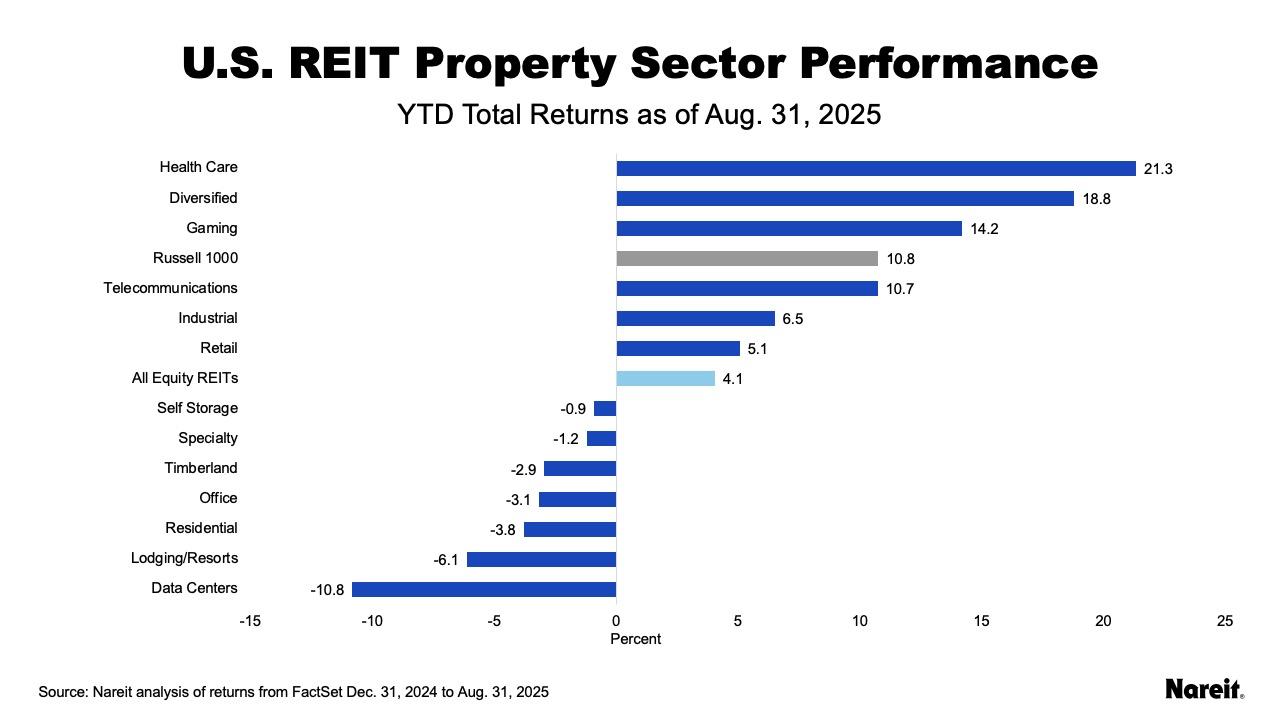

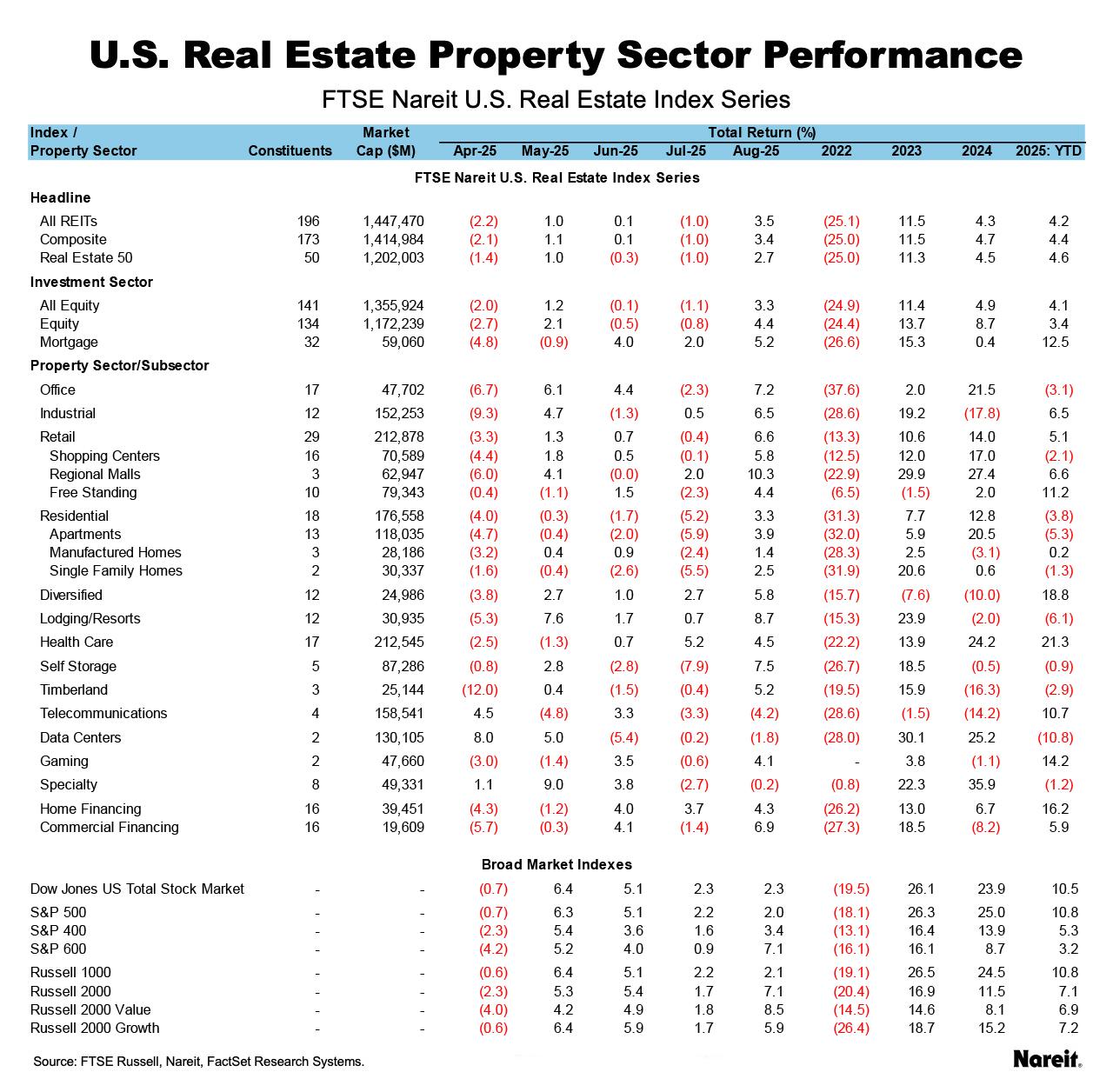

The FTSE Nareit All Equity REITs Index rose 3.3% in August, outperforming the broader stock market. The Dow Jones U.S. Total Stock Market rose 2.3% and the Russell 1000 rose 2.1% for the month. On a year-to-date basis, the All Equity REITs index posted a total return of 4.1%, while the Russell 1000 is up 10.8% and the Dow Jones U.S. Total Stock Market is up 10.5%. All of this occurred as investors gained some confidence that rate cuts may be on the near horizon in part due to more-dovish commentary from the Federal Reserve, while debates over trade policy remain a simmering backdrop.

The yield on the 10-year Treasury fell 14 basis points to close the month at 4.22%. As of Aug. 31, the dividend yield on the All Equity REITs index was 3.87% and the FTSE Nareit Mortgage REITs Index yielded 12.05%, compared to 1.16% for the S&P 500.

As shown in the chart above, health care continues to lead on a year-to-date basis with a total return of 21.3%, followed by diversified at 18.8%, and gaming at 14.2%.

As reflected in the table above, at the property sector level lodging/resorts, self-storage, and office led in August, while telecommunications, data centers, and specialty lagged.

The Mortgage REITs index rose 5.2% in August and is up 12.5% year-to-date. Commercial financing climbed 6.9% and home financing rose 4.3% during the month. For the year, home financing is up 16.2% and commercial financing is up 5.9%.