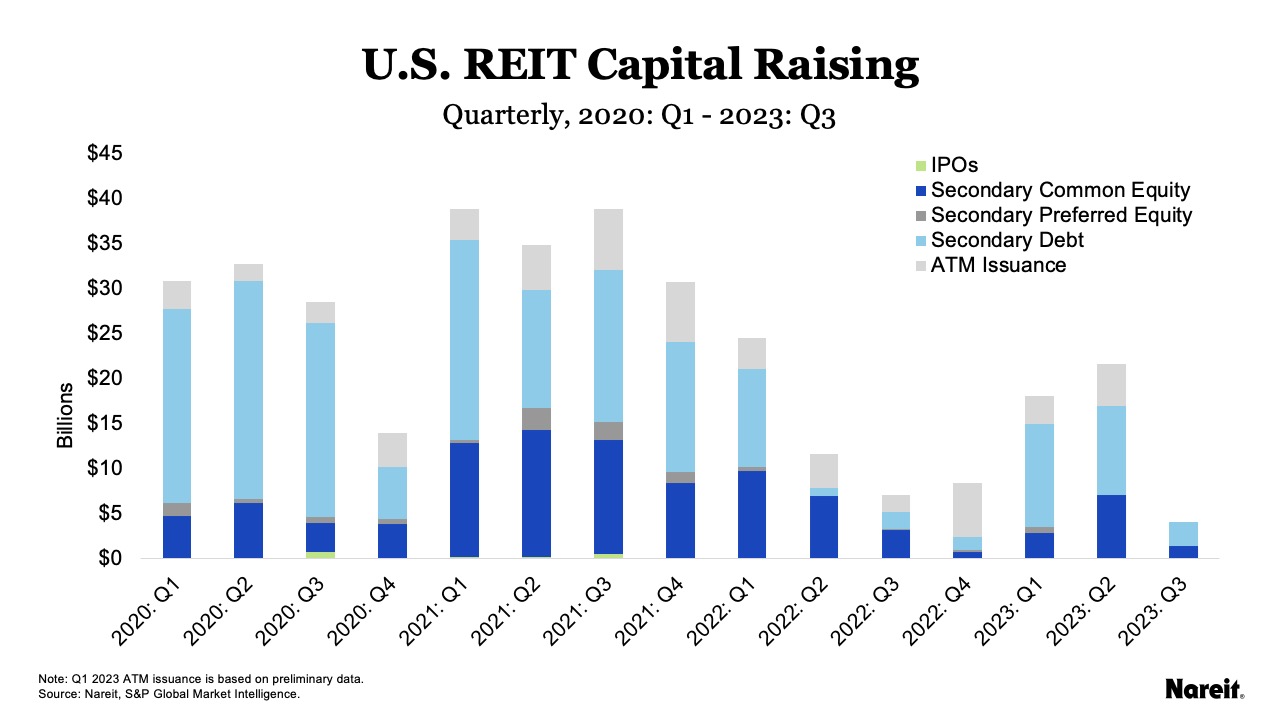

U.S. REITs raised $4.1 billion from secondary debt and equity offerings in the third quarter of 2023, though this preliminary total will be revised upward when ATM program usage data become available. $2.7 billion came from secondary debt and $1.4 billion came from secondary common equity offerings. The total capital raised represents an 81% decrease from the prior quarter, when REITs raised $21.7 billion. On a year-to-date basis, REITs have raised $43.8 billion, which compares to $39.1 billion last year through the third quarter (excluding third quarter 2022 ATM issuance for comparability). Nareit’s historical capital offerings summary can be found here.

