The FTSE Nareit All Equity REITs Index rose 0.4% in September as the Federal Reserve, noting the softening labor market, cut the federal funds rate by 25 basis points. Investors had largely expected the move. While some investors consider rates to still be too restrictive, the pace and timing of further rate cuts will continue to be data-dependent, a situation that could be complicated by the shutdown of the federal government.

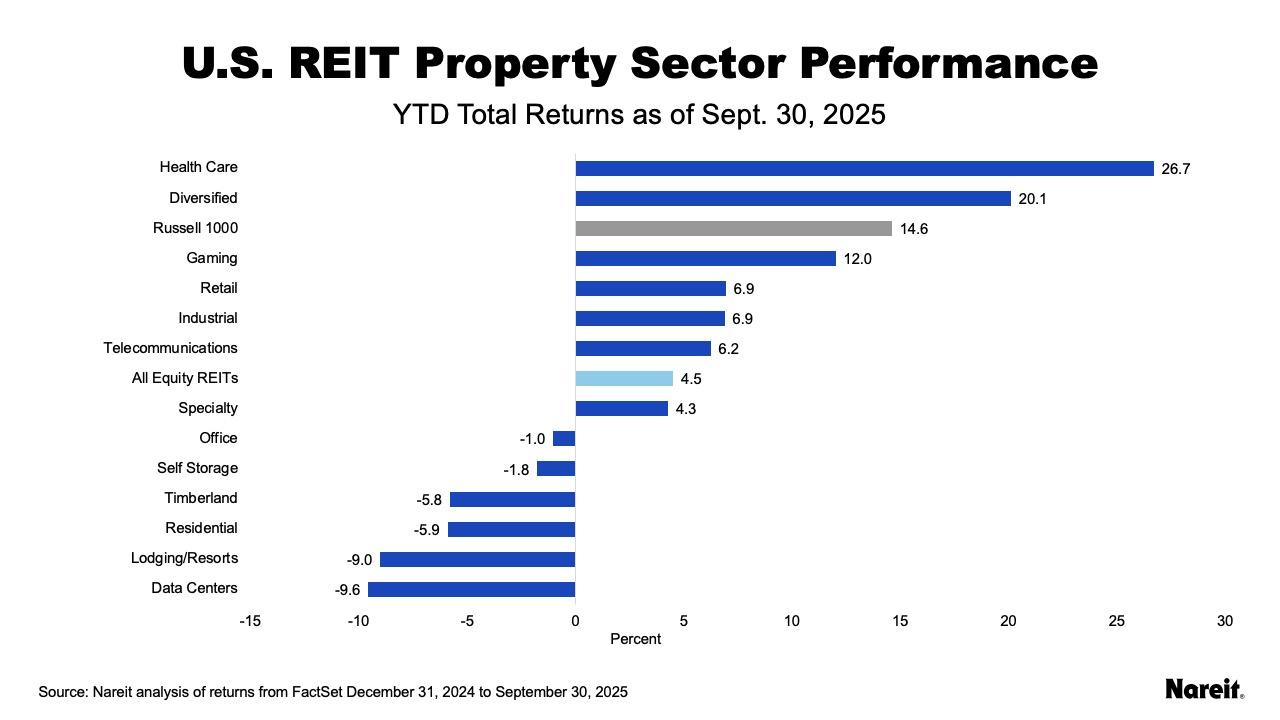

The broader stock market responded more positively than REITs in September, as the Dow Jones U.S. Total Stock Market and the Russell 1000 both rose 3.5% for the month. On a year-to-date basis, the All Equity REITs index is up 4.5%, while the Russell 1000 is up 14.6% and the Dow Jones U.S. Total Stock Market is up 14.4%.

The yield on the 10-year Treasury declined 7 basis points to close the month at 4.15%. As of Sept. 30, the dividend yield on the All Equity REITs index was 3.88% and the FTSE Nareit Mortgage REITs Index yielded 12.68%, compared to 1.11% for the S&P 500.

As shown in the chart above, health care continues to outpace all other sectors on a year-to-date basis with a total return of 26.7%, followed by diversified at 20.1%, and gaming at 12.0%.

