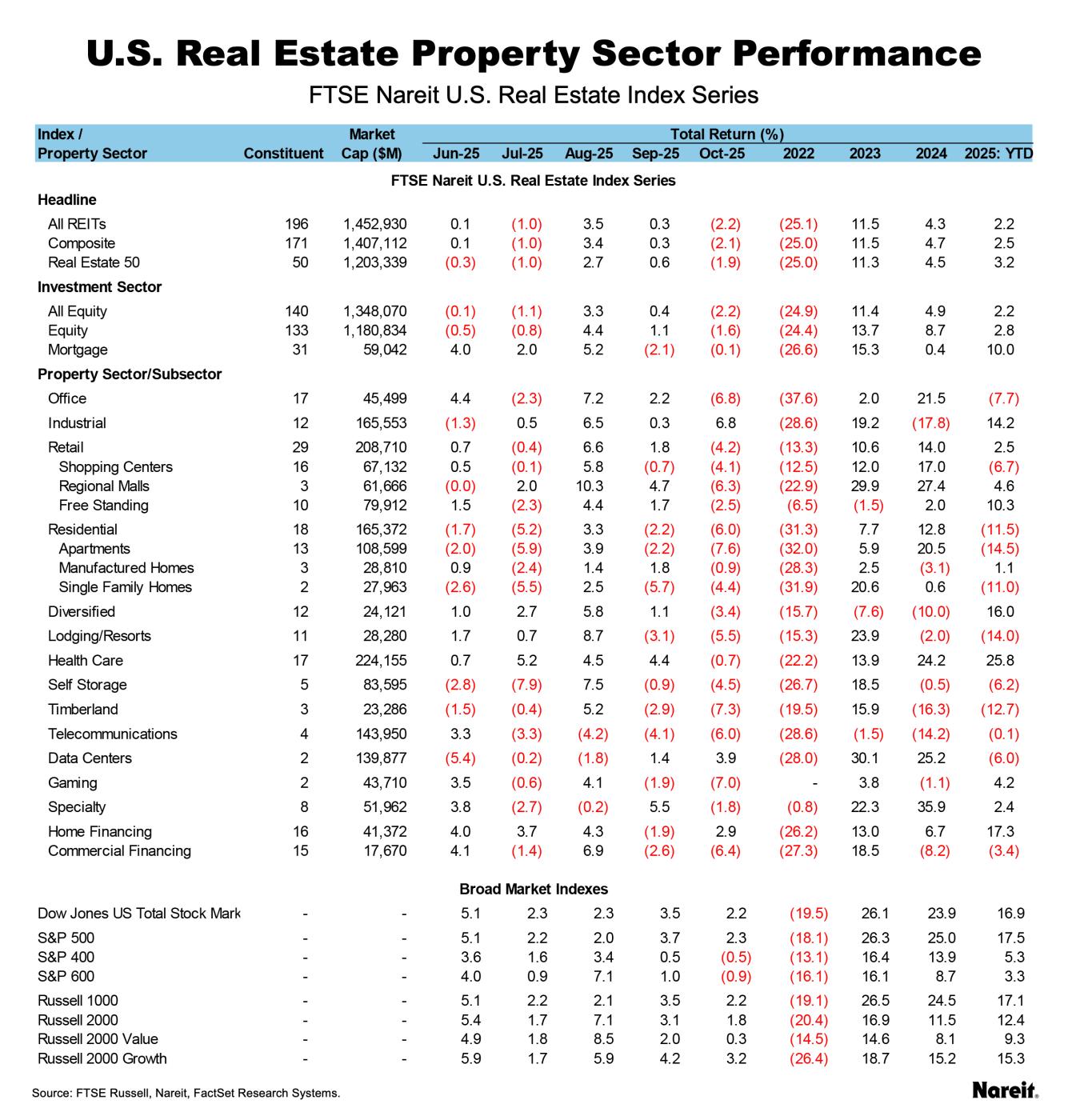

The FTSE Nareit All Equity REITs Index fell 2.2% in October, with most of the losses concentrated at month-end, as markets responded to company news about earnings risks and the possibility that the Federal Reserve will not be lowering rates any further for the time being.

