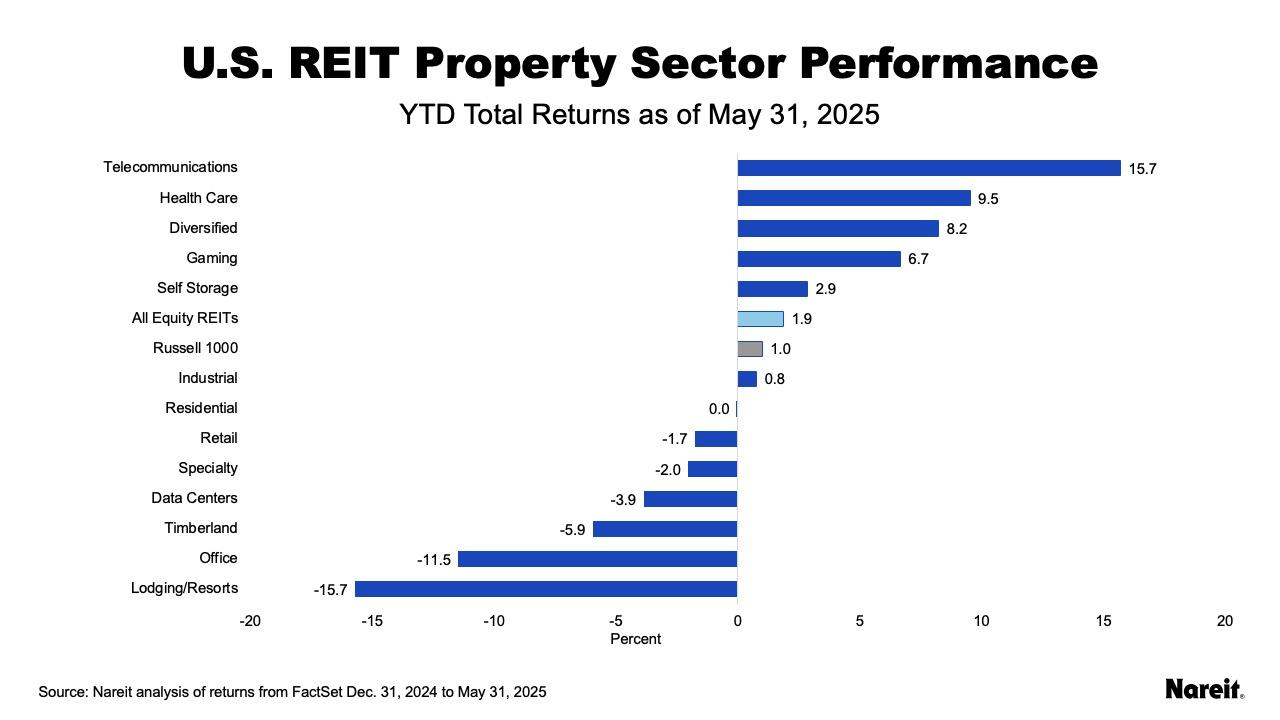

The FTSE Nareit All Equity REITs Index rose 1.2% in May. REITs trailed the broader stock market for the month as the near-term risk of tariff disputes abated, perhaps temporarily. REITs continue to outperform on a year-to-date basis with a total return of 1.9% compared to 1.0% for the Russell 1000 and 0.5% for the Dow Jones U.S. Total Stock Market. The Russell 1000 and Dow Jones U.S. Total Stock Market both rose 6.4% in May as tensions between the U.S. and China cooled following an announcement to temporarily reduce tariffs on May 12.

The yield on the 10-year Treasury rose to 4.39% at the end of the month after closing April at 4.15%. As of May 31, the dividend yield on the FTSE Nareit All Equity REITs index was 3.99% and the FTSE Nareit Mortgage REITs Index yielded 12.91%, compared to 1.25% for the S&P 500.

As shown in the chart above, telecommunications leads on a year-to-date basis with a total return of 15.7%, followed by health care at 9.5%, and diversified at 8.2%.

As reflected in the table above, specialty, lodging/resorts, and office led during May, while telecommunications, gaming, and health care lagged.

The FTSE Nareit Mortgage REITs Index fell 0.9% during the month with both home financing and commercial financing declining. For the year, home financing is up 3.3% and commercial financing is down 3.5%.