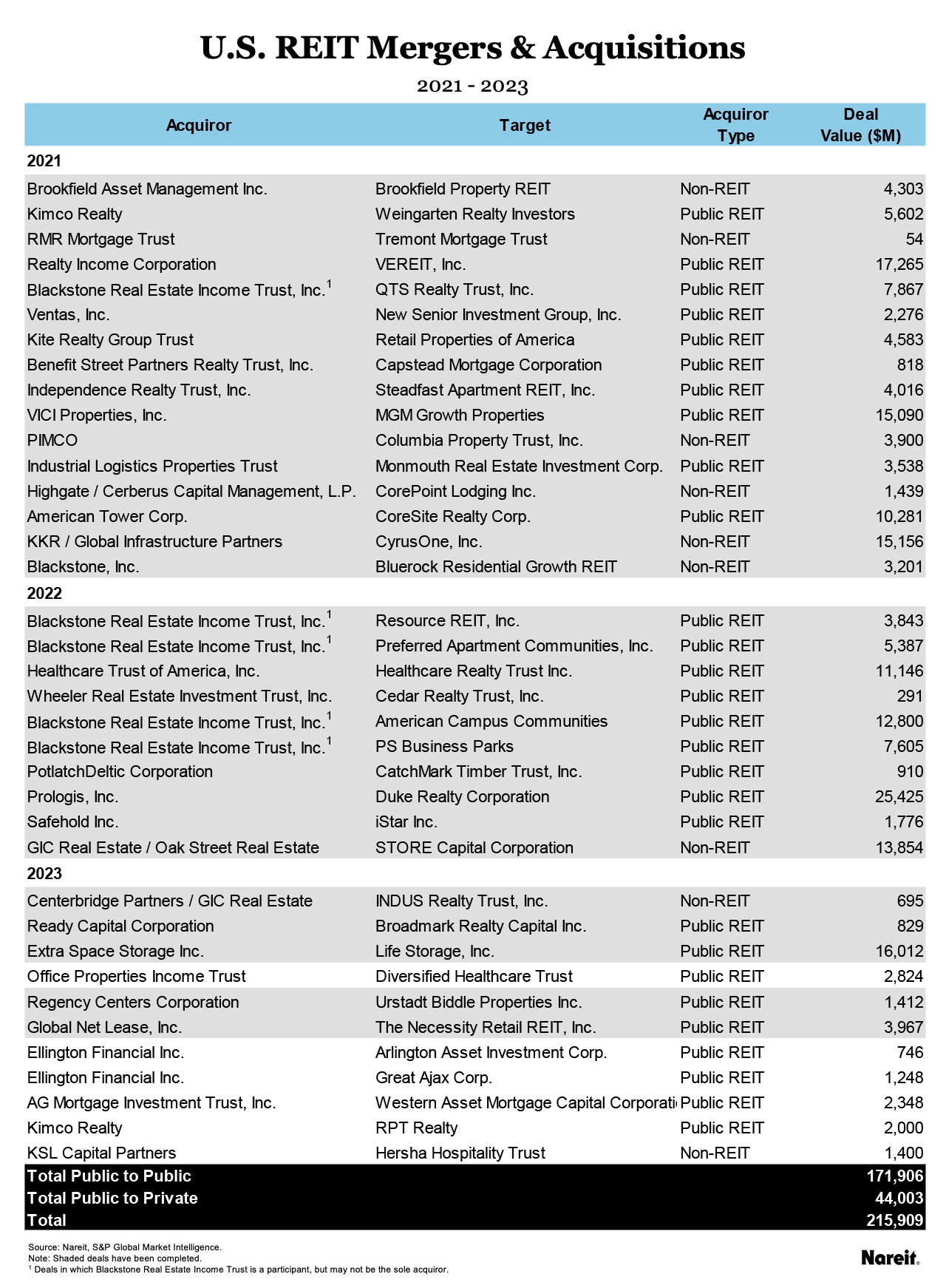

During the quarter, four mergers were announced, reflecting an aggregate deal value of $7.0 billion. In 2022, $83 billion in acquisitions of publicly traded U.S. REITs was announced. Of the $204 billion in public REIT mergers and acquisitions from 2019–2023, 74.3% of the transaction value represents deals between listed REITs in the same property sector.

2023 Capital Raising

- Equity issuance totaled $12.0 billion on a year-to-date basis in 2023, with $11.3 billion from common equity offerings and $685 million in preferred equity offerings; REITs have raised $7.9 billion through ATM offerings based on data available through 2023: Q2. Through 2022: Q3, total equity issuance including ATM offerings was $32.0 billion, with $37.2 billion during the same period in 2021.