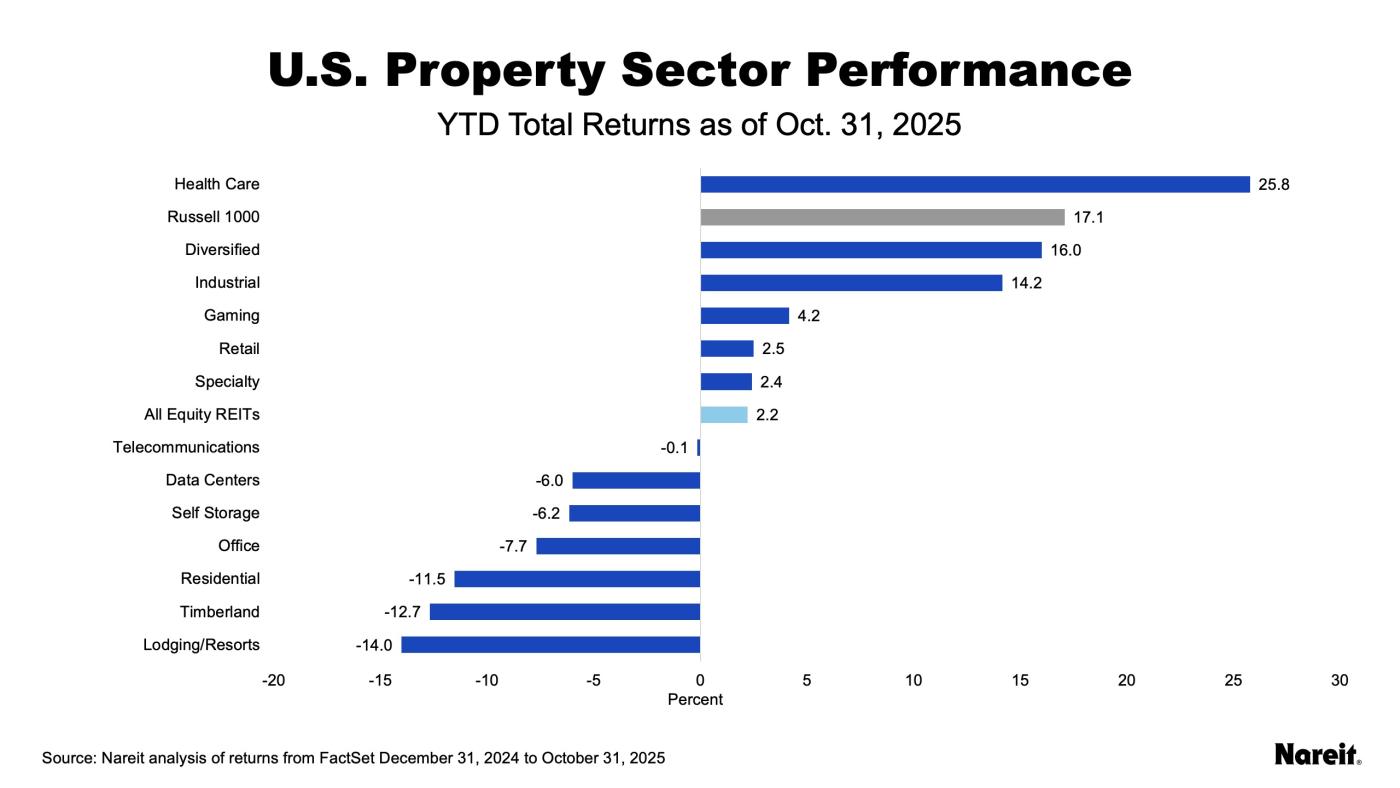

The Dow Jones U.S. Total Stock Market and the Russell 1000 both rose 2.2% in October as mega-cap equities largely continued to outperform. On a year-to-date basis, the All Equity REITs index is up 2.2%, while the Russell 1000 is up 17.1%, and the Dow Jones U.S. Total Stock Market is up 16.9%.

The yield on the 10-year Treasury declined 6 basis points to close the month at 4.09%. As of Oct. 31, the dividend yield on the All Equity REITs index was 4.00% and the FTSE Nareit Mortgage REITs Index yielded 12.75%, compared to 1.09% for the S&P 500.

As shown in the chart above, health care continues to lead with a year-to-date total return of 25.8%, followed by diversified at 16.0%, and industrial at 14.2%.

As reflected in the table above, industrial and data centers led with total returns of 6.8% and 3.9% respectively in October, while timberland, gaming, and office lagged.

The Mortgage REITs index declined 0.1% in October, and has posted a year-to-date total return of 10.0%. Home financing rose 2.9% and commercial financing fell 6.4% during the month. On a year-to-date basis, home financing is up 17.3% and commercial financing has declined 3.4%.