By Ed Pierzak, Senior Vice President, Research, Nareit

July 2023

During the first half of 2023, the United States faced considerable economic and capital market uncertainty, characterized by elevated inflation and higher interest rates. This uncertainty affected public and private real estate markets. Nareit’s analysis of those markets offers two key insights. First, the ongoing divergence between private and public real estate market valuations has been closing, but the wheels of progress have been slow as illustrated by appraisal cap rates. Second, though REITs have not been immune to capital market uncertainty and mortgage market turmoil, they continued to have sound operations, solid balance sheets, and successful equity and unsecured debt issuances in the capital markets—proving that they continue to be well-prepared to navigate the ongoing economic uncertainty.

First Half of 2023: Economic Review

A look at some of the key economic developments over the first half of 2023 sets the backdrop against which REITs and commercial real estate operated.

- Inflation levels remained high, but experienced welcomed declines . The Consumer Price Index for All Urban Consumers (CPI) rose 3.0% over the 12 months through June 2023, and the core CPI (excluding food and energy) increased 4.8%.

- The Federal Open Market Committee paused its interest rate hikes after its June 13-14, 2023, meeting, maintaining a target policy rate range of 5.00% to 5.25%. While the future path of rates will be highly dependent on inflation levels, labor market strength, economic activity, and financial and international developments, many economists expect one or two more rate hikes.

- The spread between the 10-year and 3-month Treasuries was negative during the first half of 2023. The 10-year Treasury yield has experienced some volatility. It was approximately 3.8% at the start of the year and declined to 3.4% by February, but reached nearly 4.1% in early March. As of mid-June, the yield was roughly 3.7%.

- Three of the four largest bank failures in U.S. history occurred in the first half of 2023. While the banking turmoil appears to have subsided, credit conditions have tightened and financial markets will likely remain stressed. Banking regulators are concerned about commercial real estate exposures, particularly at community and regional banks.

- Lending policies for commercial real estate tightened over the past year due partly to wider credit spreads. The Federal Reserve’s April 2023 Senior Loan Officer Opinion Survey on Bank Lending covered conditions in the first quarter of 2023. On balance, credit conditions tightened and demand weakened for both business and household loans. With wider credit spreads, lending policies for commercial real estate also tightened over the past year.

- The U.S. employment situation remained solid, with robust job gains and a low unemployment rate. In June 2023, total nonfarm employment increased by 209,000 jobs, a level lower than the average for the previous 12 months of 312,000. The unemployment rate decreased modestly (by 0.1%) to 3.6%.

- Concerns regarding a U.S. recession continued to loom. At the end of 2022, the Bloomberg consensus forecast survey placed the odds of a U.S. recession within the next 12 months at 70%. As of May 2023, the likelihood of an economic downturn was 65%.

Amid this economic and capital market uncertainty, public and private real estate valuations have diverged and private property values have been slow to adjust to market realities. As property values have declined, loan delinquencies and defaults have increased. May 2023 Trepp data indicated that CMBS delinquency rates had their biggest jump since June 2020, hitting a 14-month high. Today, borrowers face significantly higher interest rates, stricter underwriting standards, and potential debt availability issues. Even with these challenges, real estate fundamentals and operational performance have generally remained solid, but there has been some evidence of recent weakening.

