One of the unique aspects of REITs is the large, actively managed, dedicated REIT investment community; actively managed funds represent 7% of REIT market capitalization and they have been a key element in REITs’ long-term success because of their combined real estate and equity investment expertise and analysis.

Focusing on actively managed dedicated REIT funds and how they’re allocating their assets is critical to understanding the evolution of the REIT market. In a recent analysis of quarterly data, Nareit looked at the 28 largest actively managed real estate mutual funds and how their allocations have changed from the beginning of 2010 to the first quarter of 2023. The funds have $44 billion in assets under management as of the first quarter of 2023, and 96.6% of assets were in REITs. The analysis shows that actively managed real estate funds have significantly shifted their allocations over time, including from traditional sectors to modern economic sectors.

Analyzing REIT Property Sector Allocation Weights in Actively Managed Funds

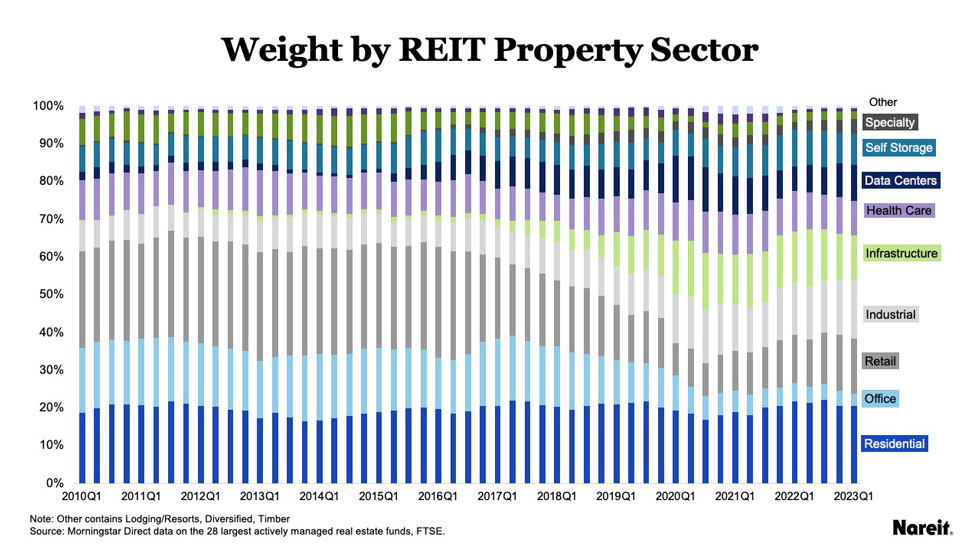

Overall, there has been a shift from the “traditional” four real estate sectors of residential, office, retail, and industrial to new and emerging sectors, like data centers and self storage. For the first quarter of 2023, 54% of REIT assets under management were in traditional property sectors, while 46% were in new and emerging sectors.

The chart above shows the share of REIT assets for all the funds in each property sector on a quarterly basis from 2010 to the first quarter of 2023. For the traditional sectors, only industrial has grown, while allocation to the other traditional sectors either stayed the same or decreased.

For example, from the beginning of 2010 to the first quarter of 2023:

- Industrial grew from an 8% share of REIT assets to 15%.

- Residential was consistent over this time period with an average of a 20% share of REIT assets.

- Office declined from a 17% share of REIT assets to 3%.

- Retail decreased from a 25% share of REIT assets to 15%.

Among the new and emerging property sectors, infrastructure, health care, data centers, and self-storage account for nearly 40% of the share of REIT assets in the funds:

- Infrastructure, which encompasses cell and communications towers, has been increasing since the third quarter of 2016. It peaked at 15% in the third quarter of 2020 and was 12% in the first quarter of 2023.

- Data centers increased in the second quarter of 2015, peaked at 12% in the third quarter of 2020, and landed at 9% in the first quarter of 2023.

- Health care and self-storage remained consistent from 2010 to 2023, averaging 10% and 7% of REIT assets, respectively.

Analyzing the Allocation Differences: Actively Managed Funds vs. FTSE Nareit All Equity Weight

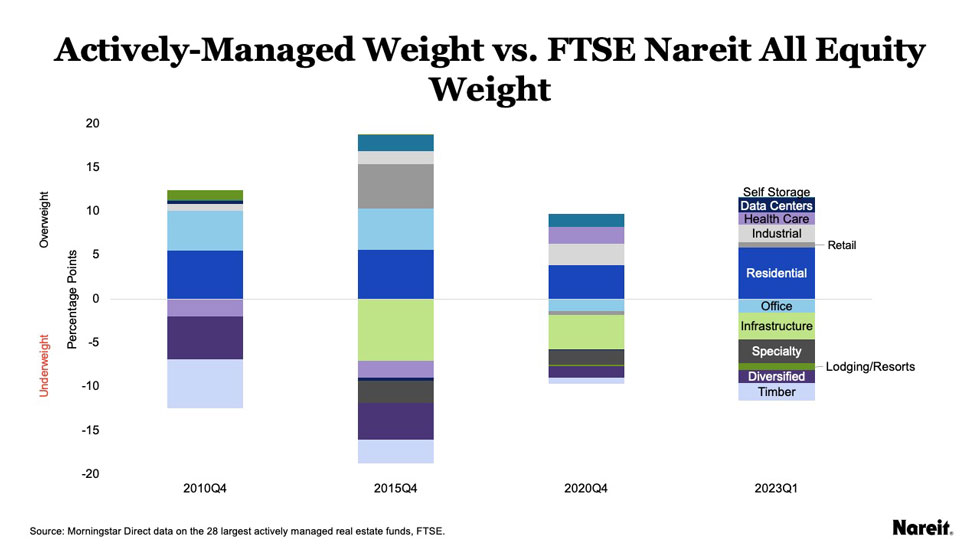

Actively managed real estate funds have strongly favored residential, retail, and industrial, and their allocations to newer sectors do not always reflect property sector assets in the FTSE Nareit All Equity Index.

The chart above shows a snapshot of over- and under-weightings by property sector for the funds compared to their share of equity market capitalization in the All Equity Index. Notably, infrastructure is consistently underweighted, although the gap narrowed to 2.9 percentage points in 2023 from 7 percentage points at the end of 2015. This is partly due to the underlying benchmarks. Almost half of the funds are benchmarked to indexes that do not include cell/communications towers, such as the FTSE Nareit Equity REITs and Dow Jones Select REIT. These funds still invest in towers, but at lower weights than those with more inclusive benchmarks.

In addition, further analysis reveals that:

- Residential remains overweighted through the entire time period (2010-2023), with a 6-percentage point difference between the weight in the funds and the index in the first quarter of 2023.

- Industrial is also overweighted through the period and growing more overweighted since 2022, despite increasing its weight in the All Equity Index.

- Data centers, lodging/resorts, and self-storage all stayed close to their index weights for most of the period, with data centers overweighted in the first quarter of 2023.

- Office swung from a large overweight to underweight over the period.

Funds began to reduce office’s share in the second quarter of 2018, but the funds remained overweighted in office until the second quarter of 2020. Most recently, office is underweighted by nearly two percentage points.

Active portfolio managers’ decisions about property sector allocations give insight into expert expectations about REITs’ performance and risk. Nareit analysis shows that their property sector allocations have shifted over time and complements other Nareit research that shows institutional investors are increasingly using REITs to "complete" their real estate portfolios, partly because they recognize that REITs offer exposure to modern day economic sectors.