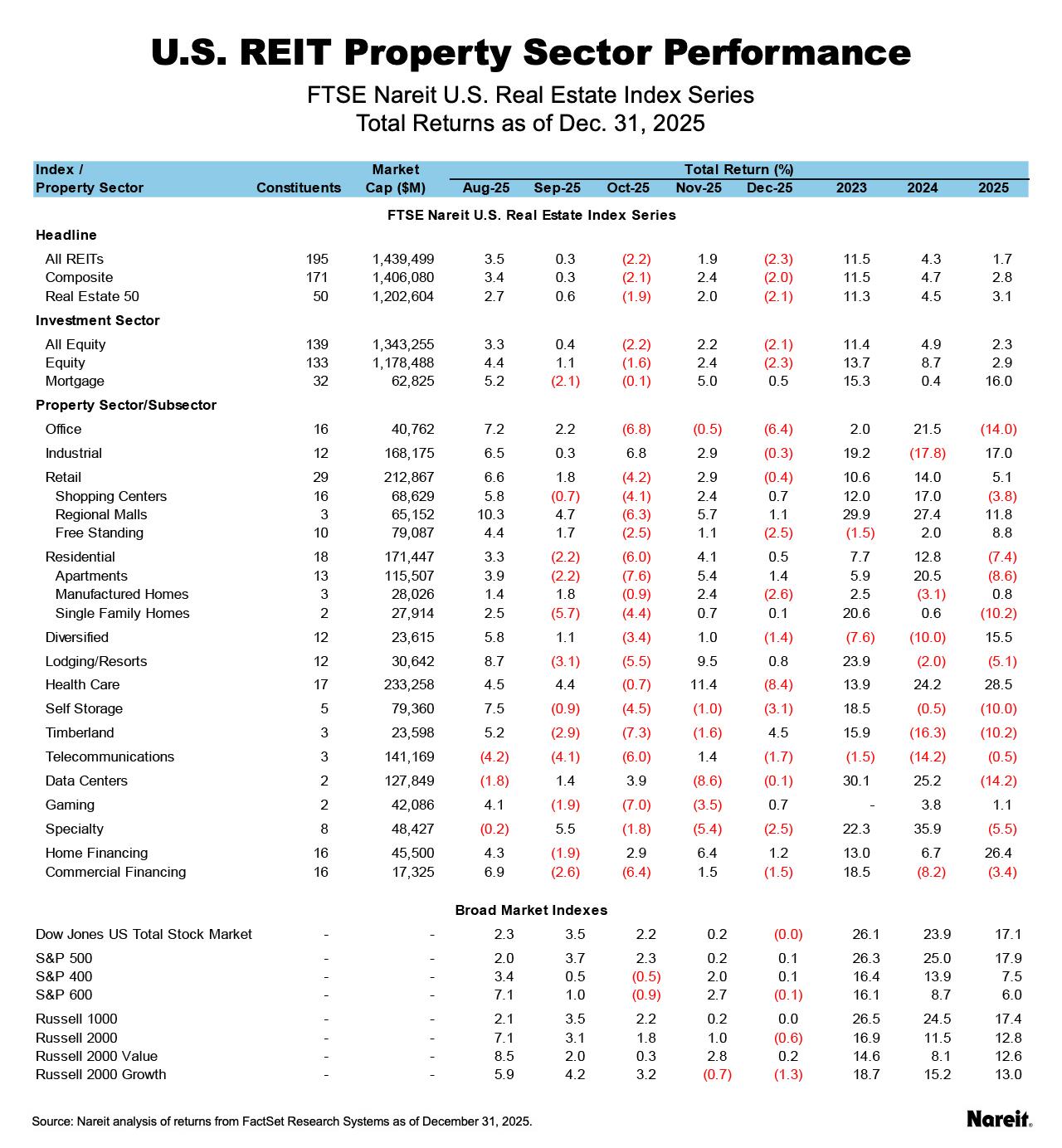

REITs ended 2025 on a muted note, as the FTSE Nareit All Equity REITs Index fell 2.1% in December, finishing the year with a total return of 2.3%. The FTSE Nareit Mortgage REITs Index rose 16.0% for the year, led by the home financing sector with a total return of 26.4%. The Russell 1000 and Dow Jones U.S. Total Stock Market were flat in December, but returned respective returns of 17.4% and 17.1% for the year. Resilient economic data and sustained optimism around artificial intelligence drove broader markets in 2025, though concerns about a softening labor market emerged towards the end of the year.

