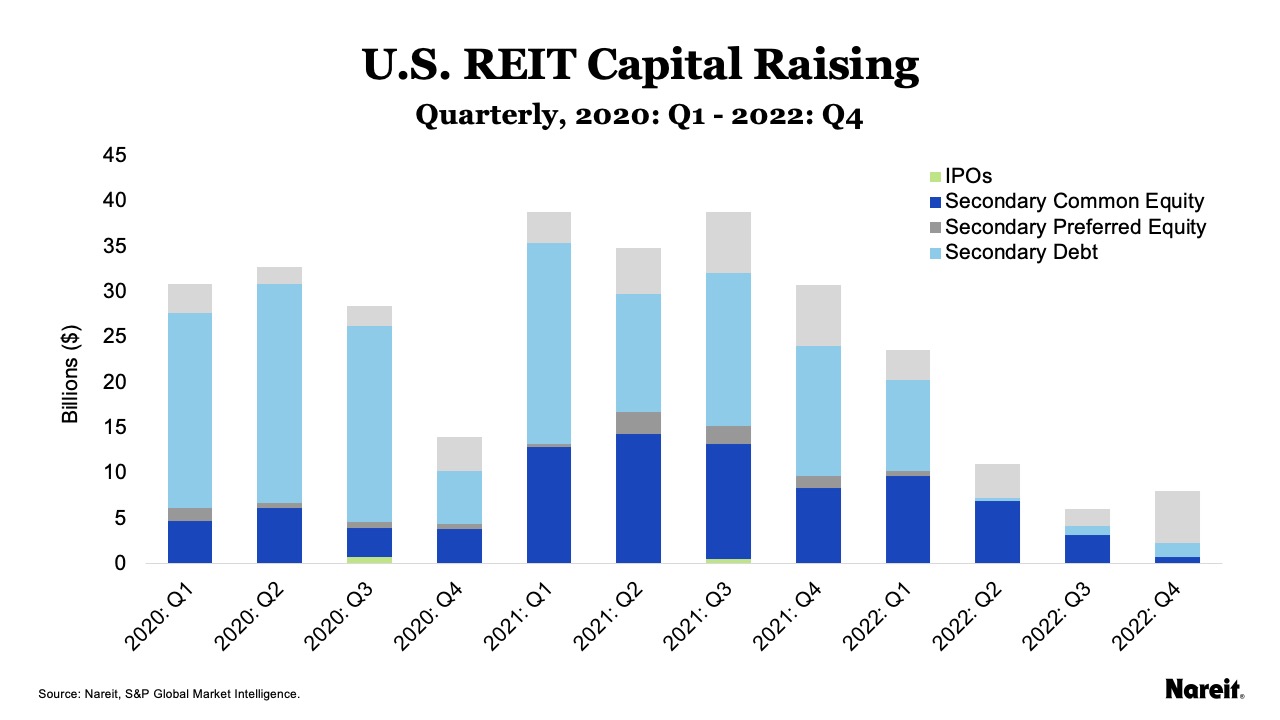

U.S. REITs raised $2.5 billion from secondary debt and equity offerings in the fourth quarter of 2022, down from $8.6 billion raised in Q3. $760 million came from secondary common equity, $200 million from secondary preferred equity, and $1.5 billion came from secondary debt offerings. Preliminary data show $5.8 billion raised through ATM programs. The last time REITs raised less capital in a quarter was the fourth quarter of 2009, when $6 billion was raised. The capital raising total represented a continued decline from 2021 when REITs raised $24.1 billion in Q4. In January 2023, $1.6 billion in secondary debt offerings have been announced, surpassing the $1.5 billion raised in the final four months of 2022, suggesting the potential for some loosening in credit markets.

