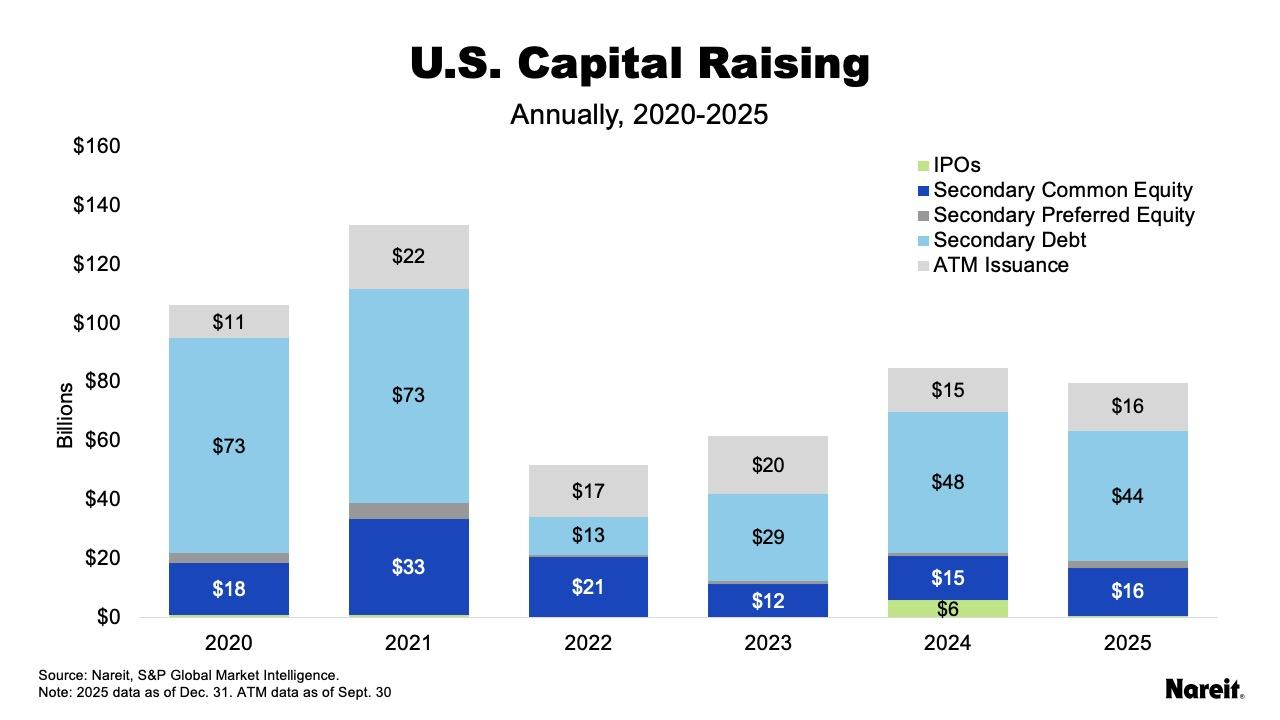

REITs raised approximately $79.9 billion in 2025, a figure that does not include fourth quarter ATM issuance due to a lag in reporting. This total represents a $3.6 billion increase over 2024, before accounting for fourth quarter ATM offerings. In the fourth quarter of last year, REITs raised $6.7 billion, a figure that was notably muted from the prior three quarters.

Of the fourth quarter total, $5.1 billion came from debt offerings, $892 million came from common equity offerings, and $750 million came from preferred equity offerings. The first REIT IPO of 2025, with a focus on the data center segment, priced on Sept. 30 and began trading in October, raising $785 million.

Secondary debt offerings accounted for 76% of capital raised in the quarter and made up 56% of capital raising activity for the year. Nareit’s historical capital offerings summary can be found here.

