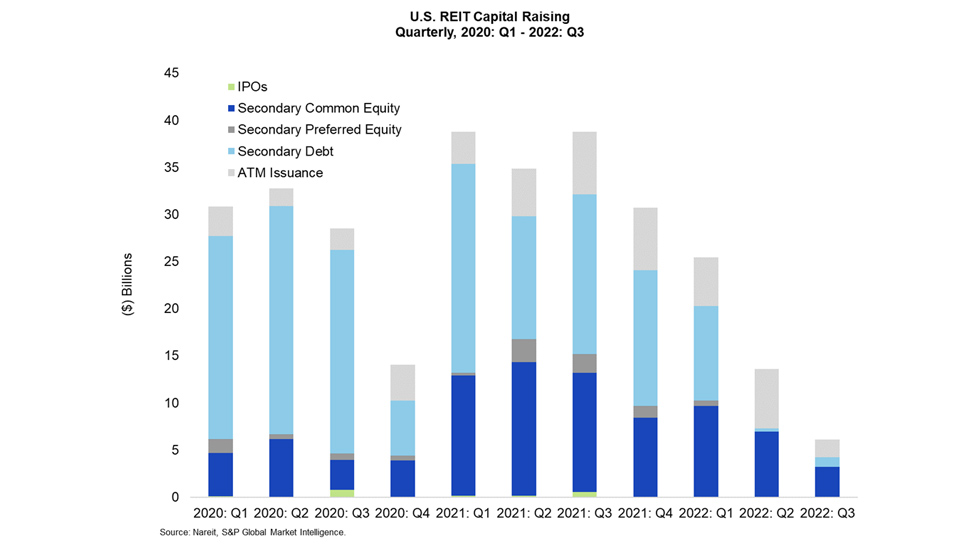

U.S. REITs raised $6.2 billion from secondary debt and equity offerings in the third quarter of 2022, down from $11.1 billion raised in the second quarter. $3.2 billion came from secondary common equity, $150 million from secondary preferred equity, $1.0 billion came from secondary debt offerings, and $1.9 billion came from ATM programs. The last time REITs raised less capital in a quarter was 2009: Q4, when $6.0 billion was raised.

The 2022: Q3 capital raising total represented a continued decline from 2021 when REITs raised $29.4 billion in Q3. The drying up of debt and preferred stock offerings was the most notable factor contributing to the decline. On Oct. 4, Realty Income announced the pricing of $750 million of senior unsecured notes yielding 5.625%.

