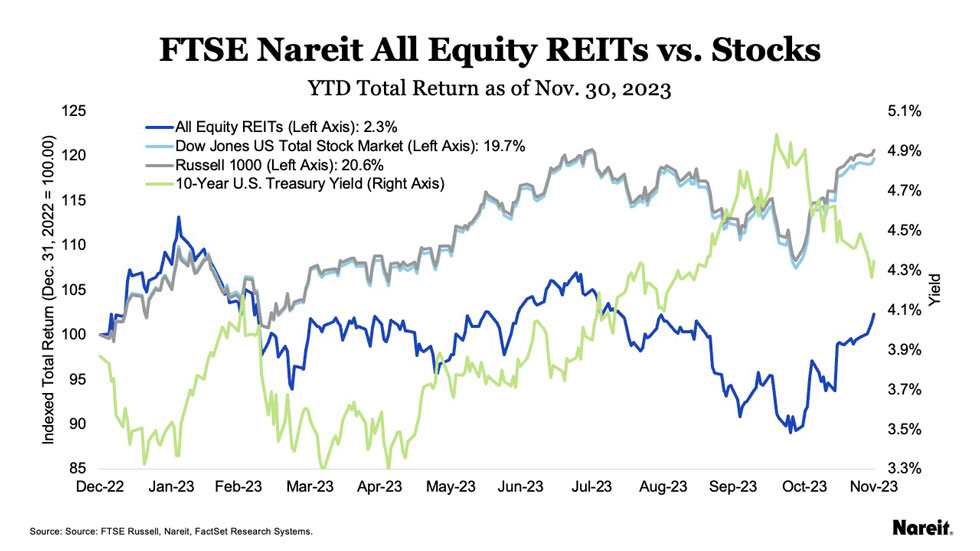

The FTSE Nareit All Equity REITs Index rose 11.9% in November as the yield on the 10-Year Treasury declined from its peak on Oct. 19. Broader markets were positive as well as the Dow Jones U.S. Total Stock Market rose 9.4% and the Russell 1000 rose 9.3%. Investors increasingly believe that the period of monetary policy tightening may have ended, and some speculate that the first rate cuts could come in as soon as the first half of 2024. In Nareit’s year-end outlook , we highlight that the impressive performance of REITs during late October and November may be a signal that, as in previous periods of monetary policy adjustments, the end of the rate-rising cycle will herald a period of REIT outperformance.

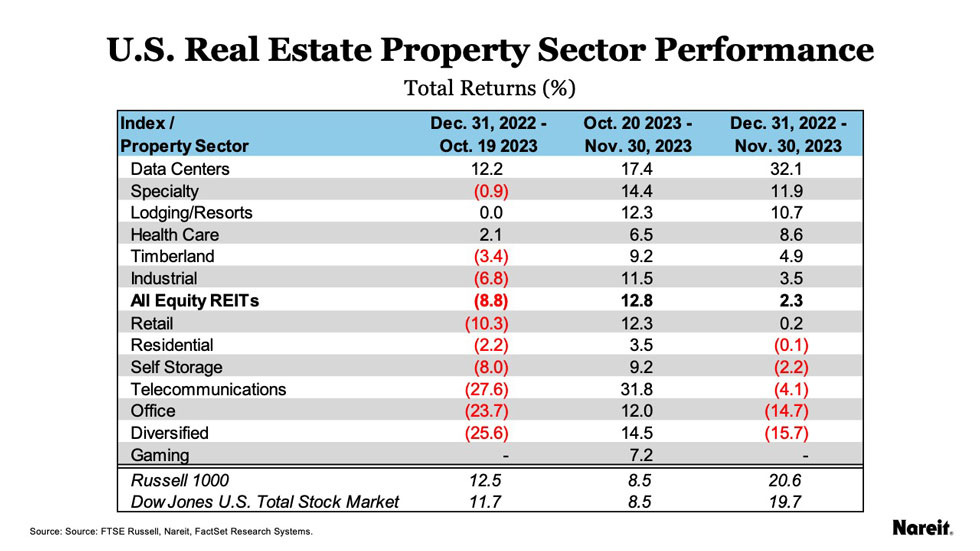

On a year-to-date basis as of Oct. 19, when the 10-Year Treasury yield hit 4.98%, the All Equity REITs index declined 8.8%. From Oct. 20–Nov. 30, All Equity REITs rose 12.8%. On a year-to-date basis as of Nov. 30, the index posted a total return of 2.3%, while the Russell 1000 is up 20.6% and the Dow Jones U.S. Total Stock Market is up 19.7%. The yield on the 10-Year Treasury closed November at 4.35%.