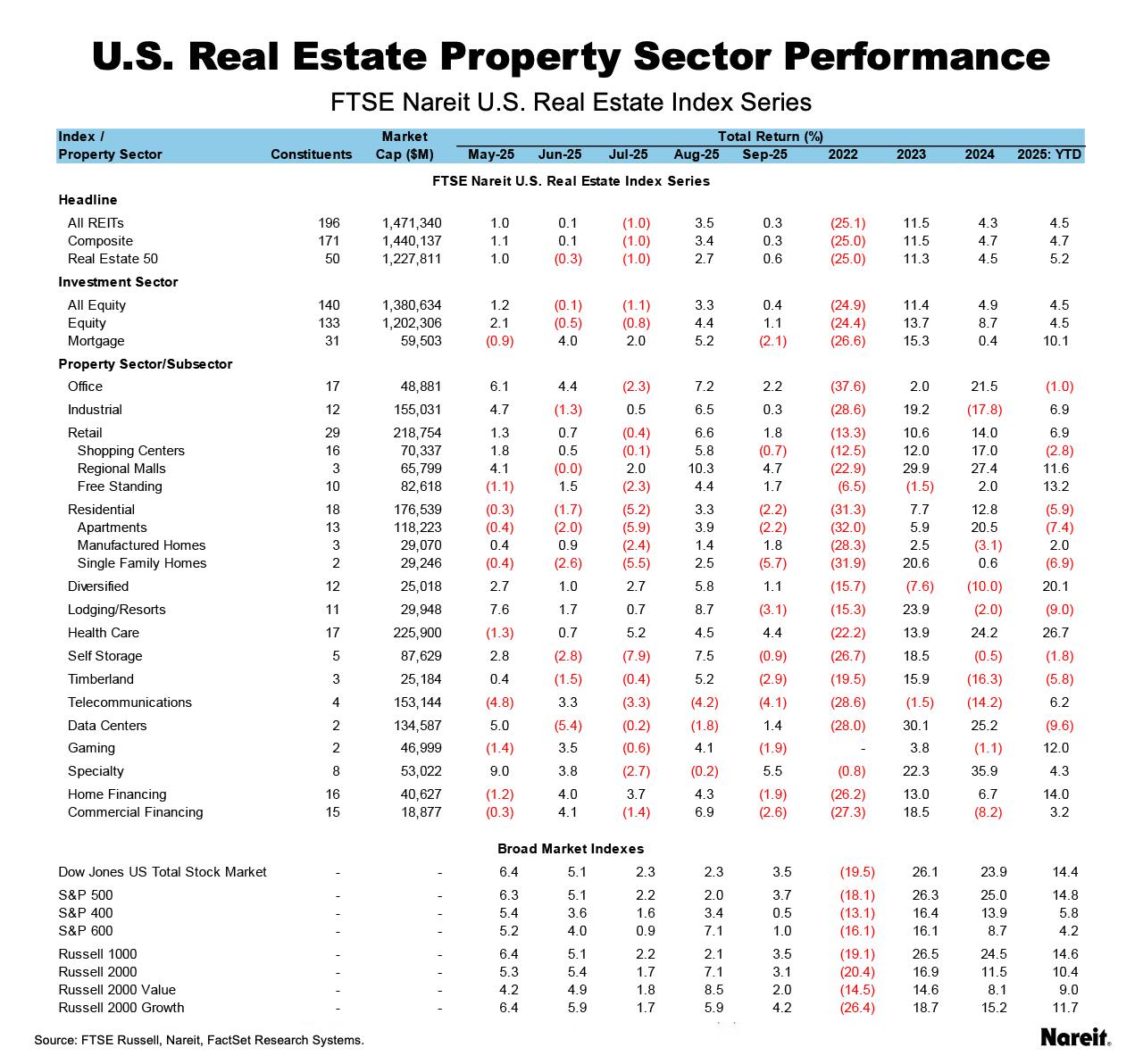

As reflected in the table above, specialty, health care, and office led in September, while telecommunications, lodging/resorts, and timberland lagged.

The Mortgage REITs index declined 2.1% in September, while gaining 10.1% year-to-date. Home financing declined 1.9% and commercial financing fell 2.6% during the month. For the year, home financing is up 14.0% and commercial financing is up 3.2%.