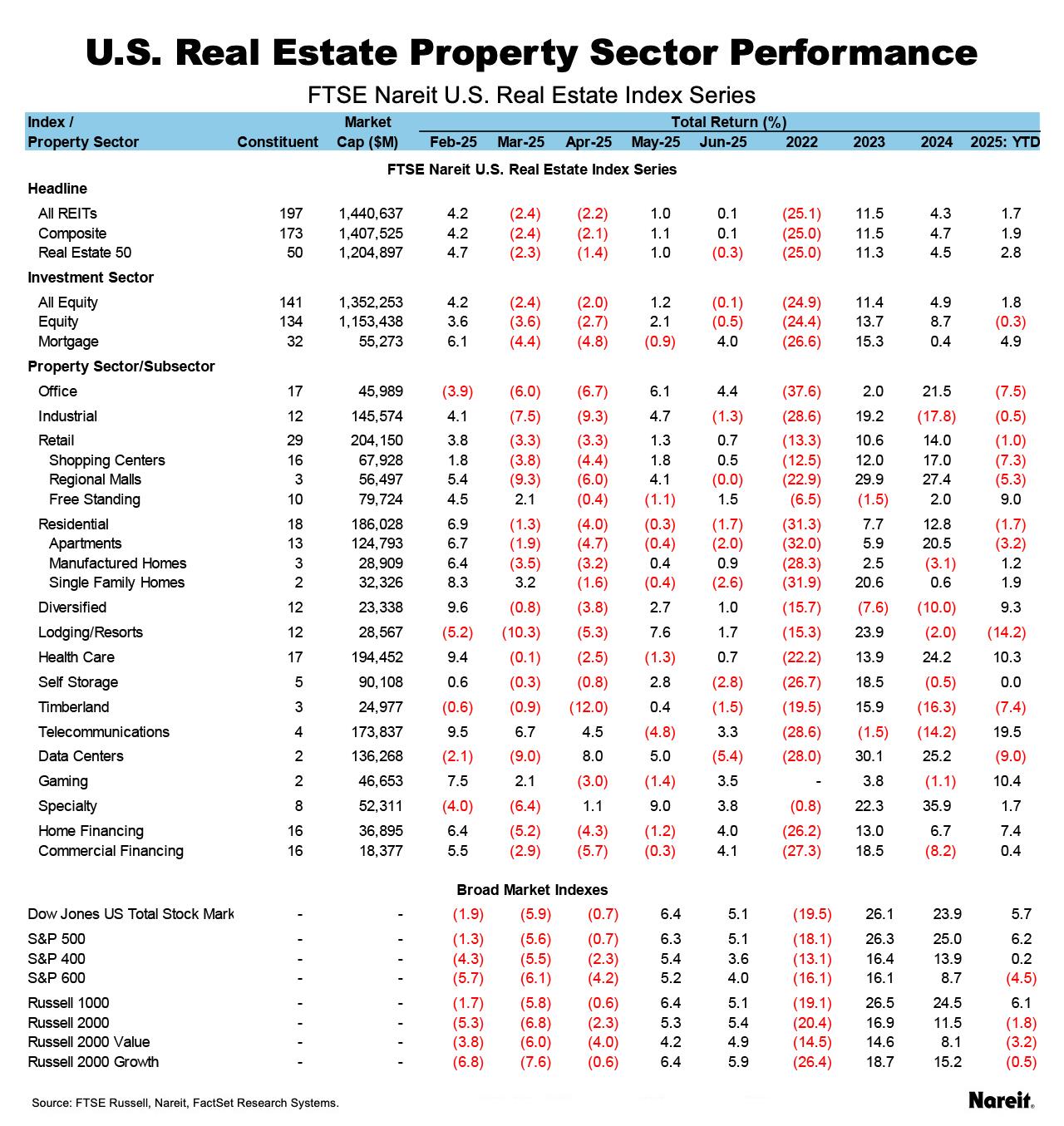

The FTSE Nareit All Equity REITs Index was essentially flat in June, posting a narrow loss of 0.1% and underperforming the broader stock market for the month. While all equities have bounced back in response to the cooling of recent tariff disputes, non-REIT stocks have responded more positively with mega-cap equities regaining upward momentum.

