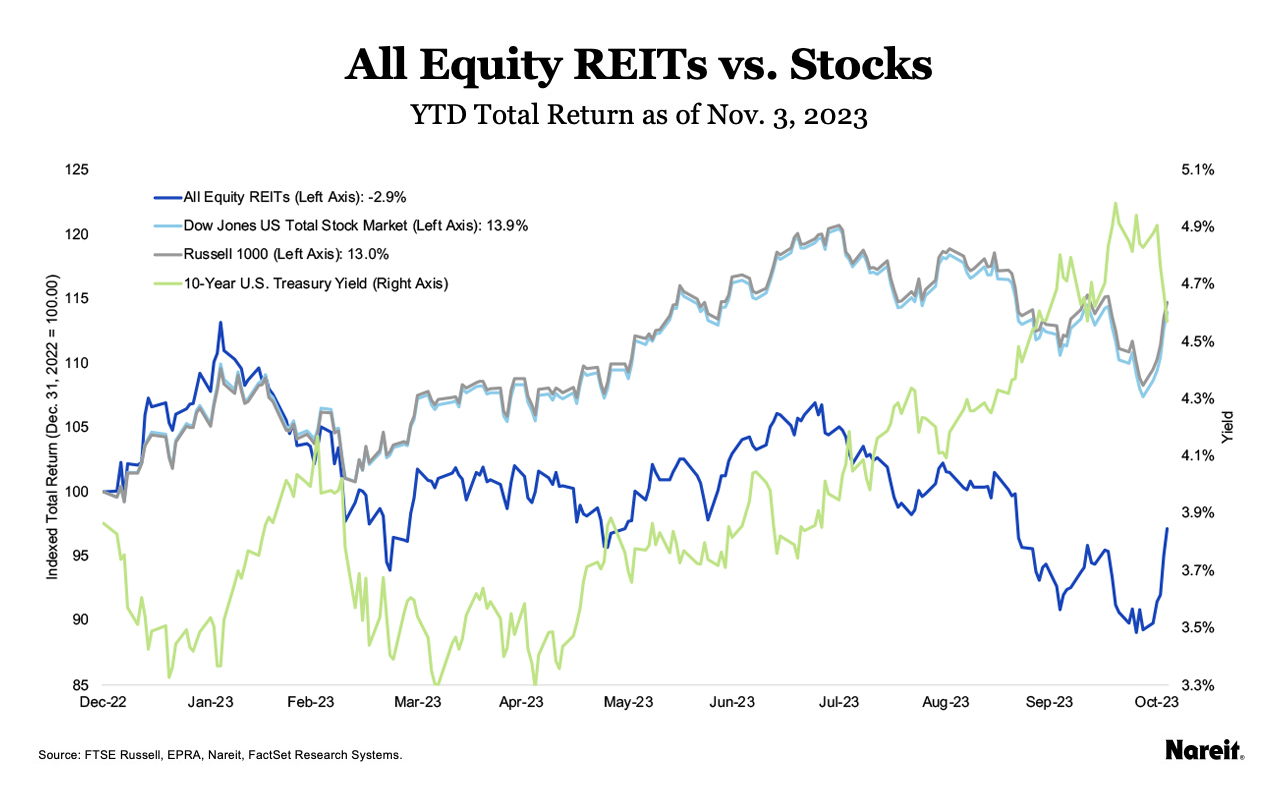

The FTSE Nareit All Equity REITs Index, broader markets, and treasuries responded positively as investors broadly believe the Federal Reserve’s cycle of monetary policy tightening to be over. From Sept. 29–Oct. 19, when the 10-Year Treasury yield hit 4.98%, the All Equity REITs index declined 3.4% then posted a total return of 6.5% from Oct. 19–Nov. 3. Over these respective periods, the Russell 1000 declined 0.4% then rose 1.9%; and the Dow Jones U.S. Total Stock Market fell 0.4% then gained 2.0%. The yield on the 10-Year Treasury fell 41 basis points to 4.57% on Nov. 3.

