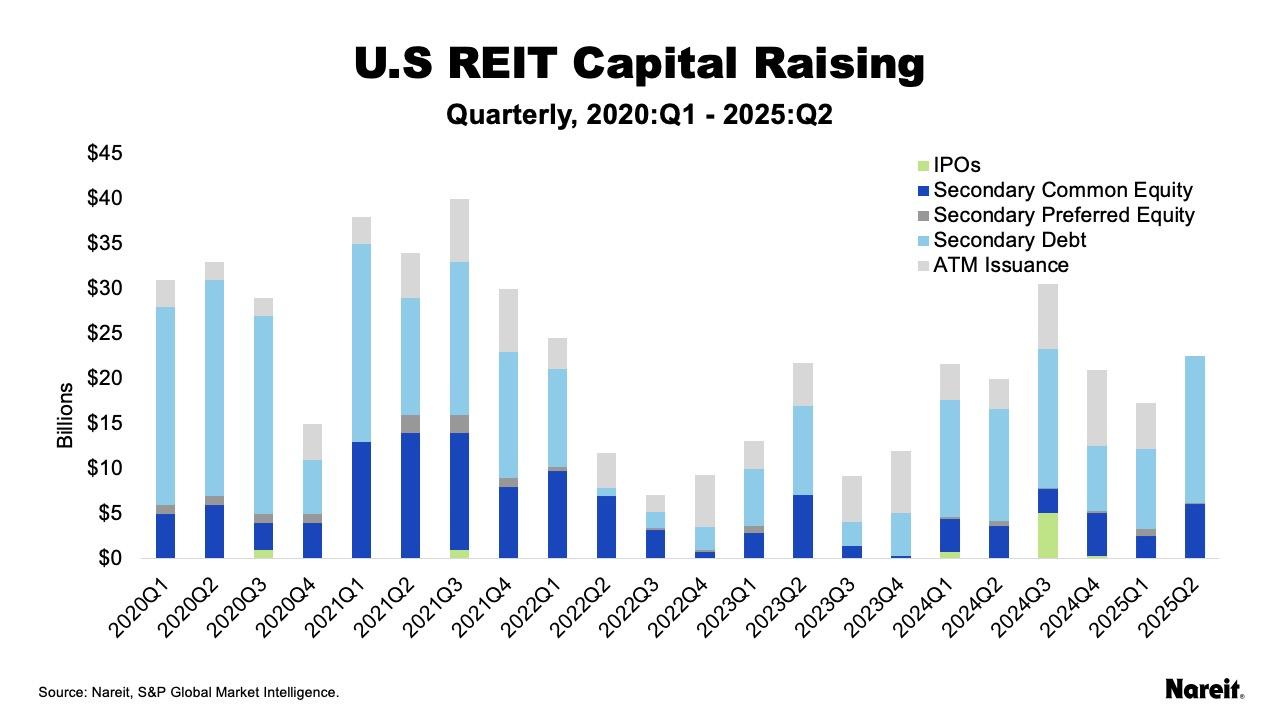

U.S. REITs raised $22.5 billion from secondary debt and equity offerings in the second quarter of 2025. Of that total, $16.3 billion came from debt offerings, $6.1 billion came from common equity offerings, and $100 million came from preferred equity offerings.

Through the first half of the year, REITs raised a total of $39.7 billion with $25.2 billion coming from secondary debt offerings, $8.7 billion from secondary common equity offerings, and $800 million from secondary preferred equity offerings. Nareit’s historical capital offerings summary can be found here.

