Publicly listed real estate outside the United States can present investment opportunities, and the FTSE EPRA Nareit Global Real Estate Index Series tracks the performance of REITs and publicly listed real estate involved in the ownership of income-producing real estate worldwide. The index series, which covers 510 constituents in 39 countries, is designed to be investable, liquid, and provide transparent methodology.

As of June 30, 2023, the total equity market capitalization of the index series was $1.9 trillion, with $1.3 trillion coming from the Americas, $415 billion from Asia/Pacific, and $202 billion from Europe, the Middle East, and Africa (EMEA). The regions and sectors within the EPRA Nareit index series do not behave uniformly, but they do provide investors with important diversification opportunities.

Newer and Emerging Property Sectors Among Strongest Performers

After declining 24.6% in 2022, the FTSE EPRA Nareit Developed Extended Index rallied in January 2023 with a total return of 8.9% as investors showed increased appetite for risk amid hope that the current period of interest rate hikes was coming to an end. With the backdrop of monetary policy authorities seeking to tamp down these expectations and fears of a banking crisis in the United States, the Developed Extended index steadily declined through spring, ending in May down 2.9% on a year-to-date basis. In June, however, the EPRA Nareit Developed Extended Index rallied 3.6% on news of a New York office transaction and continued strong REIT operating performance. The EPRA Nareit Developed Office Index also rose in June, with a total return of 4.9%.

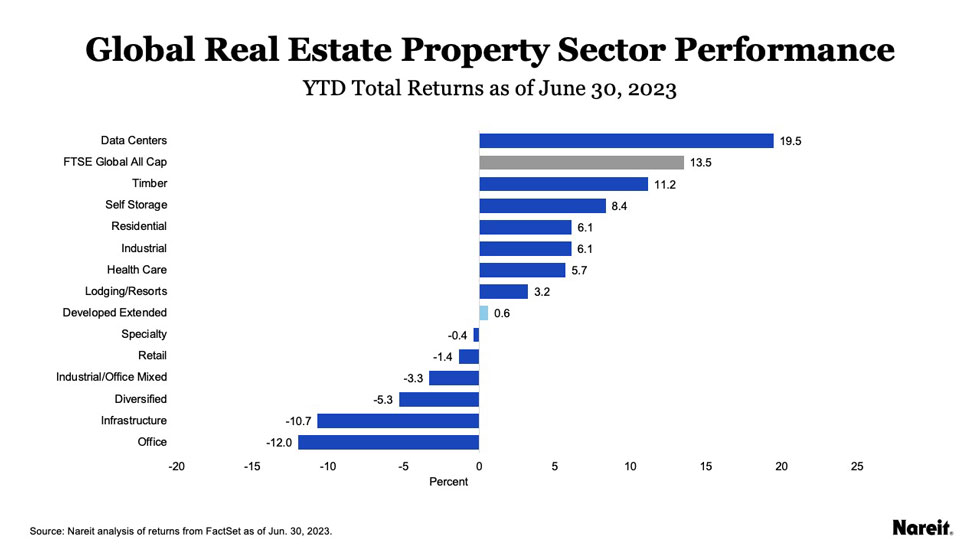

On a global basis, data centers, industrial, and self-storage have been the strongest performing sectors in 2023. As shown in the above chart, the data centers sector leads with a return of 19.5%, followed by timber at 11.2%, and self-storage at 8.4%. Office and infrastructure have lagged the most, with respective returns of -12.0% and -10.7%, with U.S. real estate exerting the greatest downward pressure on these sectors.

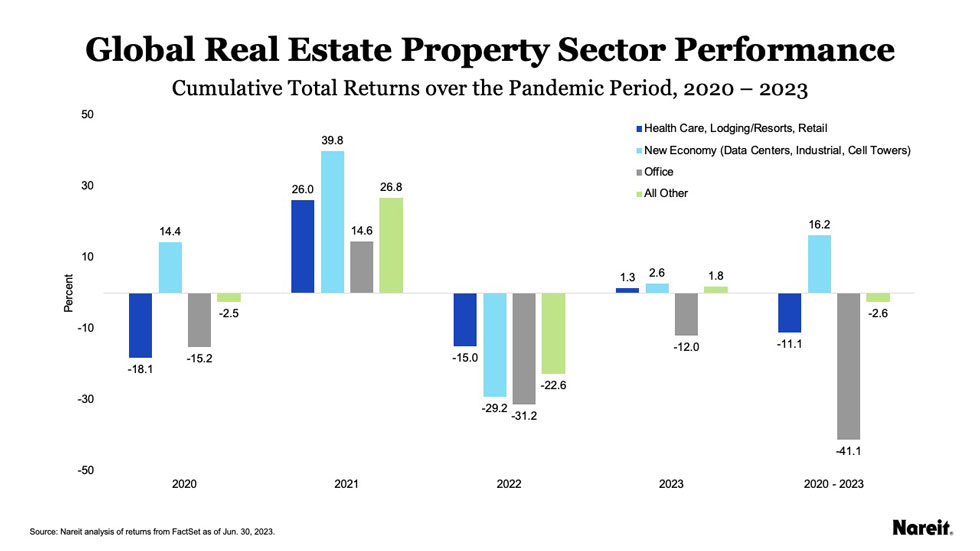

The chart above reflects an important secular trend that has taken over since the beginning of the pandemic: People are spending less time in the office, which has resulted in concerns about the current and future value of office properties—while the need for logistics capacity, data center access, and cellular communications have become more important. Since December 31, 2019, the new economy property sectors (data centers, industrial, and cell towers) are outperforming other sectors, with a cumulative total return of 16.2%.