Understanding Cap Rates in a Valuation Divergence

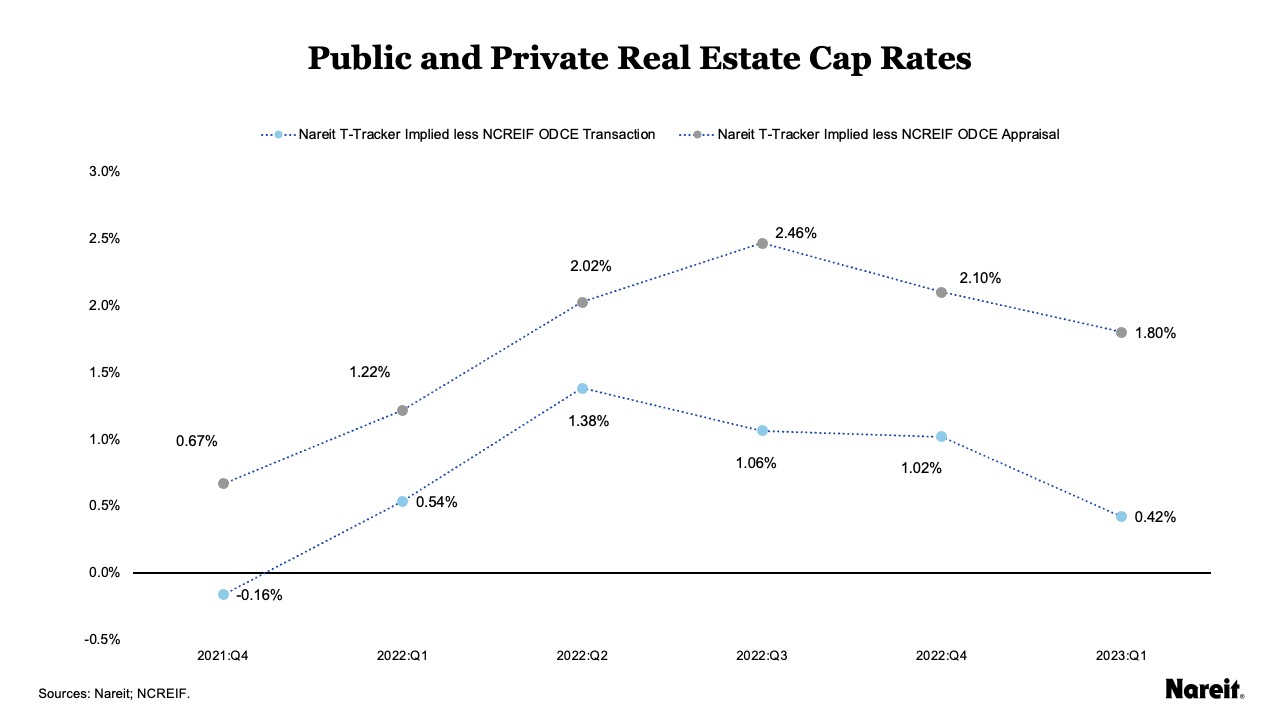

Differences in cap rates capture the divergence that occurred between U.S. public and private real estate markets in 2022, with public real estate (REIT implied) cap rates higher than their private real estate (transaction and appraisal) counterparts. As expected, the gaps between REIT implied and transaction cap rates have been narrowing through time, with changes in both REIT and private market valuations.

While welcome news, these transactions account for a mere sliver of private real estate capital. Appraisal cap rates, which represent the bulk of private capital, have shown little movement since the end of 2021, resulting in differences between REIT implied and appraisal cap rates remaining wide. Closing these gaps will likely take time and further material private real estate write-downs. Although transaction cap rates demonstrate progress in the price discovery process, appraisal cap rates highlight that the wheels of progress turn slowly.

As presented in the chart above, the relationship between REIT implied and transaction cap rates shows that the real estate valuation adjustment process has been working. As expected, the difference between REIT implied and transaction cap rates has been narrowing with changes in both REIT and private market valuations. The gap reached a maximum of 138 basis points in the second quarter of 2022; three quarters later it stood at 42 basis points. The difference between REIT implied and appraisal cap rates has remained wide; it was 180 basis points in the first quarter of 2023. While the price discovery process has been making progress, it has only been reflected in a minute portion of NCREIF ODCE valuations. In the first quarter of 2023, the transaction and appraisal cap rates represented market values of approximately $1.4 billion and $327.9 billion, respectively.

Recognizing the need for appraisal cap rates to adjust upward to reflect market realities, further material write-downs are likely on the horizon for the private real estate market. With property transaction activity throttled and many private real estate investment managers reluctant to accept brokers’ opinions of value that are significantly below current carry values, this process will likely take time. Although the real estate valuation adjustment process has made progress, its slowly turning wheels are unlikely to accelerate anytime soon.