The yield on the 10-year Treasury rose 16 basis points in December to end the year at 4.18%. As of Dec. 31, the dividend yield on the FTSE Nareit All Equity REITs index was 4.07% and the FTSE Nareit Mortgage REITs Index yielded 12.24%, compared to 1.10% for the S&P 500.

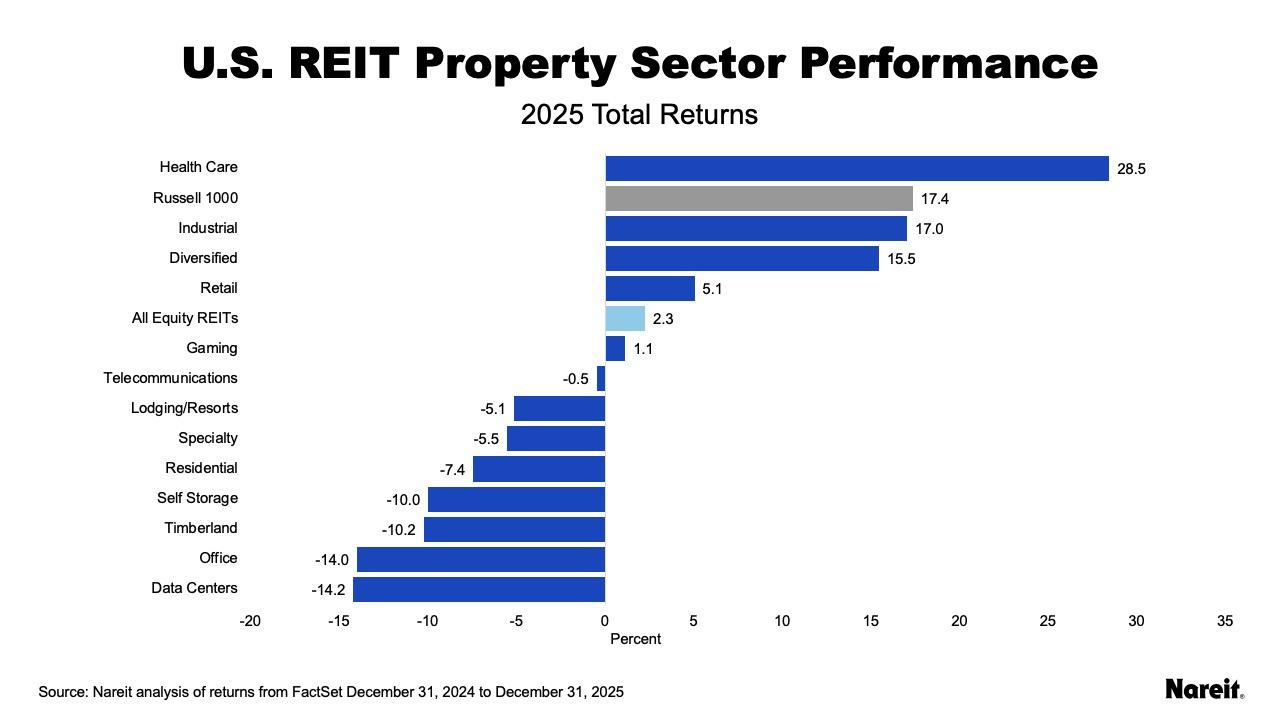

As shown in the table above, health care ended the year with a total return of 28.5%, followed by industrial at 17.0%, and diversified at 15.5%

December was a mixed month for REITs, as timberland, lodging/resorts, and gaming led with total returns of 4.5%, 0.8%, and 0.7%, respectively. The health care sector lagged in December, falling 8.4%, followed by office dropping 6.4%, and self-storage, which declined 3.1%.

At the subsector level, apartments posted a gain of 1.4% in December, followed by regional malls with a total return of 1.1%, and shopping centers rising 0.7%.

The FTSE Nareit Mortgage REITs Index rose 0.5% in December and outperformed equity REITs for the year, with a total return of 16.0%. Home financing rose 1.2% for the month and posted a total return of 26.4% for the year, while commercial financing declined 1.5% in December and was down 3.4% for the year.