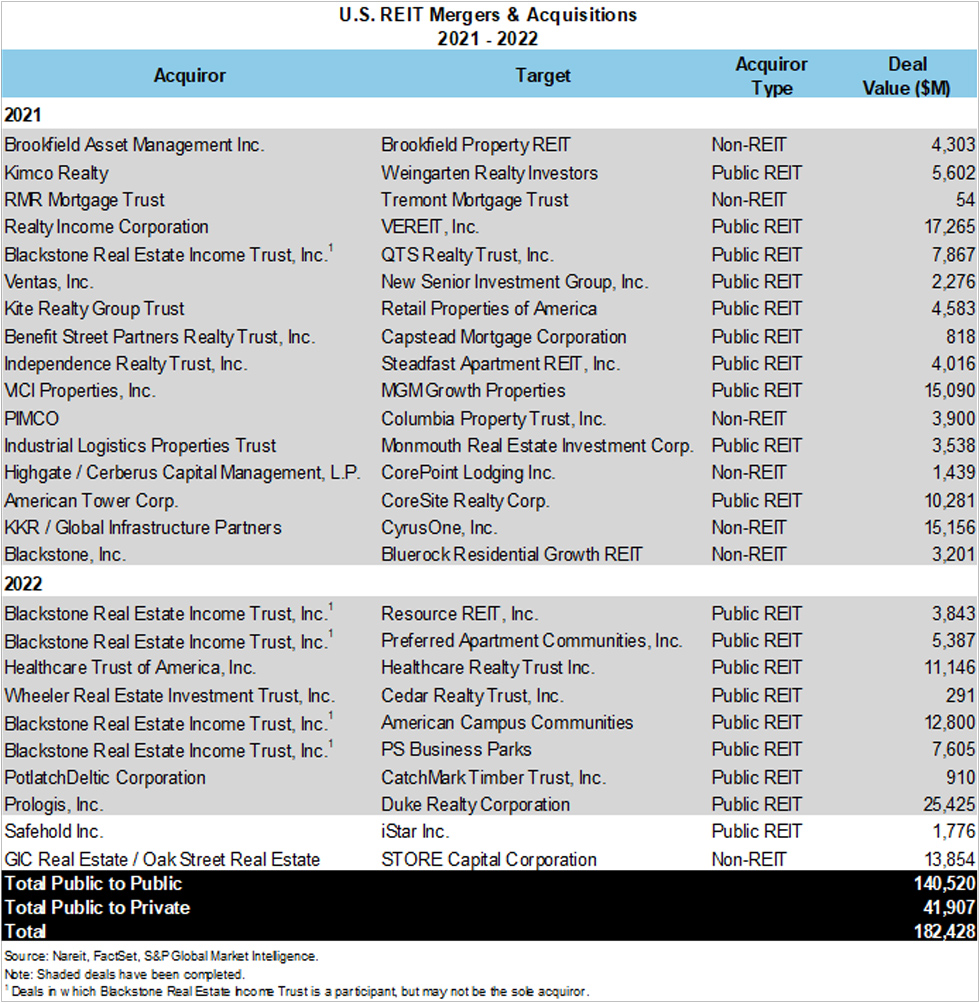

During the quarter, two offers to acquire U.S. REITs were announced, with a total deal value of $15.6 billion.

Year-to-Date Capital Raising

- Equity issuance totaled $20.5 billion, with $19.8 billion from common equity offerings and $695 million in preferred equity offerings. Total equity issuance for the same period in 2021 was $29.5 billion, with $17.5 billion in 2020.

- Debt issuance totaled $11.4 billion raised at the secondary market, down from the $58.2 billion issued in 2021 and $67.3 billion issued in 2020.

- At-the-market equity issuance was $9.0 billion, following $15.1 billion in 2021 and $7.3 billion in 2020.

Mergers & Acquisitions

In 2022, 10 deals to acquire publicly listed U.S. REITs have been announced, representing a total deal value of $83.0 billion. Two of these deals were announced in Q3 for a total of $15.6 billion, and one of these transactions was an acquisition by another publicly traded U.S. REIT with a total deal value of $1.8 billion. Since the beginning of 2021, deals for 26 REITs have been announced or completed. Of the $182.4 billion in deal value represented by these acquisitions, 77% is attributed to acquisitions by other listed REITs.

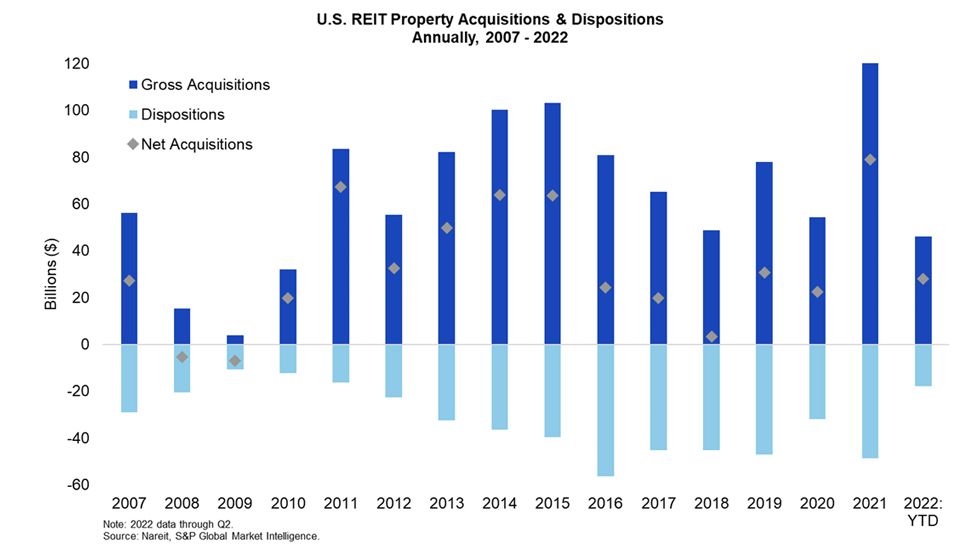

Property Acquisitions & Dispositions

REITs posted $18.9 billion in property acquisitions and $7.8 billion in dispositions in 2022: Q2, with year-to-date totals of $46.1 billion in acquisitions and $18.0 billion in dispositions. In 2021, $127.8 billion in acquisitions and $48.8 billion in dispositions were posted. In Q2, the retail, residential, and industrial sectors led with acquisitions of $4.9 billion, $4.6 billion, and $2.8 billion, respectively. REITs have been net acquirors of real estate on an annual basis since 2010 and set a new record for net acquisitions in 2021, surpassing the previous high-water mark set in 2011. Please see Nareit’s T-Tracker for further details.