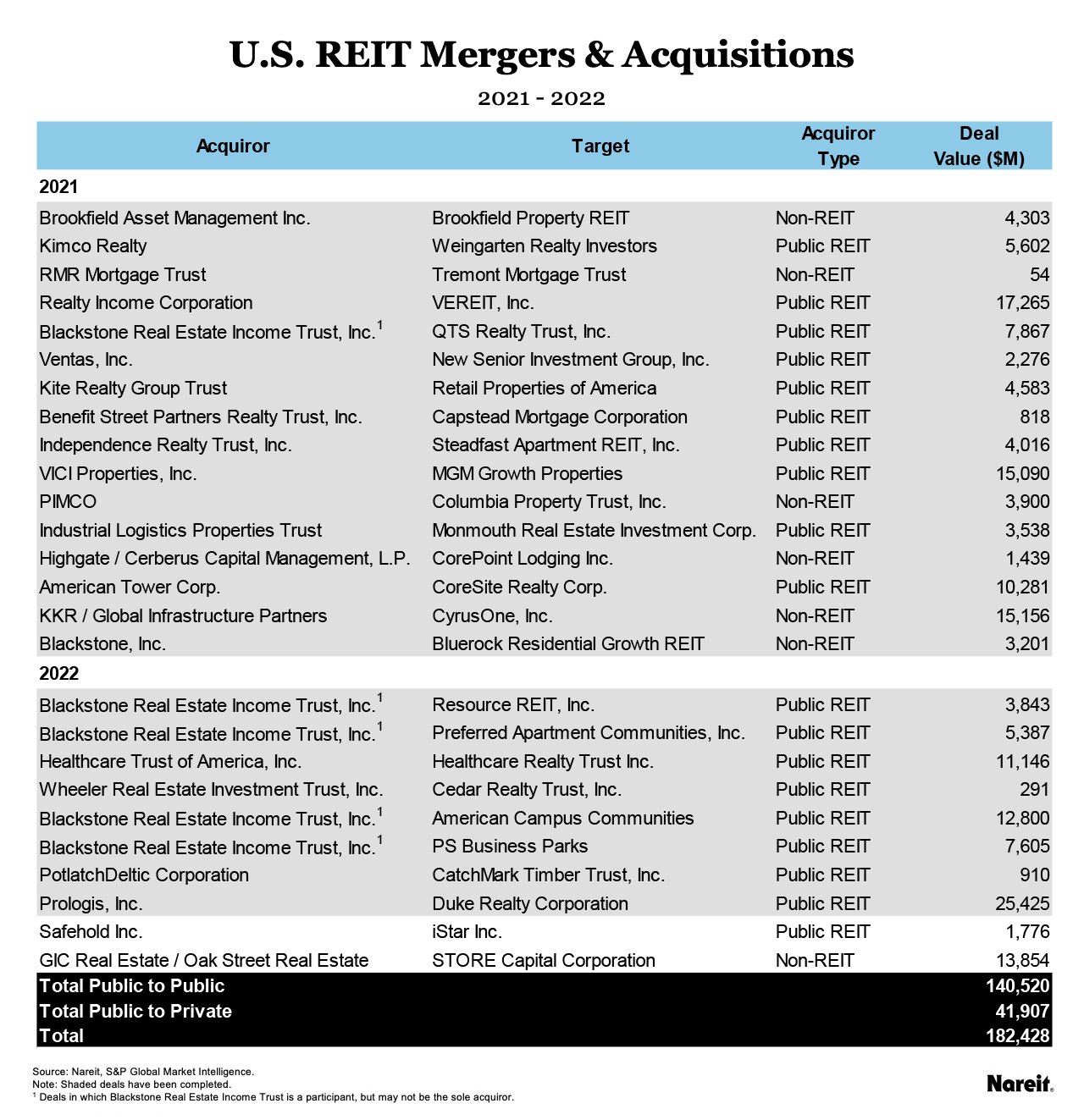

During the quarter, no mergers or acquisitions impacting U.S. REITs were announced. In 2022, $83 billion in acquisitions of public traded U.S. REITs was announced, though this activity was largely weighted to the first half of the year, with $67 billion in acquisitions occurring through June 30. Of the $173 billion in public REIT mergers & acquisitions from 2019–2022, 70.5% of the transaction value represents deals between listed REITs in the same property sector.

2022 Capital Raising

- Equity issuance totaled $21.5 billion, with $20.6 billion from common equity offerings and $895 million in preferred equity offerings. Total equity issuance in 2021 was $39.2 billion, with $21.9 billion in 2020.

- Debt issuance totaled $12.9 billion raised at the secondary market, down from the $72.6 billion issued in 2021 and $73.1 billion in 2020.