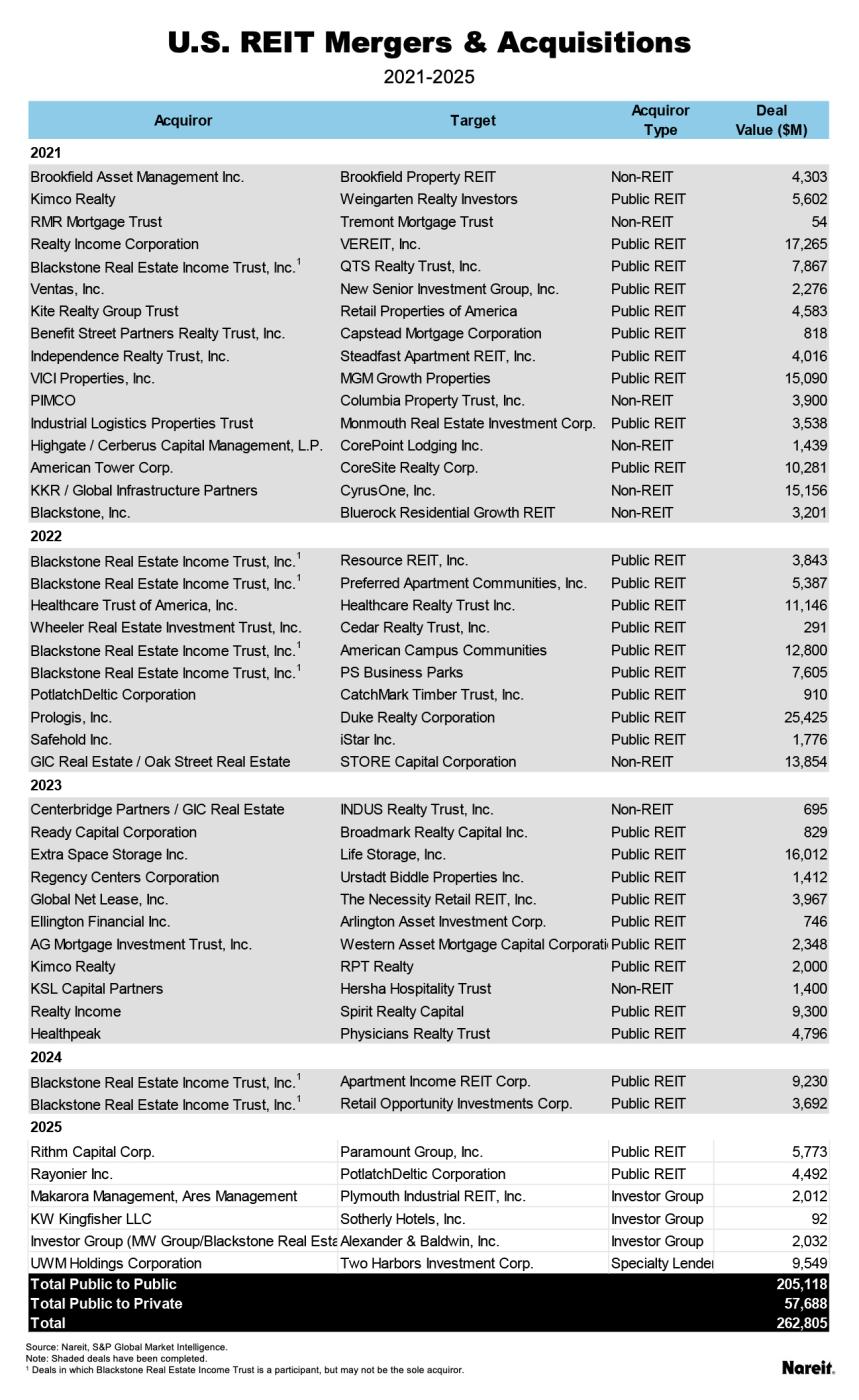

M&A activity was subdued for most of 2025, with more transactions emerging towards the end of the year. Five deals were announced in the fourth quarter, with an aggregate transaction value of $18.2 billion, including debt assumption. Total deal volume in 2025 was $24.0 billion, up from the $12.9 billion seen in 2024. Of the $300 billion in public REIT mergers and acquisitions from 2019–2025, roughly 56% of the transaction value represents deals between listed REITs in the same property sector.

2025 Capital Raising

- Non-ATM equity issuance totaled $18.5 billion in 2025, with $16.2 billion coming from common equity offerings and $2.3 billion coming from preferred equity offerings. REITs raised $16.2 billion through ATM offerings through the third quarter, after raising $23.1 billion through at-the-market in 2024.

