By John Worth, Executive Vice President, Research & Investor Outreach, Nareit

July 2023

As we look ahead to the second half of 2023, the economic and commercial real estate (CRE) environment will continue to be shaped by global central banks’ fight against inflationary pressures that have been more persistent than expected. As the Federal Reserve and other central banks have rapidly raised rates, they have increased recession risks and exposed fault lines in banking, CRE, and private equity business models that were predicated on low interest rates. While REITs are well-prepared for a period of higher interest rates, the combination of interest rate induced change in real estate valuations and concerns about regional and community bank CRE exposure have reduced transactions and created a credit crunch for commercial real estate.

During the second half of the year, we expect the Fed to maintain and likely increase the federal funds rate until it sees meaningful evidence of lower rates of inflation. Though there are some encouraging signs that inflation rates will continue to decline in the coming months, higher short- and long-term interest rates, the resulting economic slowdown, and CRE risks will likely be the defining features of the second half of 2023.

Navigating U.S. Economic Uncertainty: Inflation and Interest Rates on the Rise

Though REITs have not been immune to capital market uncertainty and mortgage market turmoil, they continue to have sound operations, solid balance sheets, and successful equity and unsecured debt issuances in the capital markets.

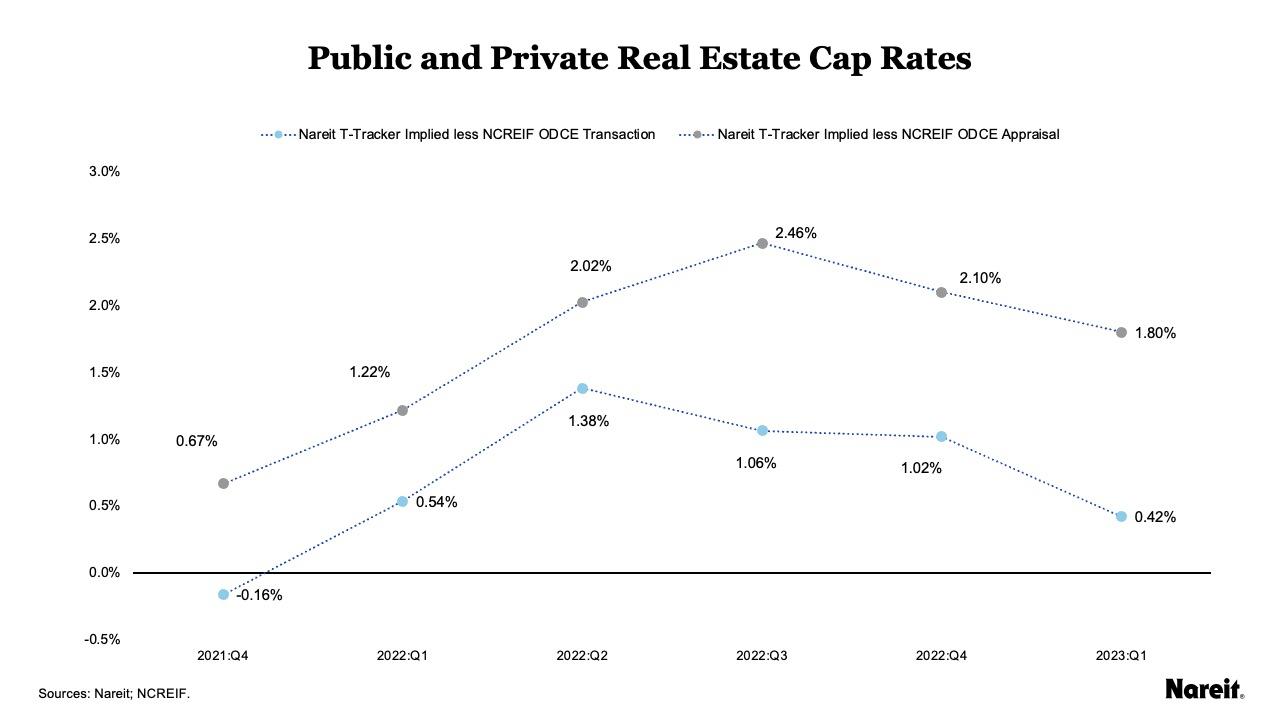

Our analysis of CRE and REITs discusses the continuing divergence between REIT and private real estate valuations. Over time, the gap between public and private valuations will close, and valuations based on new transactions suggests this adjustment process is already underway. However, given the slow pace of transactions in many sectors, the adjustment process may stretch into 2024. This extended adjustment period, while frustrating, also creates an attractive entry point for institutional investors to add REITs to their real estate strategies. That’s because REITs already have meaningfully priced in higher interest rates and slower growth, and have historically outperformed on an absolute and relative basis during these readjustment periods.

While U.S. public equity REITs may not have been immune from the current economic uncertainty and mortgage market turmoil, our review of REIT balance sheets and debt suggests that REITs are well-positioned to navigate the ongoing high interest rate environment because of their strong balance sheets. They continue to maintain leverage near historical lows and are financed with well-termed, mostly fixed-rate debt. This has resulted in REITs maintaining very manageable current interest expenses. During the first half of 2023, there was a resurgence in unsecured debt issuance, demonstrating that while bank financing may be constrained, unsecured debt markets are open and available for REITs, which may provide an important competitive advantage over many of their private real estate market counterparts.

