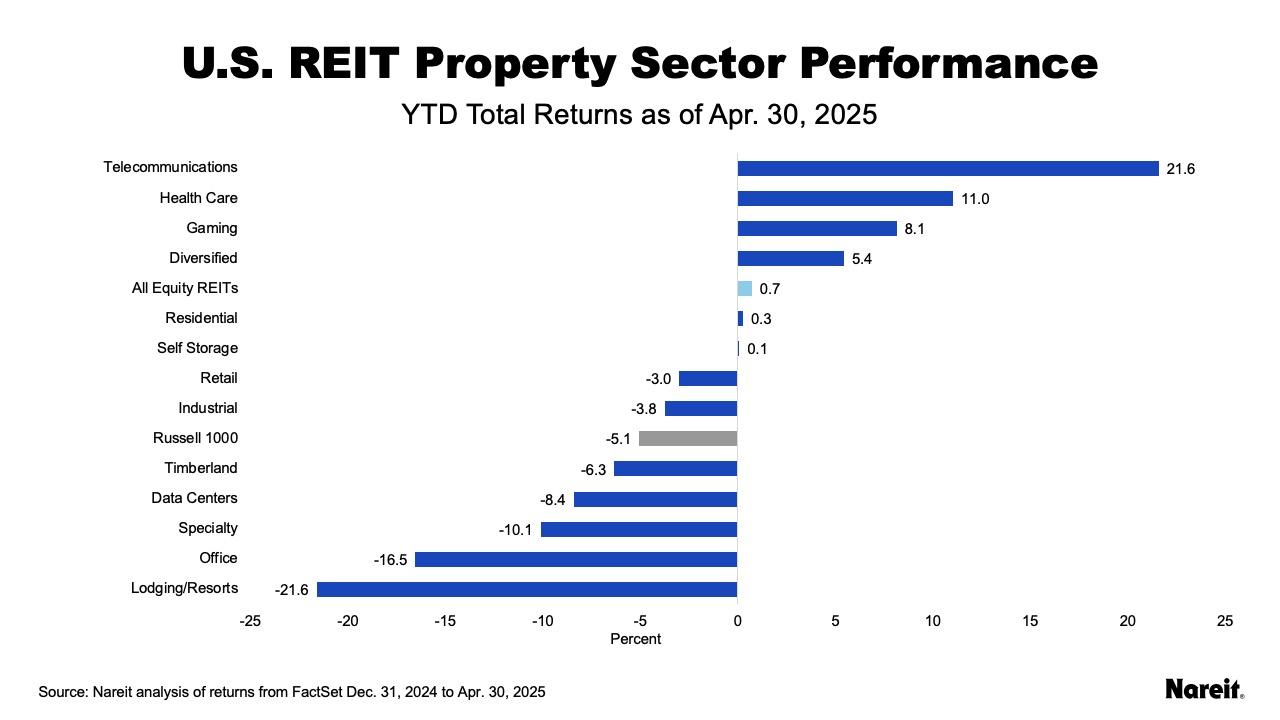

The FTSE Nareit All Equity REITs Index declined in a volatile April, bouncing back from a low of -11.9% on April 8 to end the month down 2.0%. REITs continue to lead the broader stock market on a year-to-date basis with a total return of 0.7% compared to -5.1% for the Russell 1000.

Stocks fell in April as well, with the Russell 1000 declining 0.6% and the Dow Jones U.S. Total Stock Market falling 0.7% as disputes over global trade policies and uncertainty over future economic growth generated volatile market conditions.

The yield on the 10-year Treasury declined from 4.21% on March 31 to end the month at 4.15%. As of April 30 the dividend yield on the FTSE Nareit All Equity REITs index was 4.06% and the FTSE Nareit Mortgage REITs Index yielded 12.93%, compared to 1.32% for the S&P 500.

As shown in the chart above, telecommunications continues to lead, returning 21.6% for the year, followed by health care at 11.0%, and gaming at 8.1%.

