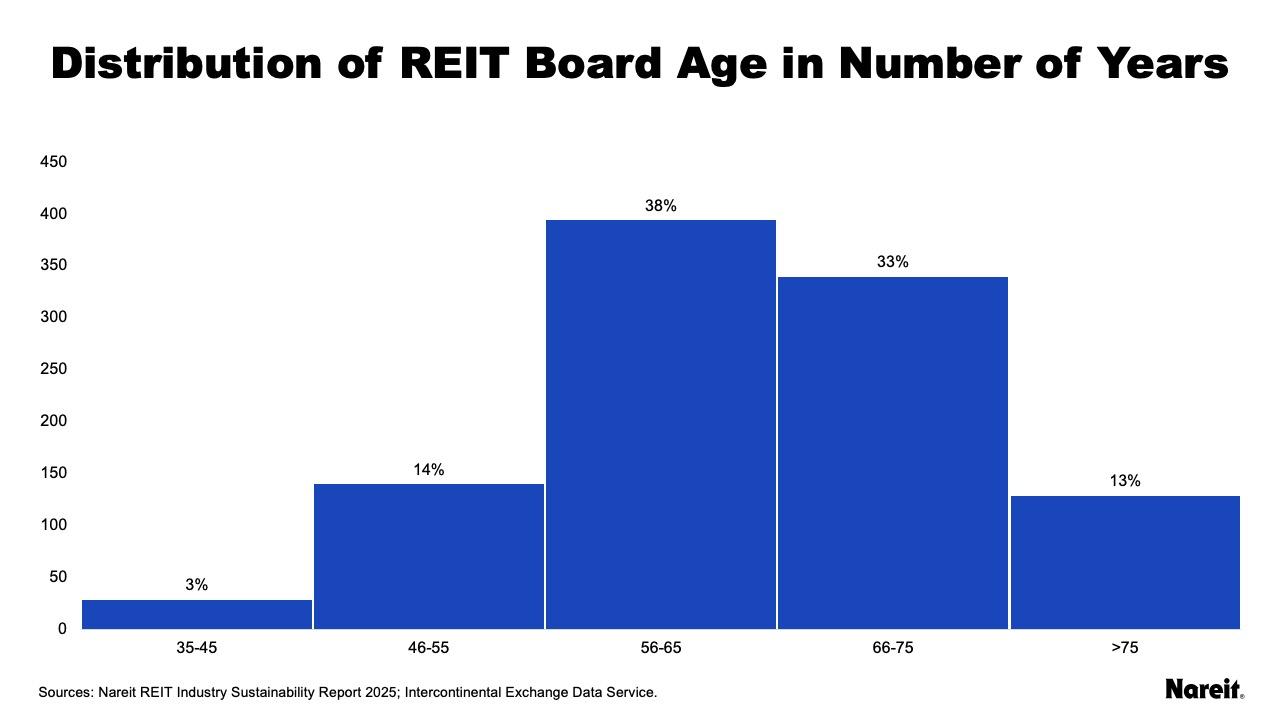

The chart above depicts the age distribution of REIT board directors in 2024. Both the median and average age for REIT directors was 64 years and nearly 40% of directors were between the ages of 55 and 65 years. REIT boards today are comprised of a mix of real estate veterans who bring years of expertise, while also including directors who are younger and are able to provide a different point of view.

