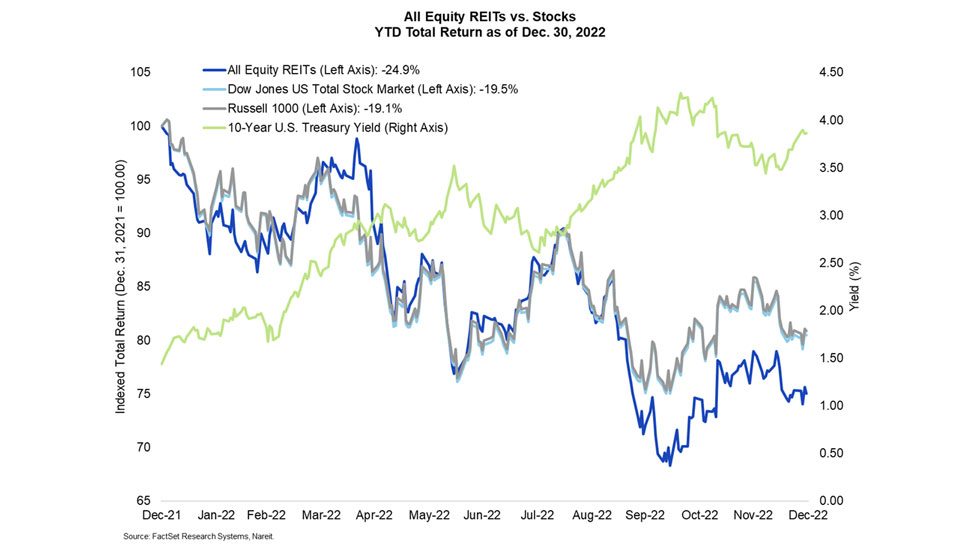

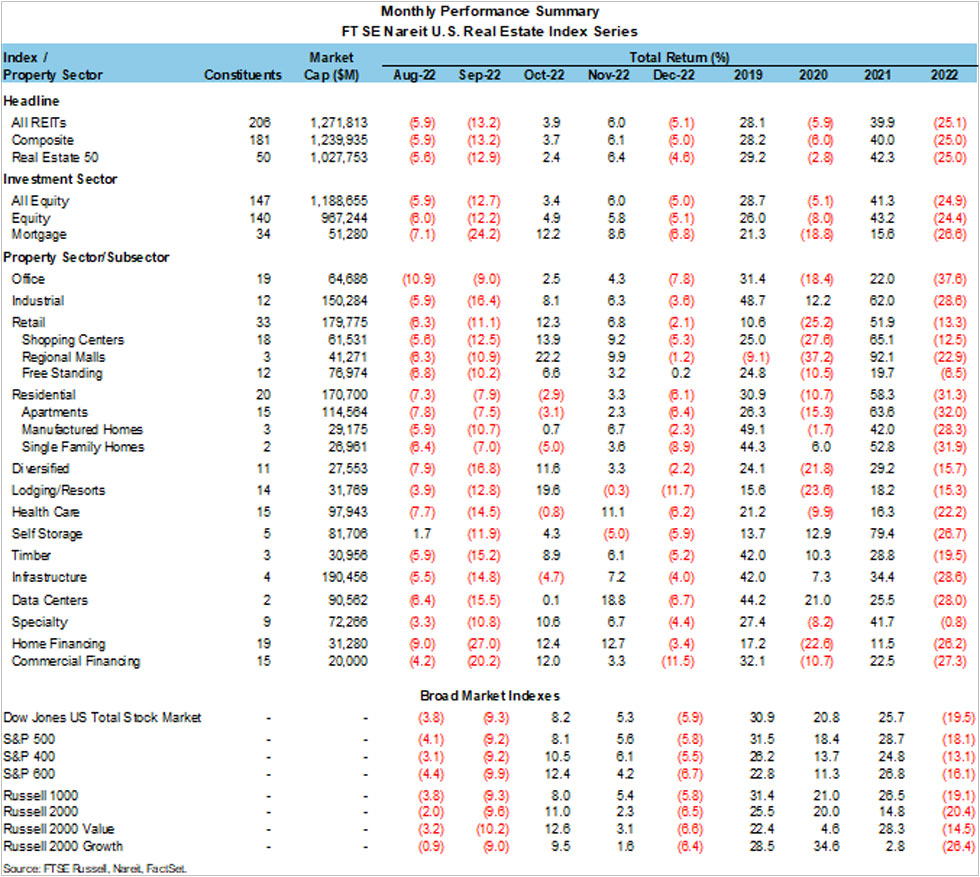

REITs underperformed broader markets in 2022, as the FTSE Nareit All Equity REITs Index posted a total return of -24.9% and the FTSE Nareit Equity REITs Index returned -24.4%. On a yearly basis this was the steepest decline since 2008, when All Equity REITs declined 41.1%. Mortgage REITs also declined in 2022, as the FTSE Nareit Mortgage REITs Index fell 26.6%. Broader markets were also negative, as the Russell 1000 and Dow Jones U.S. Total Stock Market Index fell 19.1% and 19.5%, respectively. Over the course of 2022, the yield on the 10-year Treasury rose 243 basis points to end the year at 3.9%. After initial optimism as the pace of monetary policy tightening slowed in December, markets have priced in rates remaining higher for longer, as the Federal Reserve remains decidedly hawkish.

All property sectors were negative in 2022, led by specialty at -0.8%, retail at -13.3%, and lodging/resorts at -15.3%. Office lagged all other sectors with a total return of -37.6%, followed by residential at -31.3% and infrastructure at -28.6%. Mortgage REITs were also down sharply, with returns of -26.2% for home financing mREITs and -27.3% for commercial financing mREITs.