Why U.S. Public Equity REITs are Insulated from Mortgage Market Turmoil

The commercial real estate mortgage market has changed dramatically since the end of 2021. For many real estate investors, gone are the days of low-cost, readily available property financing. Today, borrowers face significantly higher interest rates and stricter underwriting standards. The public-private market divergence in real estate valuations has further complicated the mortgage underwriting process, as private property valuations have been slow to adjust to market realities. As a result, many private market real estate investors seeking to refinance their properties are finding themselves in a pickle. Some are facing the prospects of negative leverage; others are finding their current loans cannot be refinanced at par.

While U.S. public equity REITs may not have been immune from the current mortgage market turmoil, data from the Nareit Total REIT Industry Tracker Series (T-Tracker®) for the first quarter of 2023, the latest data available, show that they have been reasonably well-insulated from it. Specifically, on average, equity REITs have maintained long-term, well-structured balance sheets with low leverage ratios, predominantly utilizing unsecured debt and fixed interest rates. Capital markets have been open for REITs and they have been successfully issuing unsecured debt and equities.

The chart above displays quarterly unsecured and fixed rate debt as percentages of total debt for U.S. public equity REITs from the first quarter of 2000 to the first quarter of 2023. Equity REIT use of unsecured debt typically ranged between 45% and 50% of total debt prior to 2013. After that time, unsecured debt utilization grew consistently, reaching 76.0% of total debt in the first quarter of 2023. REITs have also favored using fixed rate debt. At the beginning of 2000, fixed rate debt accounted for almost 70% of equity REIT total debt. By the first quarter of 2023, it comprised 87.0% of total debt, and the weighted average term to maturity for all REIT debt was nearly seven years. By focusing on unsecured, fixed rate, and longer-term debt, public equity REITs have limited their exposure to the challenges of the current mortgage market.

While U.S. public equity REITs have not been immune from rising interest rates, their debt costs only increased marginally compared to the recent surge in the 10-year Treasury yield. From the fourth quarter of 2021 to the first quarter of 2023, the U.S. 10-year Treasury yield increased by 212 basis points to 3.7%. Over the same timeframe, the public equity REIT weighted average interest rate on total debt rose by 55 basis points to 3.9%. Although the average in-place REIT debt cost has steadily increased over the past year, it is now just slightly higher than the 10-year U.S. Treasury yield.

The chart above exhibits unsecured debt issuance by U.S. public equity REITs from the fourth quarter of 2021 through the first quarter of 2023, highlighting both the number of issuances and total capital raised. With the rise in interest rates and debt costs in 2022, REITs acted rationally; their unsecured debt issuance fell off precipitously. Importantly, the unsecured debt market remained open and available to REITs during that time. In the first quarter of 2023, there was a material uptick in unsecured debt issuance. Fifteen senior debt deals with an aggregate value of $11.4 billion were closed during that time. The gross amount offered for these issuances, including over-allotment and yield-to-maturity median values, were $650 million and 5.3%, respectively.

With higher interest rates, stricter underwriting standards, and changing property valuations, many private real estate investors are ill-equipped to face the current financing environment. This has fueled concerns about real estate debt holdings and the potential for escalating CRE defaults. It has also increased the perceived risk of the overall industry. While U.S. public equity REITs are not immune from the current mortgage market turmoil, on average, REITs have limited their exposure to these challenges by maintaining leverage ratios consistent with core investment strategies and focusing on unsecured, fixed rate, and longer-term debt. Access to the unsecured debt market provides U.S. public equity REITs with a competitive advantage over many of their private real estate market counterparts.

Economic Uncertainty Brings Challenges, Concerns, and Opportunities

The first half of 2023 continued to bring economic and capital market uncertainty, including some challenges and concerns like significantly higher interest rates, stricter underwriting standards, and potential debt availability issues.

Despite these challenges and concerns, equity REITs continue to present opportunities. They have maintained solid operations and strong balance sheets, and they have consistently delivered meaningful year-over-year funds from operations and net operating income gains. They have also maintained long-term, well-structured balance sheets with low leverage ratios, predominantly utilizing unsecured debt and fixed interest rates. Finally, the first six months of 2023 illustrated that capital markets have been open for REITs, as they have been successfully issuing unsecured debt and equities. Though no one can predict what the next six months will bring, REITs are well-prepared to navigate this ongoing period of uncertainty.