- Debt issuance totaled $23.9 billion raised at the secondary market year-to-date in 2023, up from the $11.4 billion issued during the same period in 2022 and down sharply from the $42.4 billion raised in 2021. In 2023, the average coupon rate for REIT unsecured debt offerings rose to 5.4%, up from 4.6% in 2022.

Mergers & Acquisitions

In 2023, 11 deals to acquire publicly-listed REITs have been announced, with a total deal value of $33.6 billion and 93% of the value reflecting acquisitions by listed REITs. In 2022, 10 deals to acquire publicly-listed U.S. REITs were announced, representing a total deal value of $83 billion. Since the beginning of 2021, deals for 37 REITs have been announced or completed. Of the $215.9 billion represented by these acquisitions, 79% is attributed to acquisitions by other public REITs.

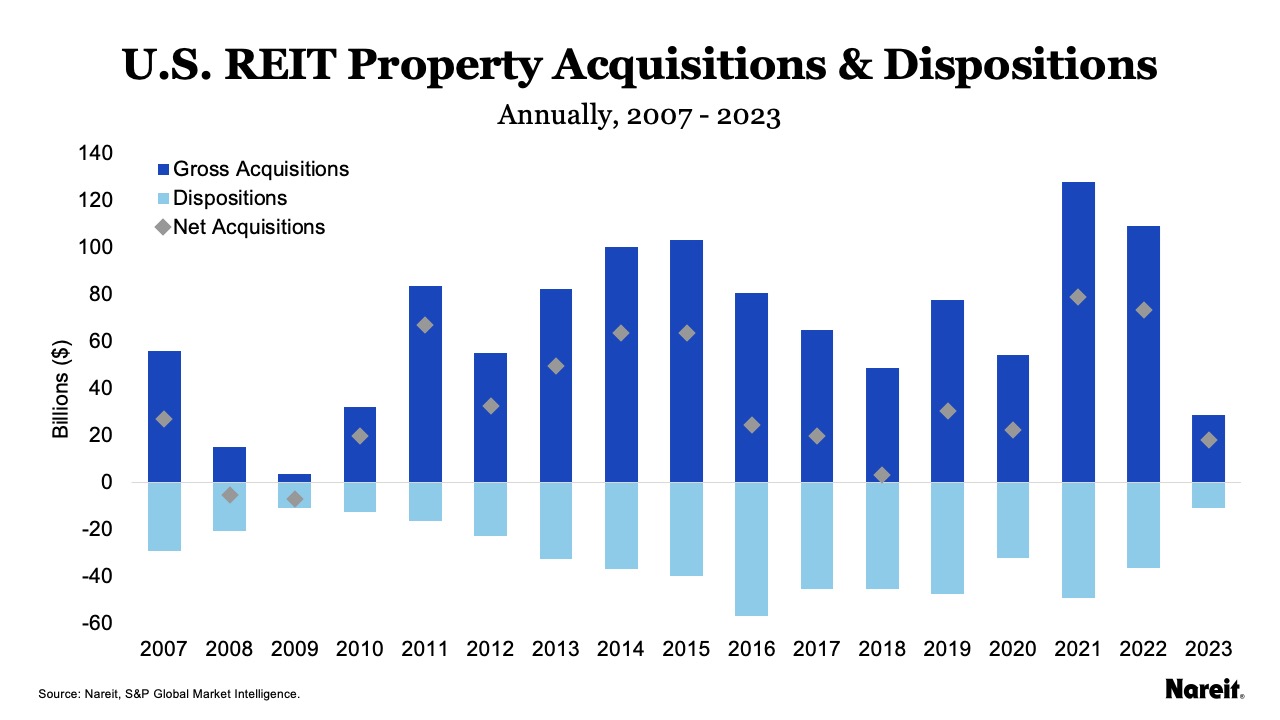

Property Acquisitions & Dispositions

REITs posted $7.8 billion in property acquisitions and $6.6 billion in dispositions in 2023: Q2, with year-to-date totals of $28.7 billion in acquisitions and $10.6 billion in dispositions. In 2022, $109.5 billion in acquisitions and $36.1 billion in dispositions were posted. In 2023: Q2, retail, diversified, and lodging/resorts led with acquisitions of $4.0 billion, $1.2 billion, and $908 million, respectively. See Nareit’s T-Tracker for further details.