- At-the-market equity issuance was $17.2 billion based on preliminary Q4 data, down from $21.8 billion in 2021 and up from $11.1 billion in 2020.

Mergers & Acquisitions

In 2022, 10 deals to acquire public-listed U.S. REITs have been announced, representing a total deal value of $83 billion. Two of these deals were announced in Q3, for a total of $15.6 billion, with one of these two transactions representing acquisitions by another publicly traded U.S. REIT, with a total deal value of $1.8 billion. Since the beginning of 2021, deals for 26 REITs have been announced or completed. Of the $182.4 billion in deal value represented by these acquisitions, 77% is attributed to acquisitions by other listed REITs.

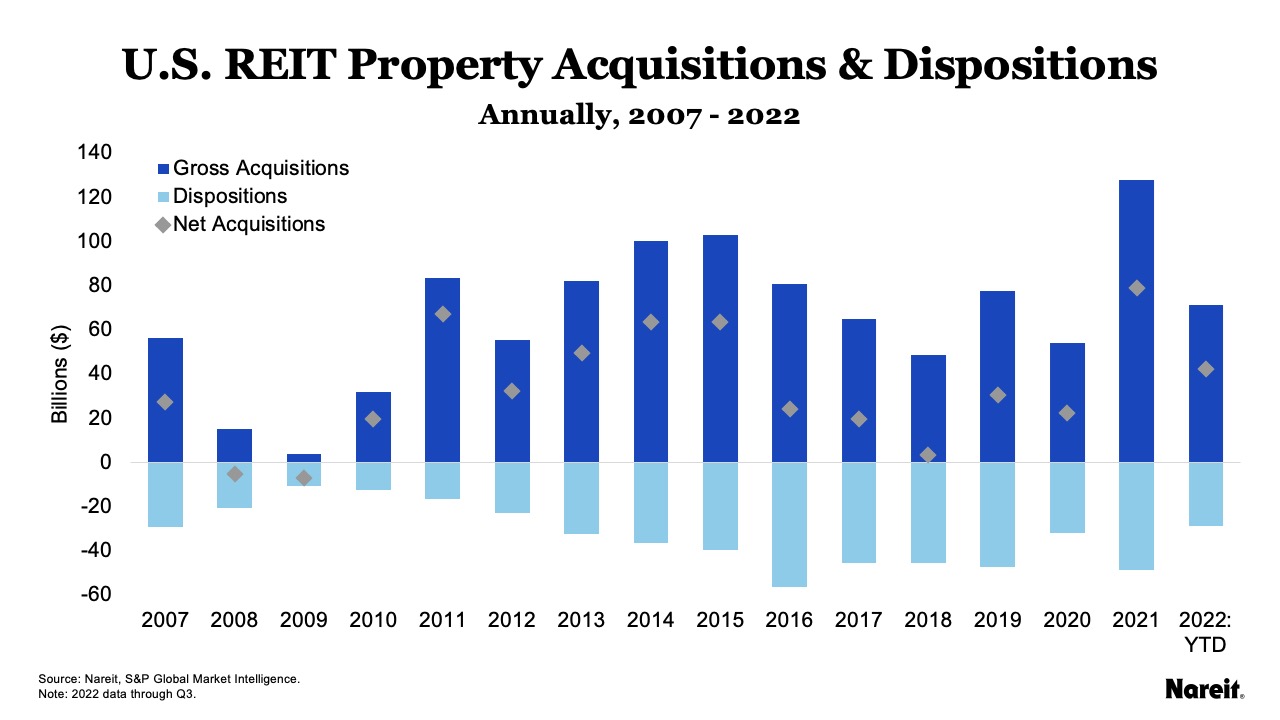

Property Acquisitions & Dispositions

REITs posted $21.7 billion in property acquisitions and $9.9 billion in dispositions in 2022: Q3, with year-to-date totals of $71.2 billion in acquisitions and $28.6 billion in dispositions. In 2021, $127.8 billion in acquisitions and $48.8 billion in dispositions were posted. In Q3, retail, office, and industrial led with acquisitions of $4.2 billion, $4.0 billion, and $3.7 billion, respectively. REITs have been net acquirors of real estate on an annual basis since 2010 and set a new record for net acquisitions in 2021, surpassing the previous high-water mark set in 2011. See Nareit’s T-Tracker for further details.