Diversification Opportunities: REIT and Real Estate Performance Around the Globe

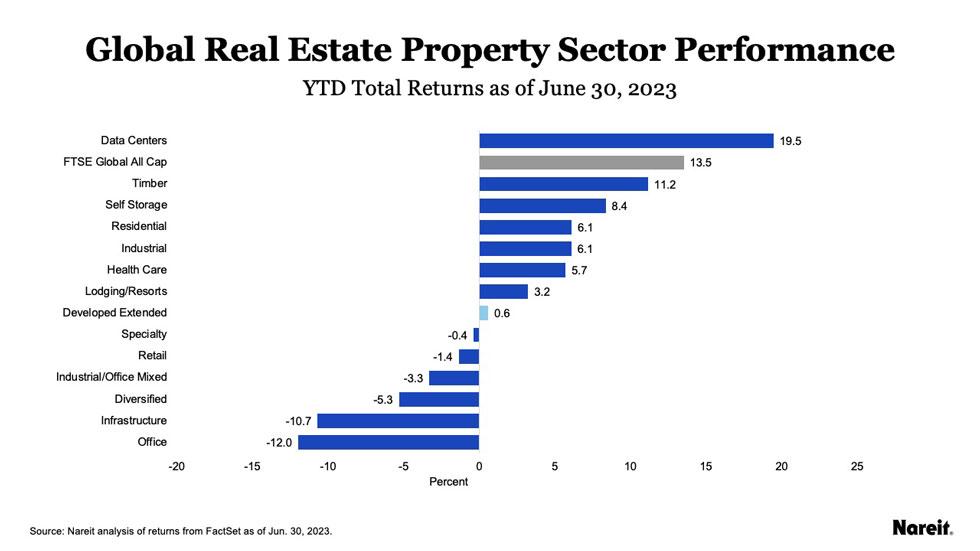

On a global basis, data centers, industrial, and self-storage have been the strongest performing sectors in 2023.

Like in the United States, REITs and listed real estate around the globe have priced in the combination of higher interest rates and the prospect of slower economic growth. Through mid-year 2023, the FTSE EPRA Nareit developed index trailed the broader global stock index by nearly 13 percentage points. The performance of the countries, regions, and sectors underlying the index series do not behave uniformly. Our review of global listed real estate returns highlights these important differences, which can provide investors with important diversification opportunities.

REIT Trends in Property Sector Allocations by Actively Managed Real Estate Funds

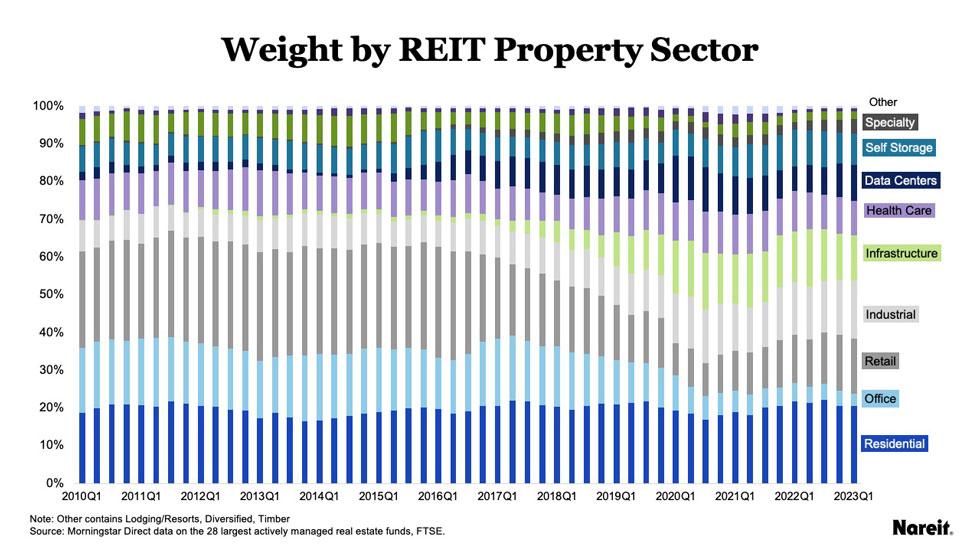

Actively managed funds represent 7% of REIT market capitalization and they have been a key element in REITs’ long-term success because of their combined real estate and equity investment expertise and analysis.

In the beginning of the year, our 2023 REIT Outlook explored how REITs have been leaders in providing access to new and emerging property sectors, global real estate, and best-in-class ESG performance—and how these attributes are driving institutional investors to increasingly use REITs to "complete" their real estate portfolios . In this report, we examine how the investment strategies for large actively managed dedicated REIT funds have similarly evolved over the same period. The analysis shows that REIT managers have increasingly shifted their exposures to capture new and emerging sectors and deemphasized office exposure, while maintaining overweight positions in industrial and residential sectors.