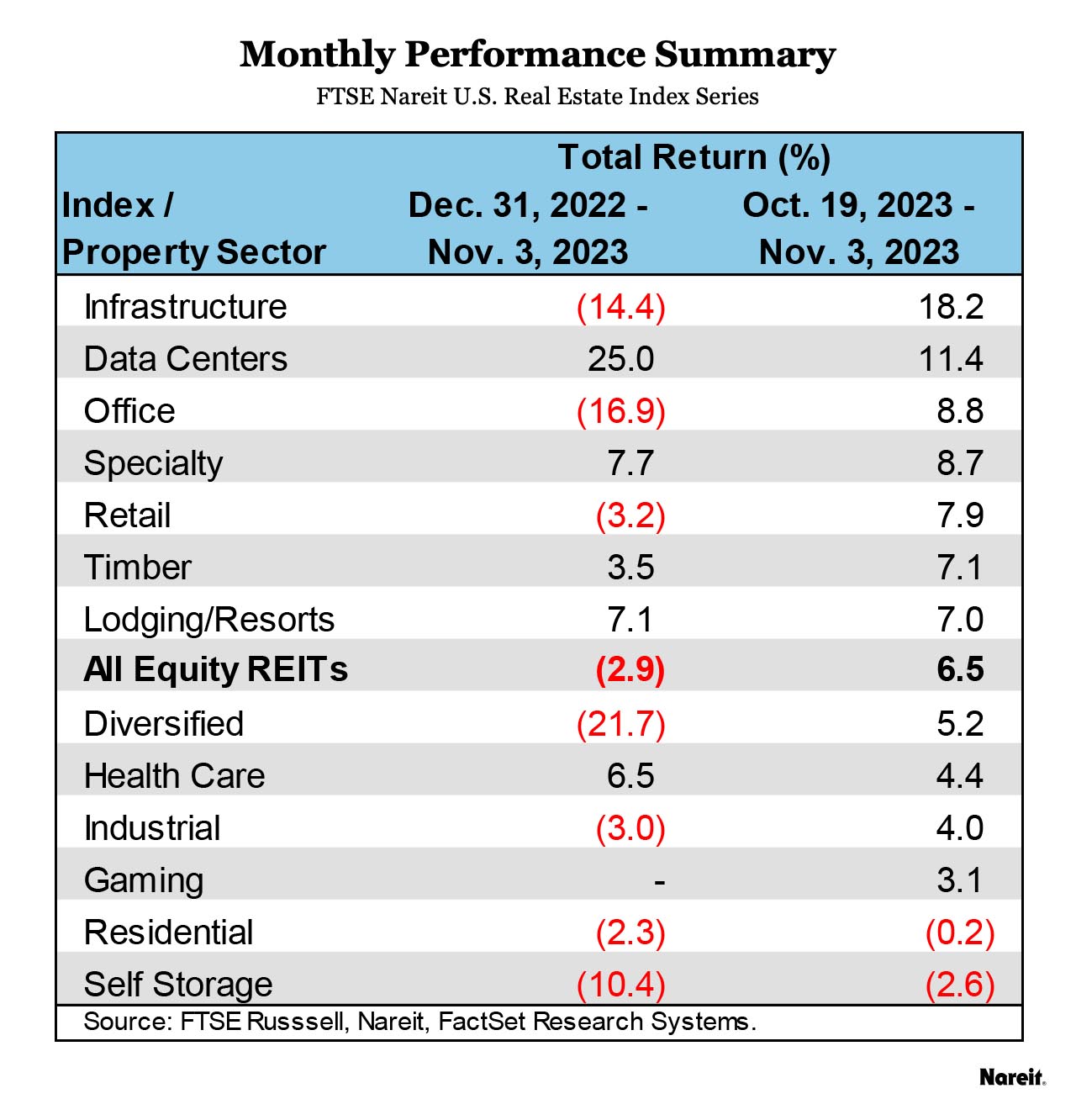

As reflected in the table above, REITs responded positively as Treasury yields declined from Oct. 19–Nov. 3, led by infrastructure, with a total return of 18.2%, followed by data centers at 11.4% and office at 8.8%.

The chart above shows REITs and broad market equities responding positively as the 10-year Treasury declined to 4.57% on Nov. 3, though REITs continue to underperform broader markets on a year-to-date basis. Year-to-date total returns through Nov. 3 were:

- All Equity REITs: -2.9%

- Russell 1000: 14.7%

- Dow Jones U.S. Total Stock Market: 13.9%

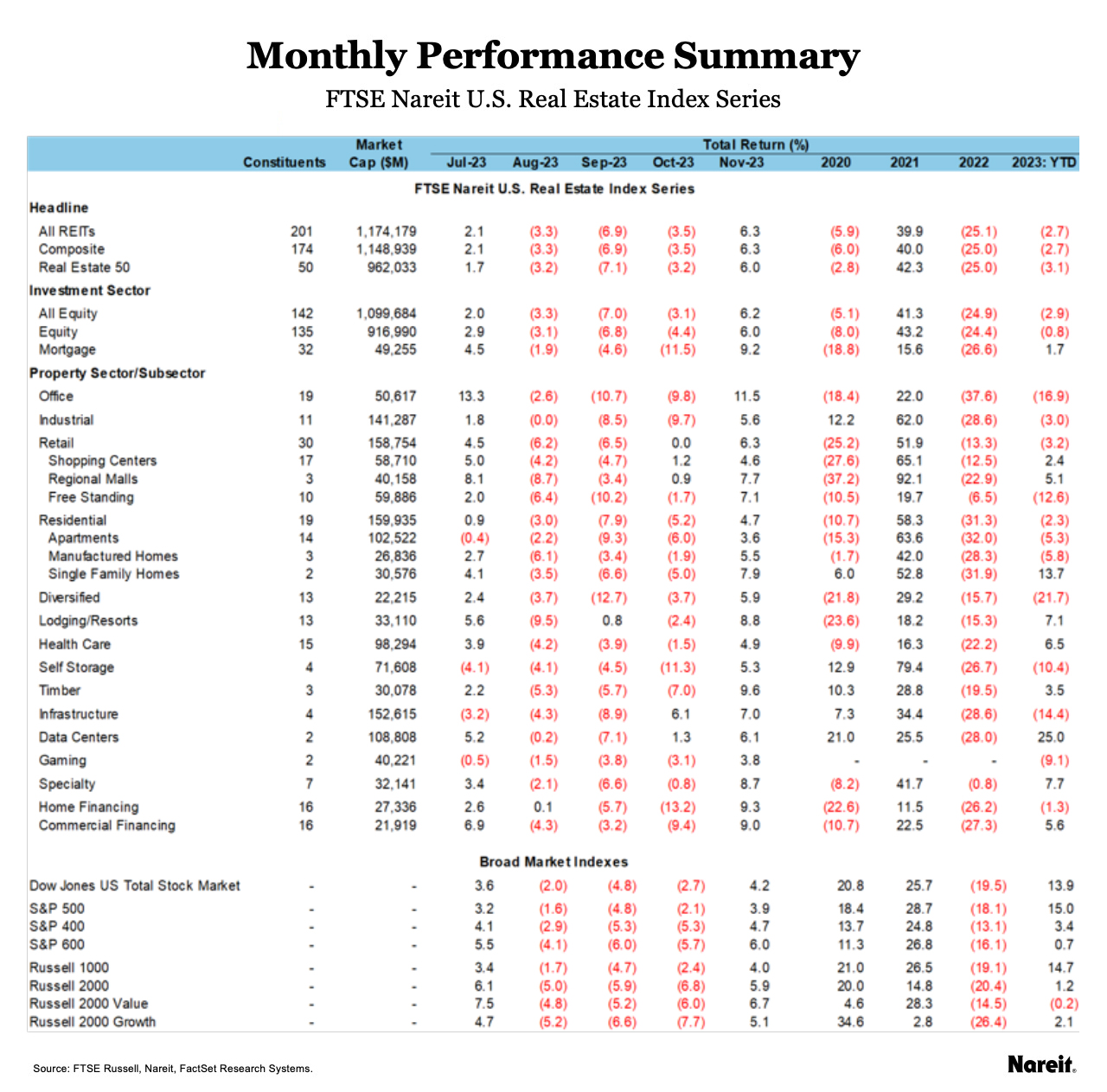

As shown in the table above: the infrastructure sector led in October, with a total return of 6.1%, followed by data centers at 1.3%; while self-storage lagged, down 11.3%, and office fell 9.8%. In the first week of November, office rebounded with a total return of 11.5%, followed by timber at 9.6%. On a year-to-date basis through Nov. 3, data centers are up 25.0%, specialty is up 7.7%, and lodging/resorts is up 7.1%. Over this same period diversified has declined 21.7% and office is down 16.9%.

The FTSE Nareit Mortgage REITs Index fell 11.5% in October before rebounding 9.2% in the first week of November. On a year-to-date basis, mREITs are up 1.7%. Commercial financing mREITs fell 9.4% for the month, and home financing mREITs declined 13.2%. In the first week of November, home financing rose 9.3% and commercial financing rose 9.3%. On a year-to-date basis, the commercial financing sector is up 5.6% and home financing has declined 1.3%.