- Debt issuance continued to be the primary funding source in the fourth quarter, with $5.1 billion issued. REITs raised $44.4 billion through secondary debt offerings in 2025, compared to $48.1 billion in 2024. In the fourth quarter of 2025, the average coupon for REIT unsecured debt offerings was 4.6% compared to 5.5% for the full year.

Mergers & Acquisitions

Six acquisitions of listed REITs were announced in 2025, reflecting an aggregate transaction value of $24.0 billion. In 2024, two REIT M&A deals were announced, with a value of $12.9 billion. In 2023, 11 deals to acquire listed REITs were announced, with a total deal value of $44 billion and 95% of the value reflecting acquisitions by listed REITs. In 2022, 10 deals to acquire listed U.S. REITs were announced, representing a total deal value of $83 billion. Since the beginning of 2021, deals for 45 REITs have been announced or completed. Of the $263 billion represented by these acquisitions, 73% is attributed to acquisitions by other public REITs.

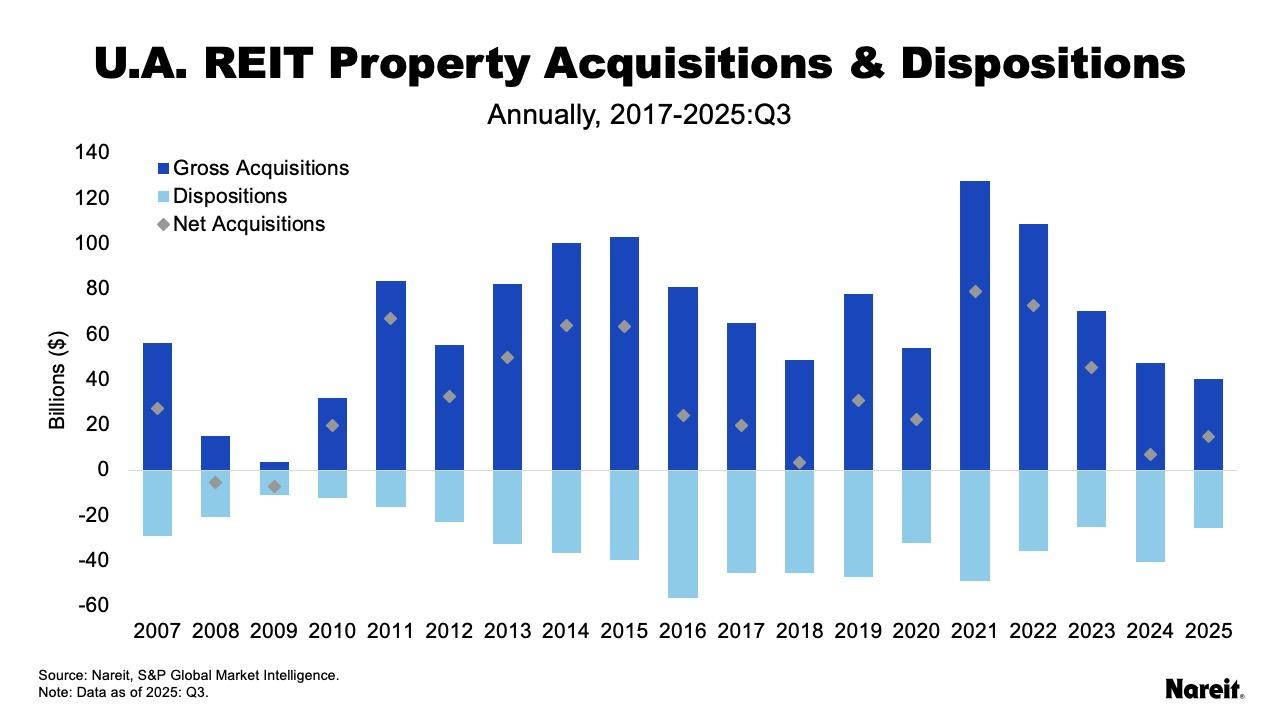

Property Acquisitions & Dispositions

Property acquisitions through the first three quarters of 2025 amounted to $40.5 billion, with $25.6 billion in dispositions. In 2024, $47.6 billion in acquisitions and $40.5 billion in dispositions were posted. Through the third quarter of 2025, retail, health care, and residential led with acquisitions of $10.9 billion, $10.1 billion, and $5.0 billion, respectively. See Nareit’s REIT Industry Tracker for further details.