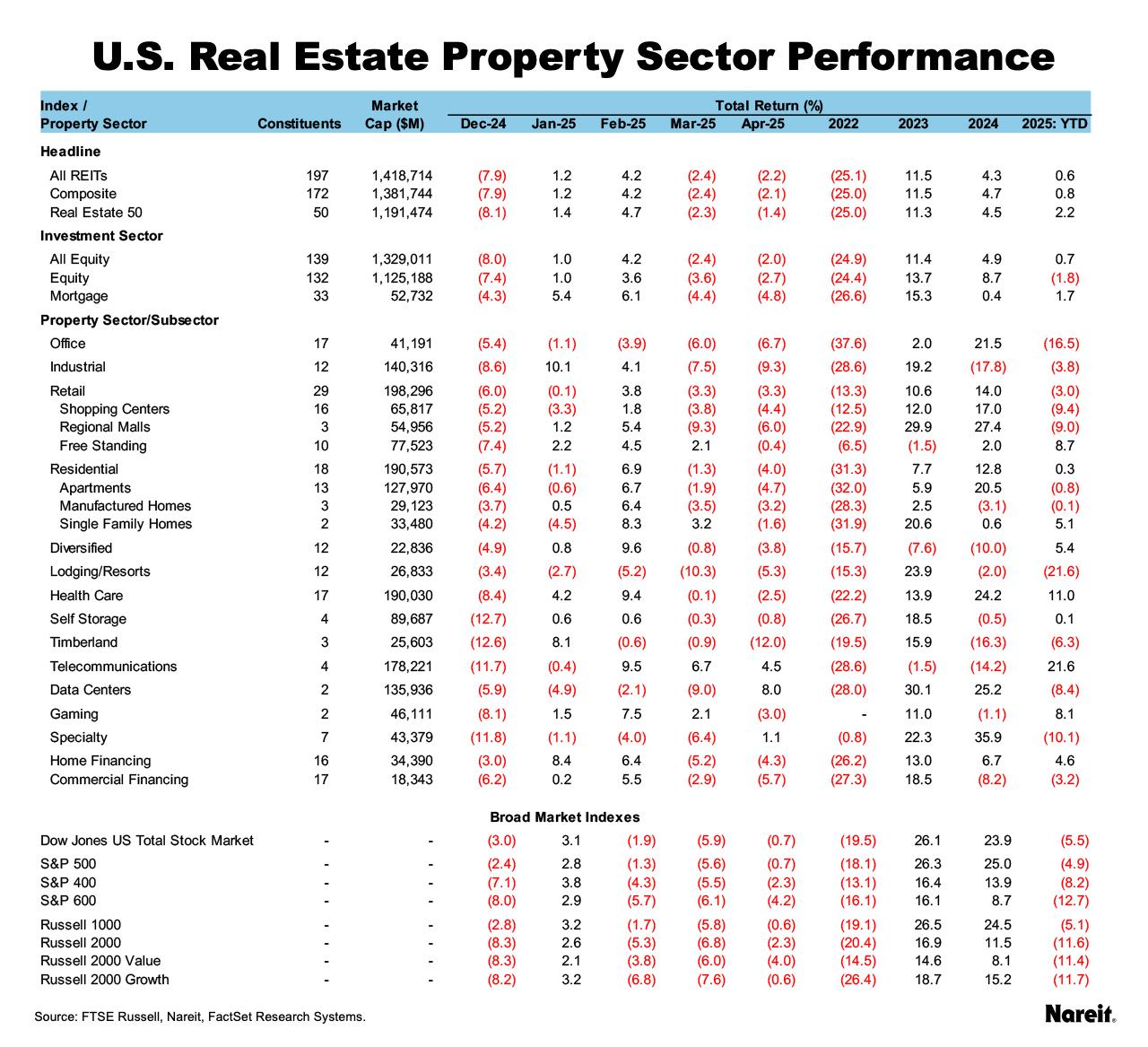

As reflected in the table above, data centers, telecommunications, and specialty led at the property sector level in April. Timberland, industrial, and office lagged during the month.

The FTSE Nareit Mortgage REITs Index fell 4.8% in April, with both home financing and commercial financing posting steeper declines than REITs overall.