As reflected in table 1, REITs responded positively as Treasury yields declined from Oct. 20–Nov. 30, led by telecommunications, with a total return of 31.8%, data centers at 17.4% and diversified at 14.5%.

REITs and broad market equities responded positively as the 10-year Treasury declined to 4.35% on Nov. 30, as shown in the chart above. REITs are underperforming broader markets on a year-to-date basis, though have responded more positively to declining Treasury yields. Year-to-date total returns through Nov. 30 were:

- All Equity REITs: 2.3%

- Russell 1000: 20.6%

- Dow Jones U.S. Total Stock Market: 19.7%

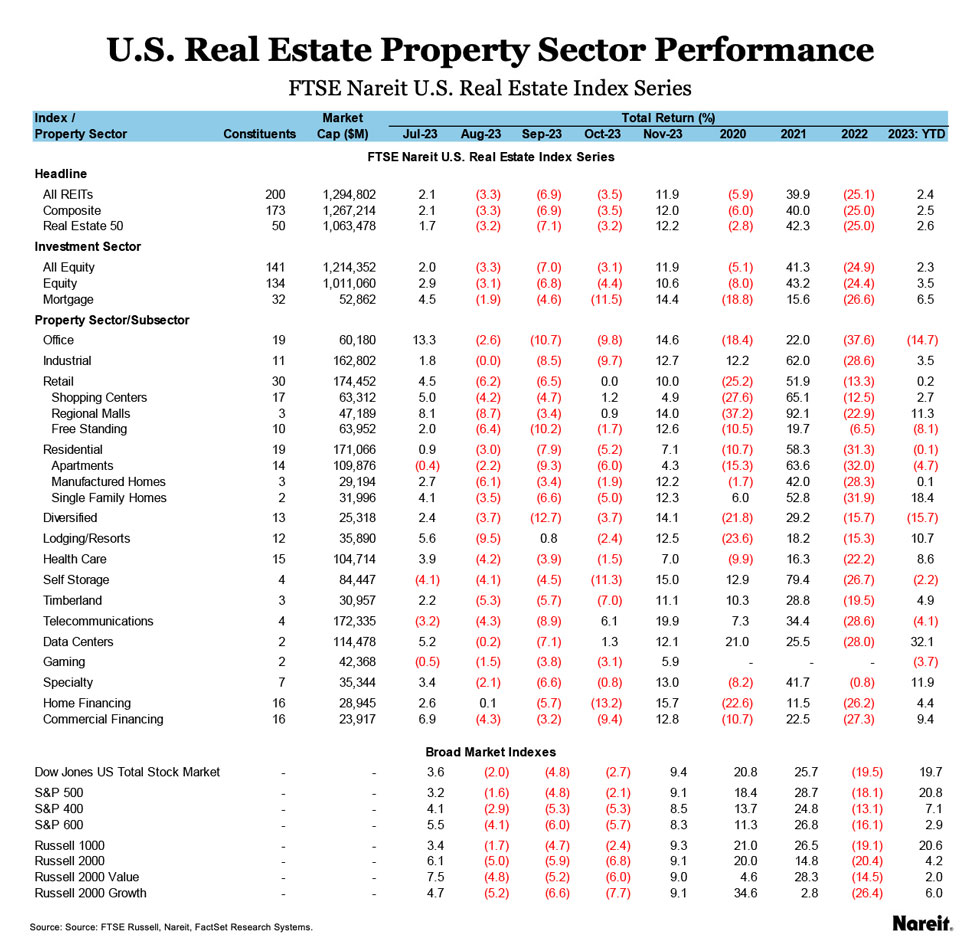

As shown in the table above, the rally was broad and inclusive in November, as telecommunications led with a total return of 19.9%, followed by self-storage at 15.0%, and office at 14.6%. On a year-to-date basis through Nov. 30, the data centers sector leads with a return of 32.1%, specialty is up 11.9%, and lodging/resorts is up 10.7. Over this same period, diversified, which has notable exposure to office properties, is down 15.7% and office has declined 14.7%.

The FTSE Nareit Mortgage REITs Index also performed well in November with a total return of 14.4%. On a year-to-date basis, mREITs are up 6.5%. Home financing mREITs rose 15.7% for the month, while commercial financing mREITs rose 12.8%. On a year-to-date basis, the commercial financing sector is up 9.4% and home financing is up 4.4%.