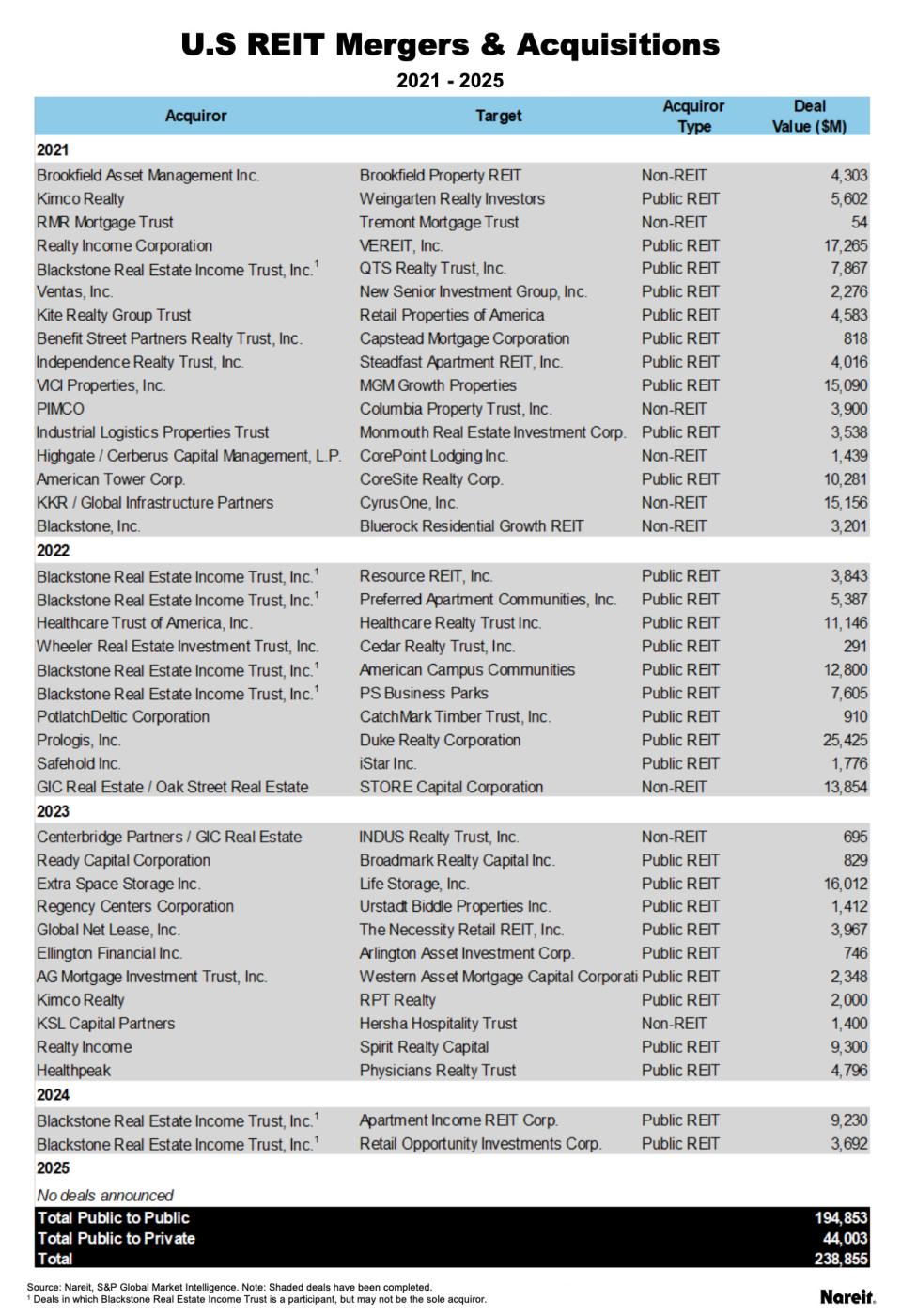

M&A activity remains muted, with no deals announced in the first half of 2025. In 2024, $12.9 billion in acquisitions of publicly traded U.S. REITs were announced. Of the $272 billion in public REIT mergers and acquisitions from 2019–2024, 56% of the transaction value represents deals between listed REITs in the same property sector.

2025 Capital Raising

- Non-ATM equity issuance totals $9.5 billion year-to-date in 2025, with $8.7 billion coming from common equity offerings and $800 million coming from preferred equity offerings. REITs raised $5.0 billion through ATM offerings through 2025: Q1 after raising $23.1 billion through ATM offerings in 2024.

- Debt issuance continued to be the primary funding source in the second quarter, with $16.3 billion issued. REITs raised $48.1 billion through secondary debt offerings in 2024, compared to $29.4 billion in 2023. In the second quarter of 2025, the average yield to maturity for REIT unsecured debt offerings was 5.5% and was 5.8% in the first half of 2025.

