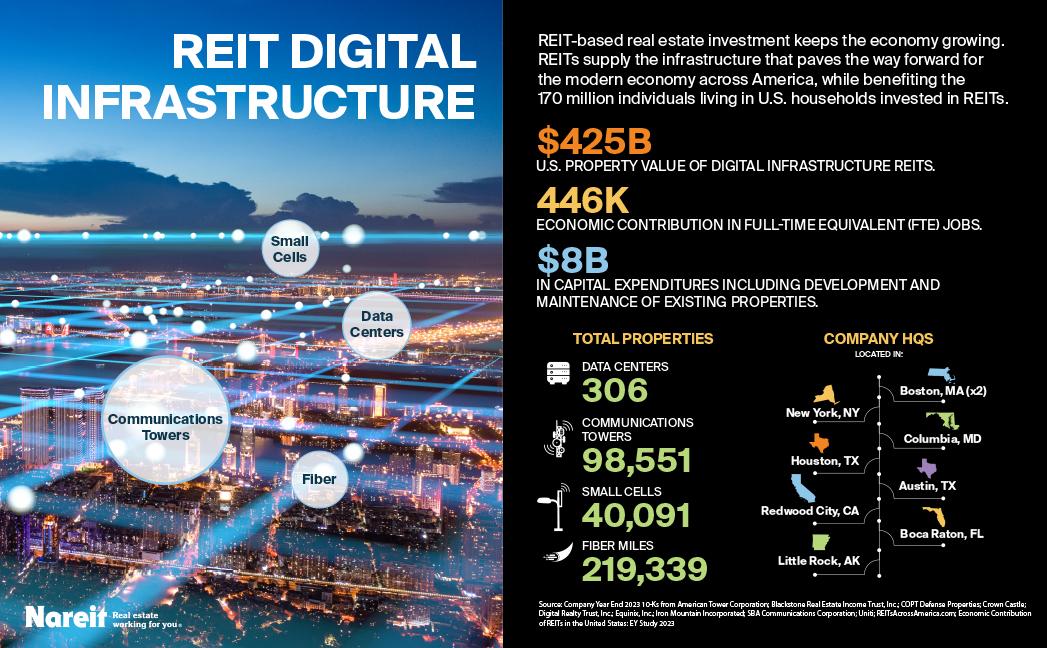

Telecommunications REITs own and manage infrastructure real estate and collect rent from tenants that occupy that real estate. Infrastructure REITs’ property types include fiber cables, wireless infrastructure, and telecommunications towers.

Telecommunications REIT tenants include most major wireless service providers (AT&T, Verizon Wireless, T-Mobile, Sprint), and broadcast and satellite television companies including DISH network and Pavlov Media. Telecommunication REITs are also leading the development of small cell 5G networks nationwide.

Who Invests in Telecommunications REITs?

Many Americans may be unaware that they already have investments in REITs via their 401ks, Thrift Savings Plan (TSP), or other investment vehicle geared towards retirement. Large institutional investors, including pension funds, endowments, foundations, insurance companies, and bank departments, also invest in REITs as a cost effective and efficient way to gain exposure to the real estate asset class.

How to Invest in Telecommunications REITs

There are currently 4 telecommunications REITs listed on the FTSE Nareit US Real Estate Indexes that individuals can invest in directly with the help of a broker or by purchasing shares in a participating REIT mutual fund of REIT exchange-traded fund (ETF).

Overview

2/27/2026, Source: FTSE

Quarterly Data

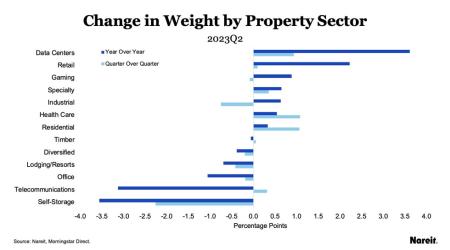

Source: Nareit REIT Industry Tracker

| Q3 2025 | 2024 | |

|---|---|---|

| FFO ($M) | $2,041 | $7,560 |

| NOI ($M) | $3,335 | $13,122 |

| Dividends paid ($M) | $1,406 | $6,050 |

| SS NOI | - | |

| Occupancy Rate | - |