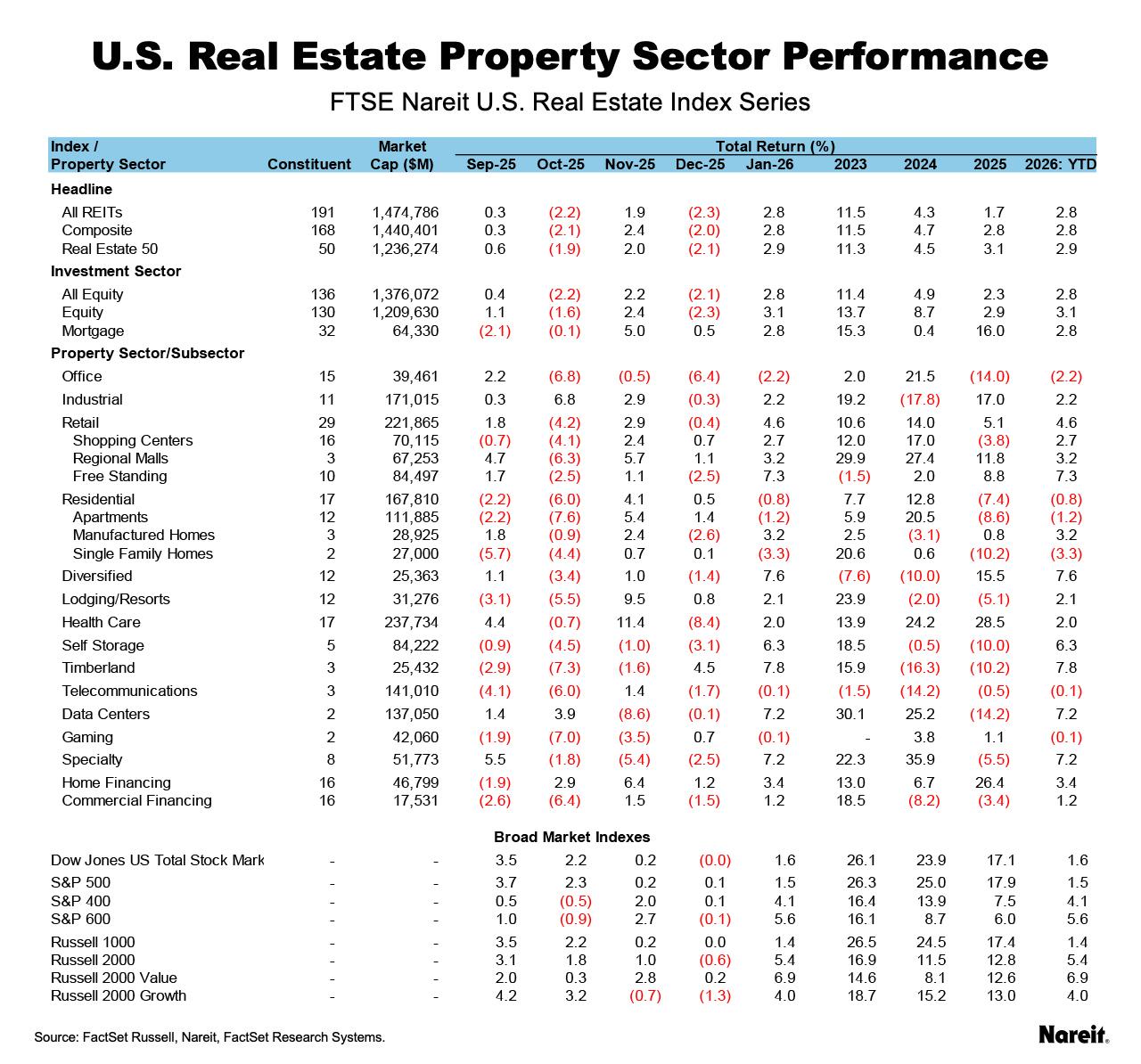

REITs outperformed large-cap equities and the broader stock market in January, with the FTSE Nareit All Equity REITs Index posting a total return of 2.8%. The Dow Jones U.S. Total Stock Market rose 1.6% in January, while the Russell 1000 posted a total return of 1.4%; small-caps significantly outperformed as the Russell 2000 posted a gain of 7.0%. Market sentiment was influenced by the Federal Reserve’s first policy meeting of the year on Jan. 28, where officials voted to keep the target federal funds rate steady.

