The FTSE Nareit All Equity REITs Index declined 7.0% in September as the 10-year Treasury yield continued to climb, ending the month at 4.6%, while the All Equity REITs dividend yield ended the month at 4.4%. Broader markets also faced pressure as the Dow Jones U.S. Total Stock Market fell 4.8% and the Russell 1000 declined 4.7%. The sharp increase in Treasury yields reflects the combined effects of the Federal Reserve’s hawkish stance in its efforts to combat inflation and economic growth prospects that have been surprisingly resilient. Markets are now pricing in higher long-term interest rates for a longer period.

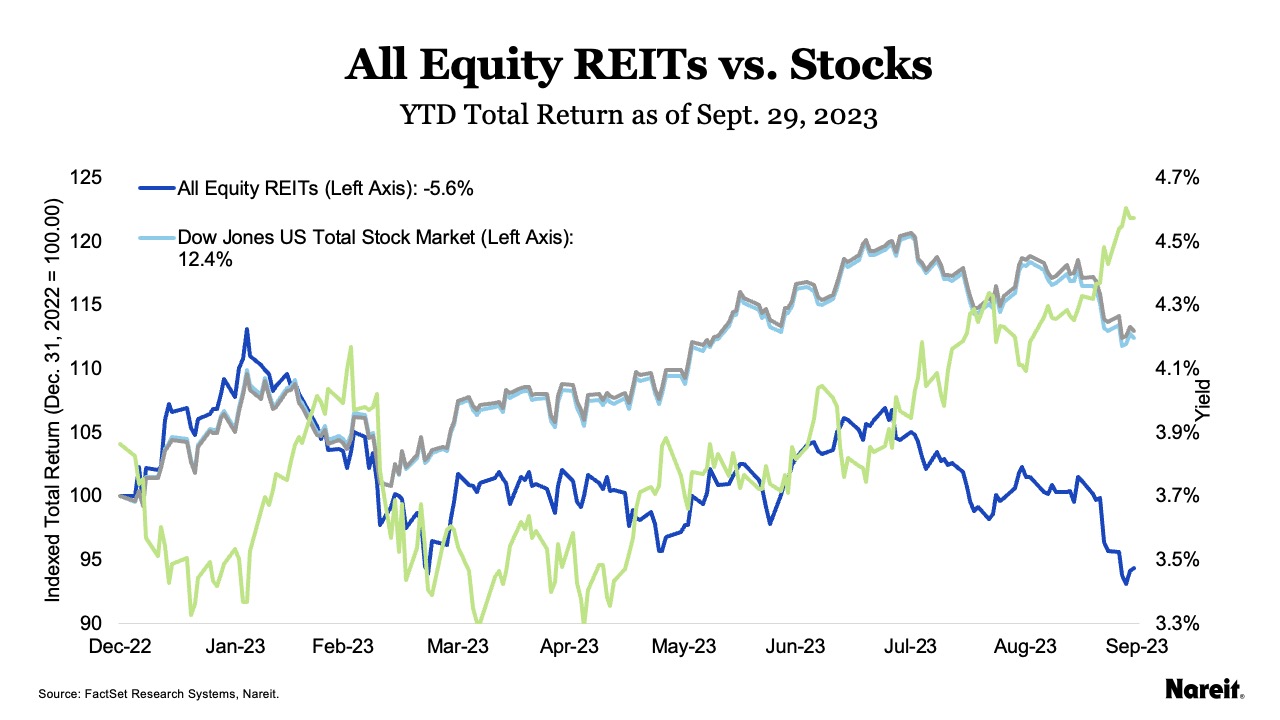

As shown in the above chart, the 10-year Treasury climbed nearly 50 basis points in September. REITs continued to underperform broader markets on a year-to-date basis. Total returns through the end of September were:

- All Equity REITs: -5.6%

- Russell 1000: 13.0%

- Dow Jones U.S. Total Stock Market: 12.4%

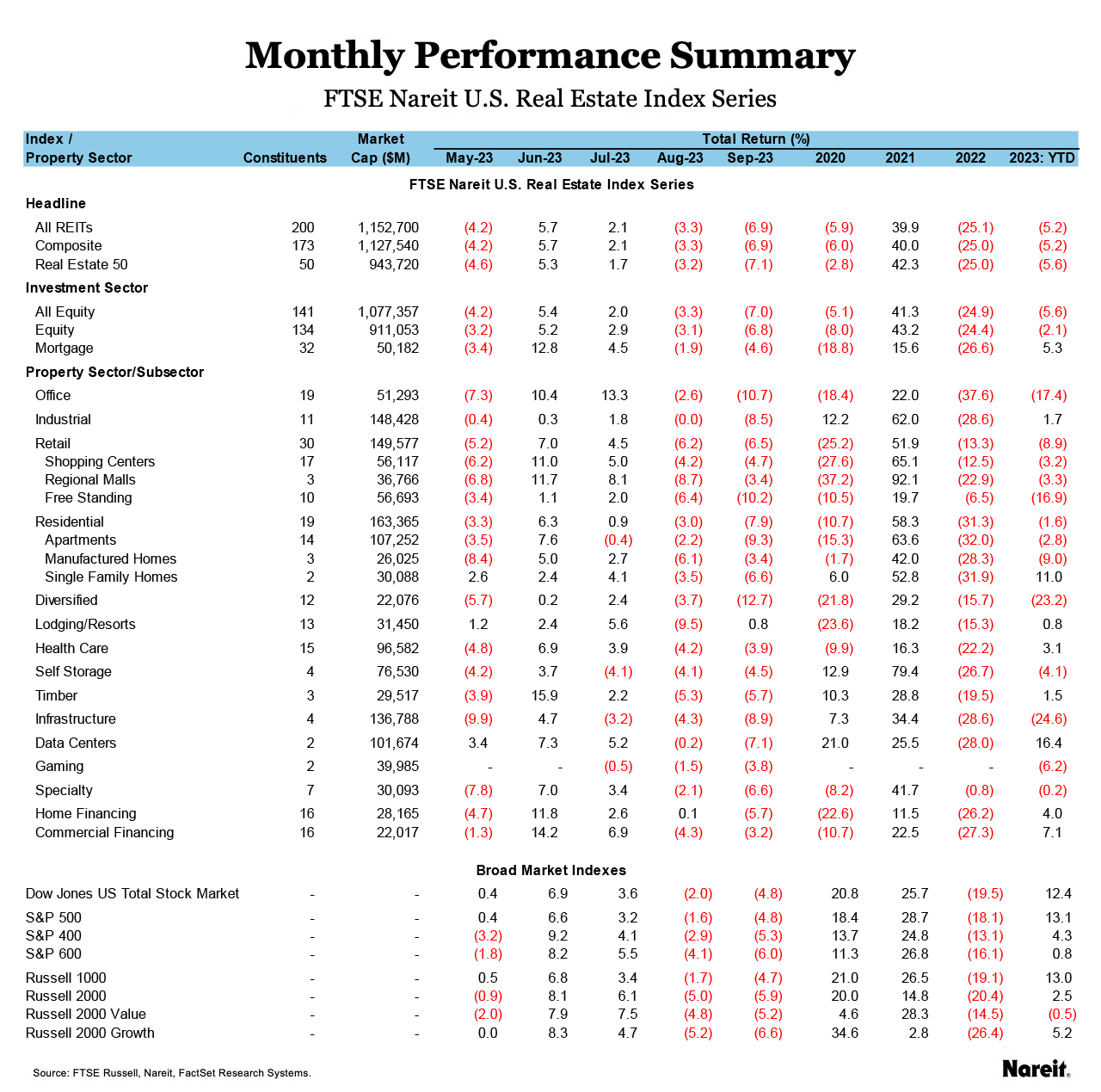

As shown in the preceding table, the lodging/resorts sector was the only sector posting a positive total return in September, rising 0.8%, followed by gaming at -3.8% and health care at -3.9%. Diversified, office, and infrastructure lagged in September, with total returns of -12.7%, -10.7%, and -8.9%, respectively. On a year-to-date basis, the data centers sector continues to outperform with a total return of 16.4%, followed by health care at 3.1% and industrial at 1.7%. Infrastructure, diversified, and office lag on the year, with respective returns of -24.6%, -23.2%, and -17.4%. In 2023, the single family homes subsector is a relative bright spot with a return of 11.0%.

The FTSE Nareit Mortgage REITs Index fell 4.6% in September, with a year-to-date total return of 5.3%. Commercial financing mREITs fell 3.2% for the month, while home financing mREITs declined 5.7%. On a year-to-date basis, the commercial financing sector is up 7.1%, with home financing up 4.0%. At month-end, the mortgage REITs index had a dividend yield of 12.7%, and commercial financing and home financing mREITs yielded 11.2% and 13.9%, respectively.