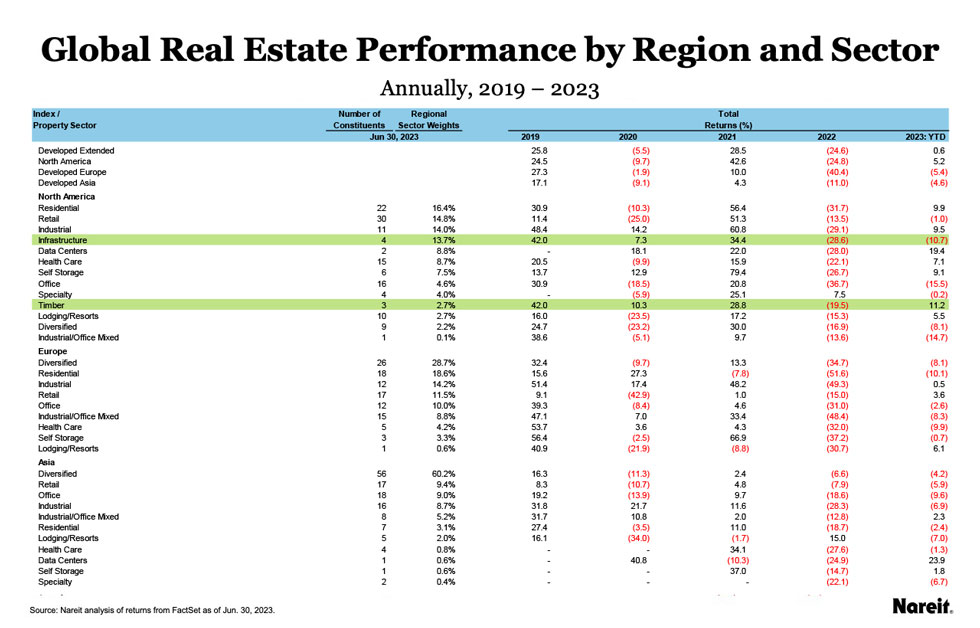

Regionally, North America is leading on a year-to-date basis through June 30, with a total return of 5.2%, while Developed Asia is down 4.6% and Developed Europe is down 5.4%. In 2022, the regions were down 24.8%, 11.0%, and 40.4%, respectively. Comparing sector performance across regions presents some similarities and a few key differences:

- Data centers is the strongest performing sector in North America and Asia with respective returns of 19.4% and 23.9%. (Note that there is no data centers sector in Europe.)

- Residential has performed well in North Americawith a return of 9.9%, while the sector has lagged in Asia and Europe, with respective returns of -2.4% and -10.1%.

- Industrial is performing well in North America and Europe : North America has posted a year-to-date total return of 9.5%; and in Europe, industrial is the third best performing sector with a total return of 0.5%. In Asia, industrial has declined 6.9% in 2023.

- Self-storage is strong in North America: In North America the sector has returned 9.1%, while the sector has been flat in Asia and Europe with a total return of 1.8% and -0.7%, respectively, in 2023.

- Globally, the office sector has lagged with a total return of -41.1% since 2019, though the extent of the underperformance is driven by U.S. returns. For example, in 2023, the sector is down 15.5% in North America, while posting returns of -2.6% in Europe and -9.6% in Asia.

FTSE EPRA Nareit Real Estate Indices: Flexible and Bespoke

Looking to the future, Nareit will continue to provide an index series that is flexible enough to keep pace with the modern evolution of the global real estate market as new categories of real estate are institutionalized. Nareit, along with FTSE Russell and EPRA, have embarked on methodological changes to the indices to ensure that the coverage of global data centers is as complete as possible. Similarly, the goal is to provide index products with as complete coverage of cell tower owners globally as possible.

Underlying these steps is the idea that users of the EPRA Nareit series have the options available to them to approach real estate investing in a way that meets their goals. In this vein, FTSE Russell, EPRA, and Nareit recently announced the launch of the FTSE EPRA Nareit Developed Extended Opportunities RIC 6/45 Capped Index in collaboration with the National Pension Service of Korea. This bespoke index solution identifies developed REITs and non-REITs with niche or non-core property exposure by using portfolio level screenings to target property sector and tenant profile exposures. This new index underscores the effectiveness of using REITs and listed real estate companies as part of a completion portfolio strategy.