Mergers & Acquisitions

No acquisitions of listed REITs have been announced in 2025. In 2024, two M&A deals were announced, with a value of $12.9 billion. In 2023, 11 deals to acquire listed REITs were announced, with a total deal value of $44 billion and 95% of the value reflecting acquisitions by listed REITs. In 2022, 10 deals to acquire listed U.S. REITs were announced, representing a total deal value of $83 billion. Since the beginning of 2021, deals for 37 REITs have been announced or completed. Of the $225 billion represented by these acquisitions, 81% is attributed to acquisitions by other public REITs.

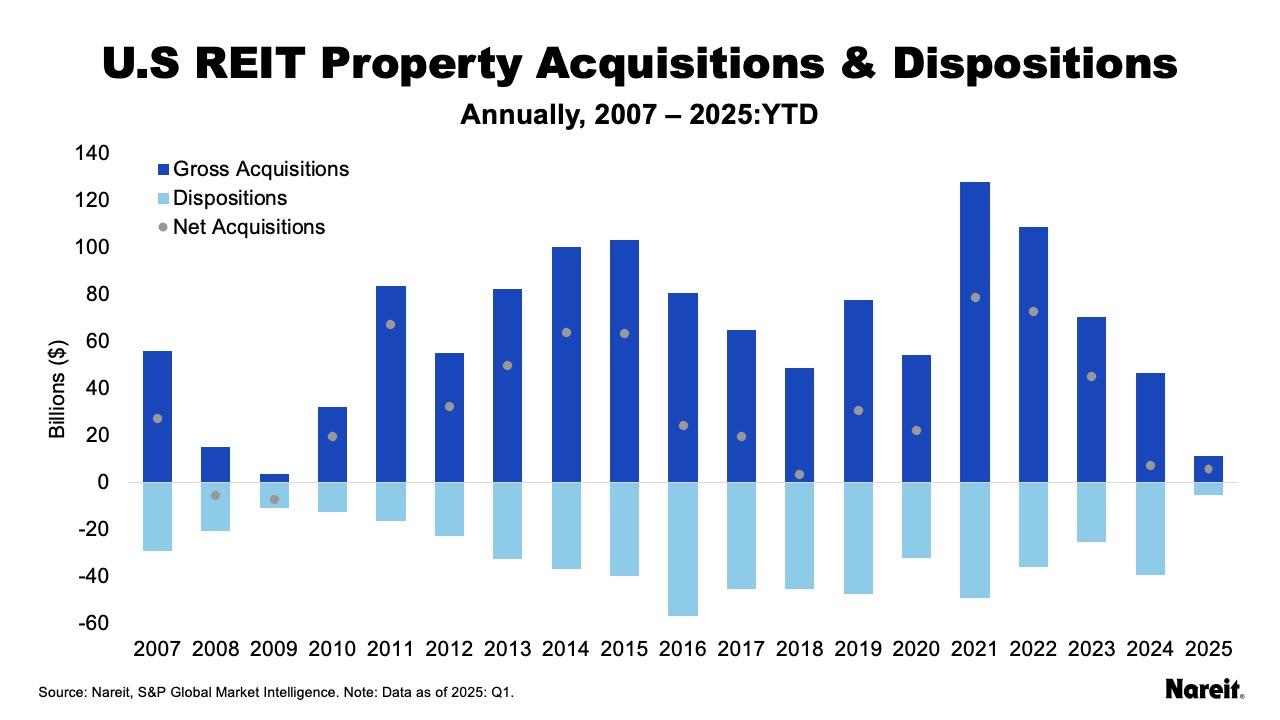

Property Acquisitions & Dispositions

Property acquisitions for the first quarter of 2025 amounted to $11.2 billion, with $5.4 billion in dispositions. In 2024, $46.5 billion in acquisitions and $39.1 billion in dispositions were posted. In the first quarter of 2025, health care, retail, and industrial led with acquisitions of $3.7 billion, $3.1 billion, and $1.4 billion, respectively. See Nareit’s REIT Industry Tracker for further details.