The FTSE Nareit All Equity REITs Index rose 1.8% in March. Broader equity markets continued to outperform, as the Russell 1000 and Dow Jones U.S. Total Stock Market each rose 3.2%. Market expectations of rate cuts have moderated as many investors expect fewer cuts than at the beginning of the year as inflation measures remain higher than the Federal Reserve’s target range.

As of March 28, the dividend yield for the FTSE Nareit All Equity REITs Index was 4.06% and the FTSE Nareit Mortgage REITs Index yielded 12.18%, compared to 1.3% for the S&P 500. The 10-Year Treasury yielded 4.24% at the end of March, rising 32 basis points since the end of 2023.

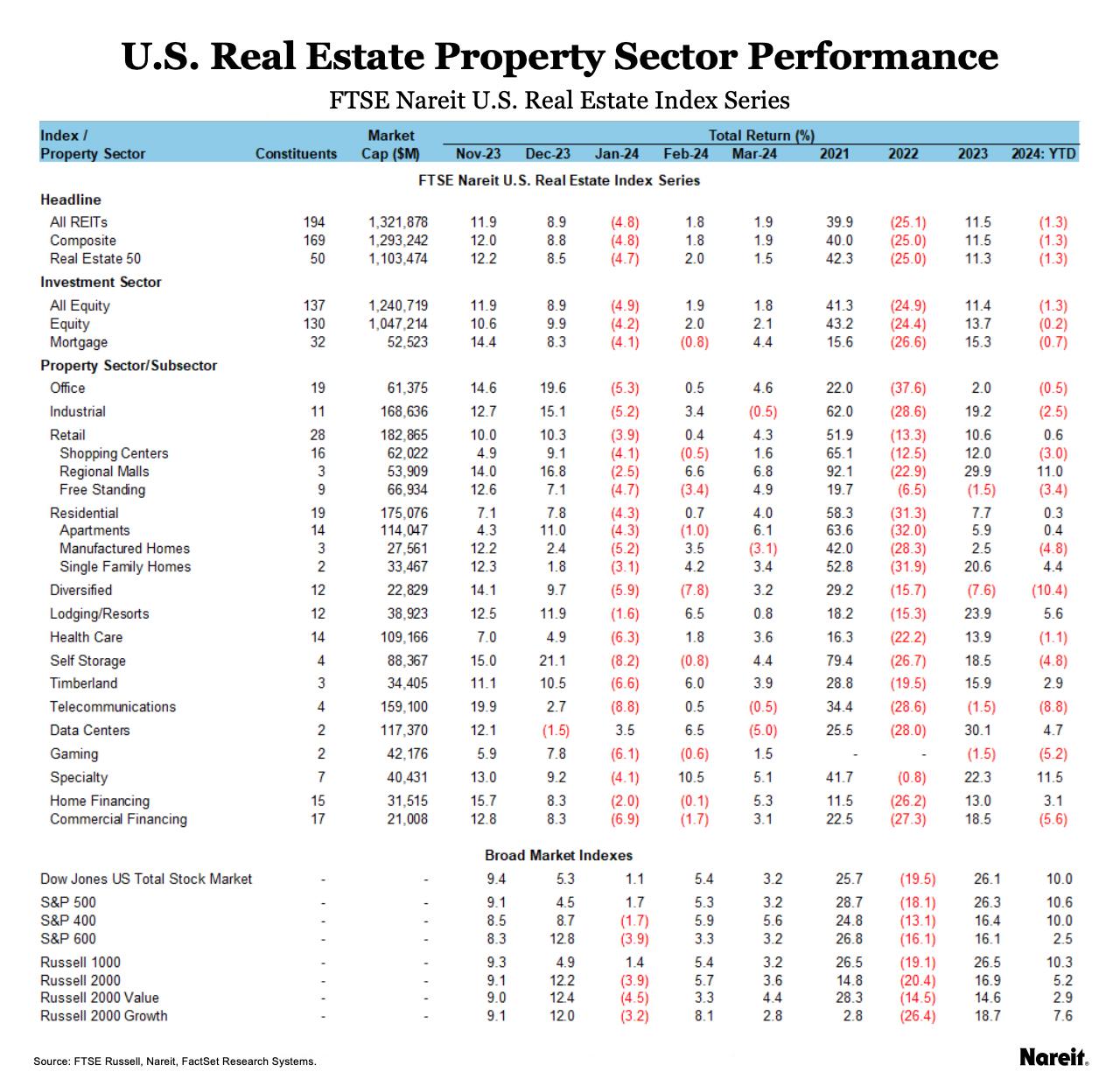

As shown in the above table, since Oct. 19, 2023, the FTSE Nareit All Equity REITs Index is down 1.3% year-to-date in 2024, but has returned 20.5% since mid-October 2023. The Dow Jones U.S. Total Stock Market rose 24.2% and the Russell 1000 is up 24.0% over this timeframe. Year-to-date, the Russell 1000 is up 10.3% and the Dow Jones U.S. Total Stock Market has returned 10.0%.

In March, specialty led all property sectors with a return of 5.1% followed by office at 4.6%, and selfstorage at 4.4%. At the subsector level, regional malls returned 6.8% and apartments rose 6.1%. Data centers took a breather from their recent outperformance, declining 5.0%, followed by industrial and telecommunications, which both declined 0.5%.

The FTSE Nareit Mortgage REITs Index climbed 4.4% in March and is down 0.4%, year-to-date. Home financing mREITs rose 5.3% for the month while commercial financing mREITs were up 3.1%.