The yield on the 10-year Treasury rose 8 basis points during the month to finish at 4.26%, up from 4.18% at year-end. As of Jan. 31, the dividend yield on the FTSE Nareit All Equity REITs index was 3.98% and the FTSE Nareit Mortgage REITs Index yielded 11.97%, compared to 1.09% for the S&P 500.

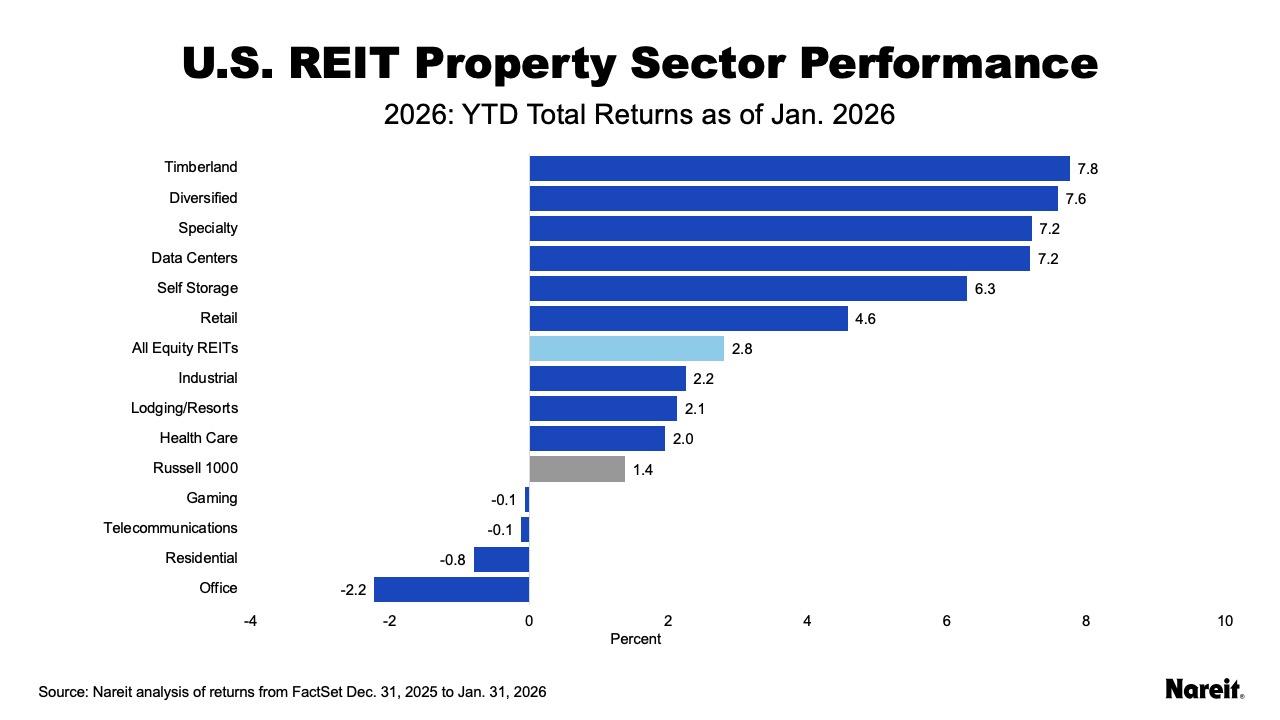

As shown in the chart above, timberland led at the start of the year, posting a total return of 7.8%.

January was a broadly strong month for REITs. As shown in the table above, timberland, diversified, specialty, and data centers began the year leading with respective total returns of 7.8%, 7.6%, 7.2%, and 7.2%. The office sector lagged during the month, falling 2.2%, followed by residential with a narrow loss of 0.8%.

At the subsector level, free standing retail posted a gain of 7.3% in January, followed by regional malls at 3.2%, and manufactured homes also climbing 3.2%.

The FTSE Nareit Mortgage REITs Index rose 2.8% in the first month of the year, equaling the returns of equity REITs. Home financing rose 3.4% for the month, while commercial financing returned 1.2%.