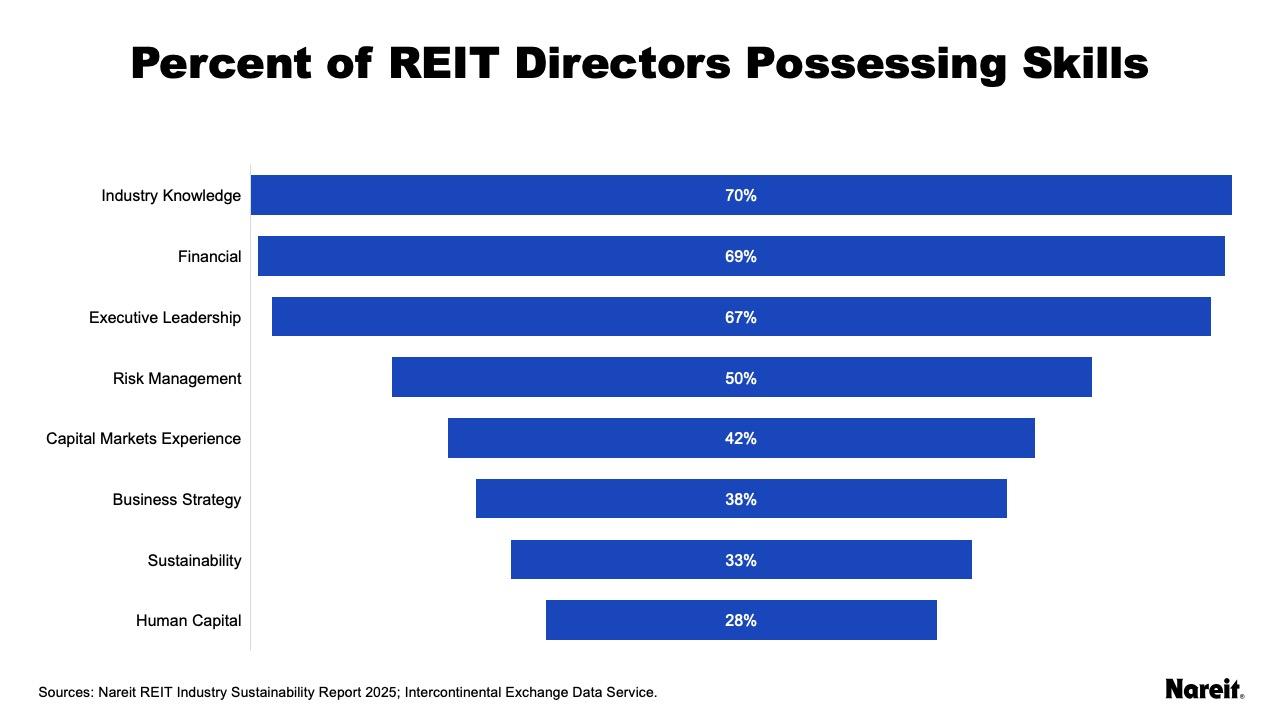

The chart above shows the top skills and perspectives of REIT directors. The skills and perspectives range from industry knowledge (70% of REIT directors) and financial expertise (69%) to experiences related to sustainability (33%) and human capital management (28%). The breadth of skills, experiences, and perspectives contributed by REIT directors to REIT leadership helps guide management to maximize value and long-term growth. Given that 80% of REIT directors are independent, REIT boards ensure that management is acting responsibly in establishing guidelines and policies tied to legal and ethical conduct, imposing strong internal controls and fiscal accountability.

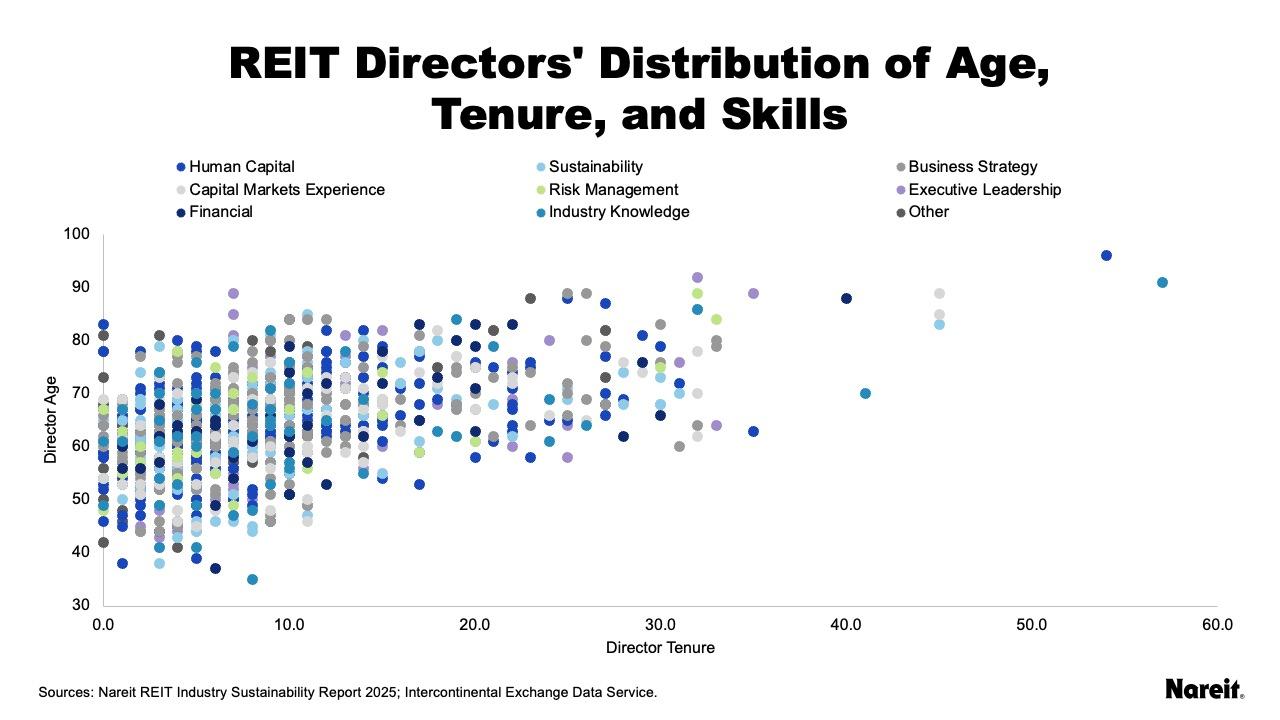

The chart above shows the distribution of NYSE-listed REIT directors’ age and tenure, with the different colors representing one of the many skills each director provides to REIT management. The skill represented in this chart for each director is based on the most unique skill they provided to the REIT from the eight skills that were highlighted in Nareit’s report, as seen in the prior chart. “Other” represents skills, experiences, and perspectives not focused on in the report, but were unique insights that REIT directors brought to REIT management.

Experience in human capital was the most unique skill for REIT directors and therefore, if a director possessed that skill, they were represented as possessing human capital management in dark blue. This was then followed by experience in sustainability (represented by light blue), then business strategy (dark gray), and so forth, based on the reversed order in the prior exhibit. As seen in the chart, REIT boards contained directors possessing a variety of skills whose ages ranged from 35 to 96 years, with tenure ranging from 0 to 57 years. Human capital, sustainability, and other skills had the lowest median tenure at six years. Financial had the highest median tenure at 10 years.

These key findings from Nareit’s REIT Industry Sustainability Report 2025 show how the REIT approach to real estate investment is responsive to shareholders and provides transparency by having a majority of independent directors who oversee leadership teams. REIT directors who possess years of experience and industry knowledge, new voices with fresh perspectives, and those with unique skills, are all contributing to REITs’ business strategies that deliver long-term growth and value.

The report includes many more findings, which underscore that publicly traded REITs inherently have good governance and accountability embedded within their business model. Investors with sustainability-focused real estate strategies should take note of REITs’ commitment to transparency and the value their sustainability performance can bring to portfolios.