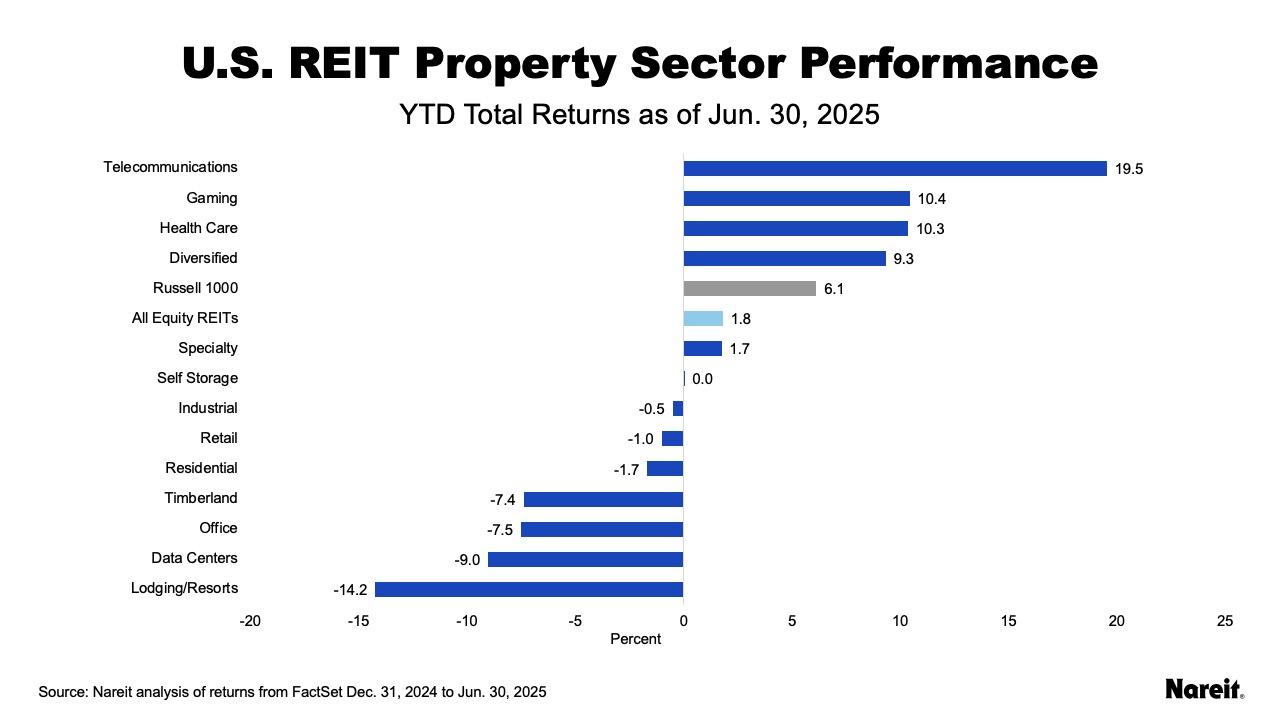

The Russell 1000 and Dow Jones U.S. Total Stock Market REITs both gained 5.1% in June. On a year-to-date basis the All Equity REITs index remains in positive territory with a total return of 1.8%, while the Russell 1000 has returned 6.1% and the Dow Jones U.S. Total Stock Market has climbed 5.7%.

The yield on the 10-year Treasury declined 16 basis points to close the month at 4.23%. As of June 30, the dividend yield on the FTSE Nareit All Equity REITs index was 3.95% and the FTSE Nareit Mortgage REITs Index yielded 12.85%, compared to 1.20% for the S&P 500.

As shown in the chart above, telecommunications continues to lead on a year-to-date basis with a total return of 19.5%, followed by gaming at 10.4%, and health care at 10.3%.

As reflected in the table above, of the Equity REIT property sectors, office, specialty, and gaming led in June, while data centers, self-storage, and residential lagged.

The FTSE Nareit Mortgage REITs Index rose 4.0% in June with commercial financing gaining 4.1% and home financing climbing 4.0%. For the year, home financing is up 7.4% and commercial financing is up 0.4%.